The federal government has begun integrating unspent capital expenditures from the 2024 fiscal year into its 2025 budget, a move officials say is aimed at improving fiscal efficiency and driving infrastructure-led economic expansion.

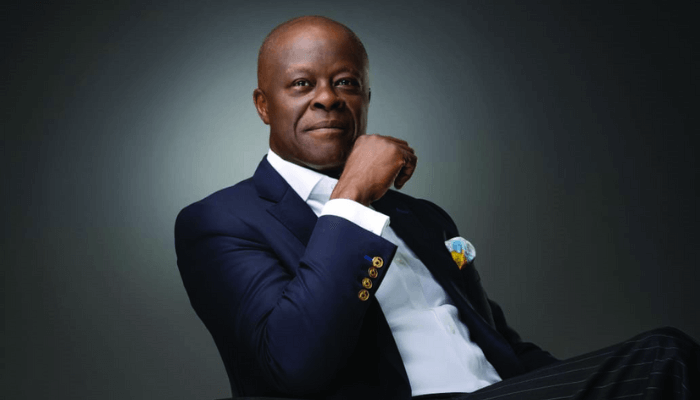

The policy, announced Wednesday by the ministry of finance, uses the Government Integrated Financial Management Information System (GIFMIS) to roll over unused capital funds. The effort, according to Wale Edun, minister of finance and coordinating minister of the economy is part of a broader reform to streamline budget execution and improve public investment impact.

At a high-level session in Abuja, Edun convened senior government officials to align on the strategy, which mandates that all Ministries, Departments, and Agencies (MDAs) secure financial warrants before entering into new contractual commitments.

The change is designed to prevent the historical accumulation of unpaid obligations and ensure that capital spending is matched by available cash.

“Nigeria’s future growth depends on effective, honest, and targeted spending,” Edun said. “We must ensure that public resources work harder for our people and our economy.”

The finance ministry emphasized that the reforms are central to President Bola Tinubu’s economic agenda, which targets a 7% annual GDP growth rate. That level of expansion, officials say, is necessary to meaningfully reduce poverty in Africa’s largest economy.

The decision to repurpose unspent capital funds marks a departure from past practice, where such funds would often be lost to the budget cycle. Instead, the use of the GIFMIS platform allows for real-time tracking and deployment of public funds, offering more flexibility and transparency in the fiscal process.

Read also: Recurrent spending dominates in 30 states while capital lags

Analysts believe that the move could help improve budget credibility—a long-standing challenge in Nigeria’s public finance management—and boost investor sentiment at a time when the country seeks increased foreign direct investment.

“This strategic move is aimed at unlocking private sector confidence, driving infrastructure delivery, and sustaining economic growth and development,” the ministry said in an official statement.

Nigeria, still recovering from currency volatility, inflationary pressure, and a fluctuating oil market, has been under increasing pressure to boost non-oil revenues and improve the credibility of its public spending.

For the private sector, the integration of unspent capital funds is expected to result in faster payment cycles and a more stable fiscal environment—key ingredients for attracting investment into critical sectors like energy, logistics, and housing.

“Transparent and efficient budget execution is critical to President Bola Ahmed Tinubu’s growth agenda,” Edun said during the meeting. By ensuring that every naira is tied to performance and measurable outcomes, the reforms aim to limit waste and encourage disciplined budgeting across federal agencies.

The ministry stressed that these measures reinforce the government’s commitment to fiscal responsibility and inclusive development, while laying the groundwork for long-term economic resilience.