Loading audio file, please wait.

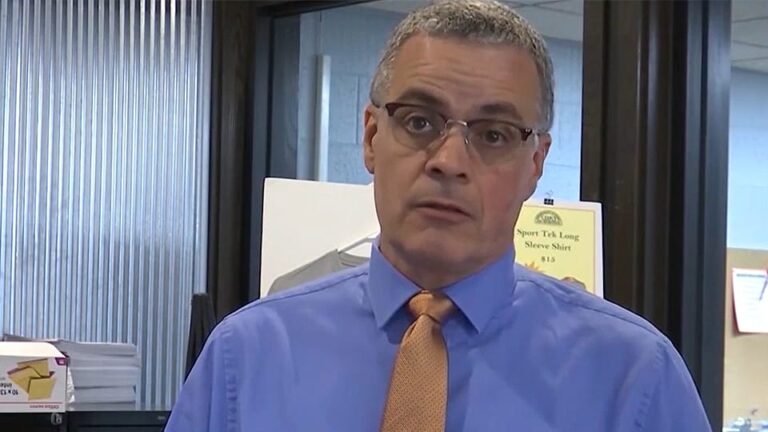

Indiana Attorney General Todd Rokita filed a lawsuit last week against the former Evansville executive parks director for allegedly misusing public funds based on an audit report.

The complaint filed with the Vanderburgh Superior Court claims the audit report showed public funds were misappropriated, illegally received and retained, wrongfully withheld from the public treasury, and obtained by fraud or in any unlawful manner.

The city of Evansville requested an investigation to be conducted by the Indiana State Board of Accounts after identifying various invoices approved by former parks director Brian Holtz which didn’t match with invoices directly from vendors.

According to the audit report, Holtz misappropriated public funds related to Capital Projects totaling $63,639. Holtz also allegedly misappropriated public funds related to staff sweatshirts totaling $326.

The complaint also alleged Holtz misappropriated public funds related to the purchase of an audio/visual system at the Aquatic Center totaling $127,723.

Following Holtz’s resignation, city officials received an invoice for the purchase of 725 trash totes totaling $38,000. SBOA reported that the purchase was not signed by the city controller.

The falsified purchase order relating to the trash totes was found on Holtz’s work computer.

Other unauthorized purchases include tables, chairs, umbrellas and receptacles for the Aquatic Center totaling $13,004.

SBOA found the city paid an invoice for a computer networking system in the amount of $125,396 based on approval by Holtz.

The networking system was discovered to not be compatible with the system used at the Aquatic Center and the project was canceled.

The city received a partial refund from the vendor for the networking system that was never installed, thereby mitigating the extent of the loss from $125,396 down to $76,225.

The Park Board contracts with private entities to manage its Dog Town and Angel Mounds boat ramps. The Boat Ramp contracts require the Boat Ramp tenants to collect daily launch fees and season pass fees.

The Boat Ramp tenants are allowed to retain the launch and season pass fees to pay their operating expenses; however, they must remit a fee to the city based on the number of daily passes and season passes sold. The city park fees are one dollar for each daily pass sold and $10 for each season pass sold.

However, the park fees were waived by Holtz without authorization. The city lost a total of $10,829 according to the audit report.

Holtz also modified concession contracts by reducing fees vendors are required to pay based on percentage of sales. The city lost $6,392.

The city also lost $3,828 due to Holtz modifying concession contracts at the Helfrich Golf Course and Fendrich Golf Course.

According to the complaint, Holtz improperly submitted and approved a falsified invoice in the amount of $31,324 for mower and trimmer equipment to be paid from the Greenway Fund.

Holtz also improperly submitted and approved an invoice for the purchase of a crew cab pick-up truck in the amount of $26,995 to be paid from the Roberts Park Fund. However, this truck was used in the capacity of general park maintenance for the city and not related to the specific purpose of the Roberts Park Fund.

Holtz did the same thing but with the purchase of a compact tractor and loader in the amount of $29,521 to be paid from the Roberts Park Fund. However, this tractor and loader were used in the capacity of general park maintenance for the city and not related to the specific purpose of the Roberts Park Fund.

The investigation cost $83,835.

Attorney General Todd Rokita posted about the case on X and said, ”Our office has a duty to hold bad actors accountable, including former public officials, who break the law and deceive Hoosier taxpayers. Brian Holtz falsely diverted funds from necessary Evansville projects and needs to pay back this money to the state. Through a lawsuit, we are working to make this happen.”

Last September, a Vanderburgh County judge sentenced Holtz to 12 months of probation after he pleaded guilty to charges of forgery, counterfeiting and official misconduct, according to WEHT-TV in Evansville.

According to MyCase, Holtz is not represented by anyone at this time.

Story Continues Below