(Bloomberg) — Investors are rushing out of electric vehicle-focused funds as growth forecasts cool and with a potential reelection of Donald Trump seen posing a further challenge to profits.

Most Read from Bloomberg

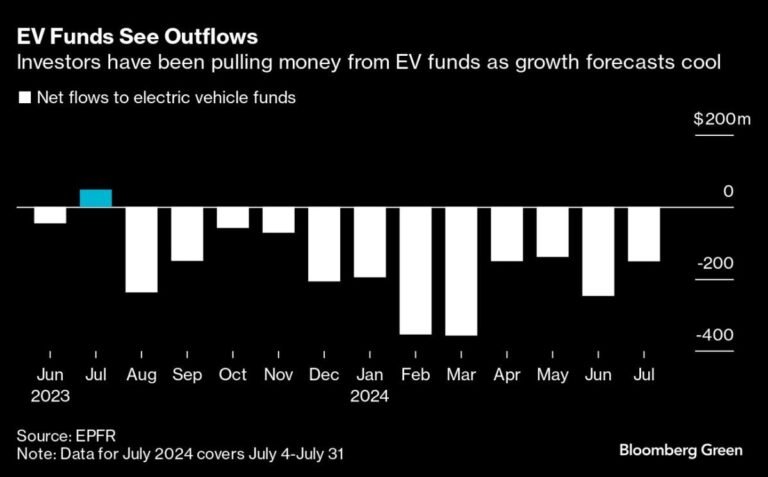

EV funds tracked by data provider EPFR Global had combined net outflows of $1.6 billion this year to July 31, more than the total redemptions in 2023. The funds saw inflows in 2022.

“The EV trade has become an anti-Trump trade,” said Vicki Chi, a portfolio manager at Robeco in Hong Kong, who manages funds that don’t have exposure to pure-play EV producers. “Despite the fact that you see more and more EVs on the road, very few companies are making money and very few companies have an outlook of expanding margins.”

Even after winning the backing of Tesla Inc. Chief Executive Officer Elon Musk, Trump has criticized incentives to support the wide adoption of electric models, insisting they’ll be a “small slice” of the market, alongside gas-powered vehicles and hybrids.

Trump has vowed to ditch some existing electric car policies if he returns to office, and to extend tariffs on Chinese EV imports to as much as 200%. Those moves threaten to exacerbate concerns over a slowdown in EV sales growth that’s already causing investors to manufacturers to reassess their outlook on the technology.

Tax credits added under the Inflation Reduction Act could be rolled back and federal funding for EVs and related infrastructure removed, JPMorgan Chase & Co. analysts including Bill Peterson wrote in a report last week.

“They don’t go far, they cost too much and they’re all made in China — other than that they are fantastic,” Trump said last week at a rally in Atlanta. “And I’m for electric cars. I have to be because, you know, Elon endorsed me very strongly.”

Funds in China, the largest EV market, saw almost $500 million in redemptions in the first half, according to EPFR data tracking about $6.5 billion in assets. Products in the US, South Korea and Japan were among those to also record net outflows in the second quarter.

Warren Buffett’s Berkshire Hathaway Inc. last month trimmed its holding in Shenzhen-based BYD Co., which vies with Tesla as the world’s biggest electric automaker, to less than 5% from more than 20% two years ago.

The removal of US subsidies by Trump would have “some impact” on Tesla, and “would be devastating for our competitors,” Musk said last month, as the automaker posted another quarter of disappointing profits. Rivals including Volkswagen AG reported weaker operating margins, in part on declining demand.

Ford Motor Co. and Mercedes-Benz Group AG have revised down forecasts on EV growth too, while Volkswagen’s Porsche AG has shifted away from a target for electric models to account for 80% of new-vehicle sales in 2030.

BYD and rival Chinese automakers face additional tariffs in the US and European Union that threaten their global expansion amid a fierce domestic price war that’s eroding profitability.

“Growth in end demand or in market share is far from a guarantee of profit growth,” said London-based Raj Shant, a client portfolio manager at Jennison Associates, a firm which benefited from an early bet on Tesla. “That, after all, is what drives share prices.”

EV sales, including plug-in hybrids, are set to rise from 13.9 million last year to more than 30 million in 2027, according to BloombergNEF’s Economic Transition Scenario, a base case forecast that assumes global efforts to hit net zero only on technologies that are currently economic.

Under that trajectory, average annual sales growth for EVs would slow to 21% through 2027, compared with 61% between 2020 and 2023.

–With assistance from Jeffrey Hernandez.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.