Overview of Fairmount Funds Management’s Recent Acquisition

On October 9, 2024, Fairmount Funds Management LLC (Trades, Portfolio) made a significant new investment in the biotechnology sector by purchasing 6,620,311 shares of Inhibikase Therapeutics Inc (NASDAQ:IKT). This transaction, executed at a price of $1.26 per share, marks a new holding for the firm and reflects a substantial commitment, as these shares now constitute 0.93% of their portfolio and 9.90% of the company’s outstanding shares.

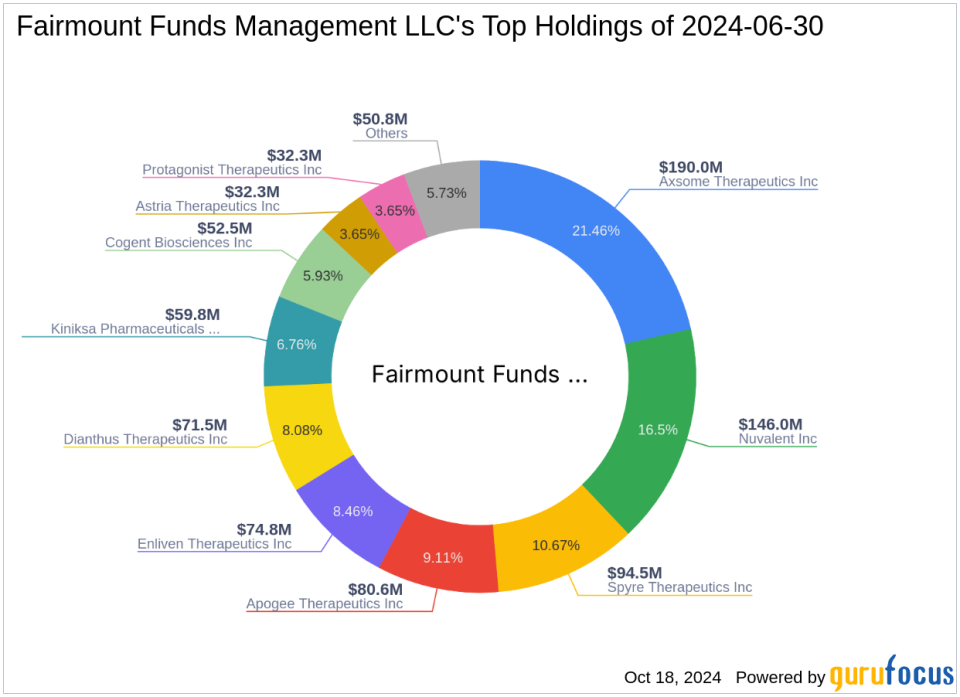

Insight into Fairmount Funds Management LLC (Trades, Portfolio)

Established with a strategic focus on long-term value creation, Fairmount Funds Management LLC (Trades, Portfolio) is a prominent investment firm based in Philadelphia. The firm manages a diversified portfolio with a keen interest in the healthcare sector, among others. With assets under management totaling approximately $885 million and 13 major holdings, the firm is known for its analytical approach to investment, focusing on sustainable growth and market resilience. Their top holdings include notable names like Spyre Therapeutics Inc (NASDAQ:SYRE) and Axsome Therapeutics Inc (NASDAQ:AXSM).

About Inhibikase Therapeutics Inc

Inhibikase Therapeutics Inc, based in the USA, is a clinical-stage pharmaceutical company dedicated to developing treatments for Parkinsons disease and related disorders. Since its IPO on December 23, 2020, the company has focused on advancing Risvodetinib, a promising drug candidate aimed at modifying the course of neurodegenerative diseases. Despite its innovative approach, the company faces significant financial challenges, reflected in its current market capitalization of $17.545 million and a stock price of $2.35, which has seen an 86.51% increase since the transaction date.

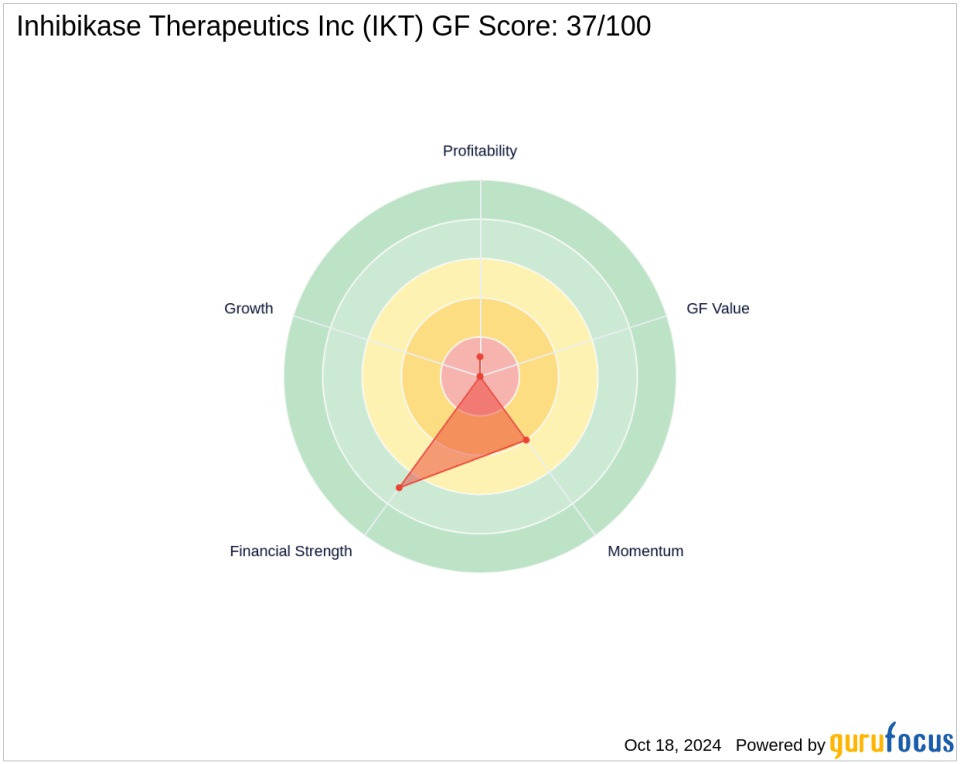

Financial Health and Market Position of Inhibikase Therapeutics

Inhibikase Therapeutics exhibits a complex financial landscape. With a Profitability Rank of 1/10 and a Growth Rank of 0/10, the company struggles in generating profitable growth. However, its Financial Strength is somewhat stable with a balance sheet rank of 7/10, supported by a cash to debt ratio of 44.61. The GF Score of 37/100 indicates challenges in future performance, with specific weaknesses in profitability and growth metrics.

Strategic Impact of the Acquisition on Fairmount’s Portfolio

The acquisition of a 9.90% stake in Inhibikase Therapeutics significantly diversifies Fairmount Funds Management LLC (Trades, Portfolio)s portfolio, particularly enhancing its exposure to the biotechnology sector. This strategic move aligns with the firm’s philosophy of investing in areas with potential for substantial scientific advancements. The trade’s impact, measured at 0.93% of the firm’s total portfolio, suggests a moderate yet meaningful commitment to Inhibikase’s future.

Market Performance and Future Outlook

Since its IPO, Inhibikase Therapeutics has experienced a drastic decline of 96.44% in its stock value, yet it has shown a remarkable recovery with a 76.45% increase year-to-date. The recent surge in stock price following Fairmounts investment could be indicative of renewed investor confidence or speculative interest in Inhibikases ongoing clinical trials.

Conclusion

Fairmount Funds Management LLC (Trades, Portfolio)s recent investment in Inhibikase Therapeutics Inc represents a calculated risk, aiming to capitalize on potential breakthroughs in Parkinsons disease treatments. While the financial health of Inhibikase poses considerable risks, the strategic nature of this investment could yield significant returns, aligning with Fairmounts long-term investment philosophy. Investors and market watchers will undoubtedly keep a close eye on this partnership’s evolution and its impacts on both entities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.