Let’s say you’re new to the whole investing thing. Maybe you’ve got $1,000 of extra cash that won’t be needed for paying bills, living life, and other necessities. And since the stock market recently took a price dip, maybe this could be a good time to put that investable cash to work.

I’ve got some good news for you:

-

It’s always a good idea to get started with investing.

-

You’re very likely to do even better in the long run if you placed your first trade when the market was down.

-

You don’t even need to do much homework before taking that crucial first step. Just pick a broad market-tracking index fund with low fees, open a brokerage account, and you’re good to go.

There are lots of exchange-traded funds (ETFs) available to manage your first investment. There’s no need to complicate the choice, though. The largest market-tracking ETFs are popular for a reason, and investors don’t get bonus points for making creative ETF choices.

So I suggest starting out with one of the simplest, most popular, and least fee-burdened of all index funds. Say hello to every new investor’s best friend, the Vanguard S&P 500 ETF (NYSEMKT: VOO) fund.

What’s so great about index funds?

Index-tracking ETFs are great for a couple of reasons.

First and foremost, diversification is a key concept in long-term investing. Holding just one stock can be great when that company is enjoying a golden age, but not so awesome when something goes wrong. Spreading your investing risk across several stocks lowers that risk dramatically, especially when you include several different market sectors, geographic markets, and business types. A single fund lets you invest in dozens, hundreds, or even thousands of stocks via a single ticker.

ETFs also have a few advantages over old-school mutual funds. They are easier to trade, come with lower annual fees, and even carry taxation advantages not available to mutual fund investments. ETFs are a relatively new addition to the investing culture, first introduced to American investors in 1993. These days, there’s not much reason to go with the older and somewhat clumsier alternative.

Index funds arguably offer the best examples of every advantage I listed earlier. As a type of ETF that tracks specific stock indexes, they reflect the value of a large stock portfolio with real-time prices. Their management is highly automated, leaving the stock-picking research to a market index researcher somewhere else. Since there’s not much analysis to do on the ETF manager’s side of the equation, that firm can pass on the cost savings to individual investors. In short, they offer instant diversification with all the comforts of simple stock trades, and often, ultra-low management fees.

Why this particular Vanguard ETF?

It’s hard to beat Vanguard in terms of investor-friendly funds. Founder Jack Bogle had the genius insight that diversified market-tracking funds with minimal fees should deliver wealth-building returns in the long run. His company still sticks closely to that philosophy, nearly 50 years later.

As a result, most of the Vanguard firm’s funds are index trackers with very low fees. The superior portfolio-tracker features of exchange-traded funds allow for even better index-matching performance with even lower fees.

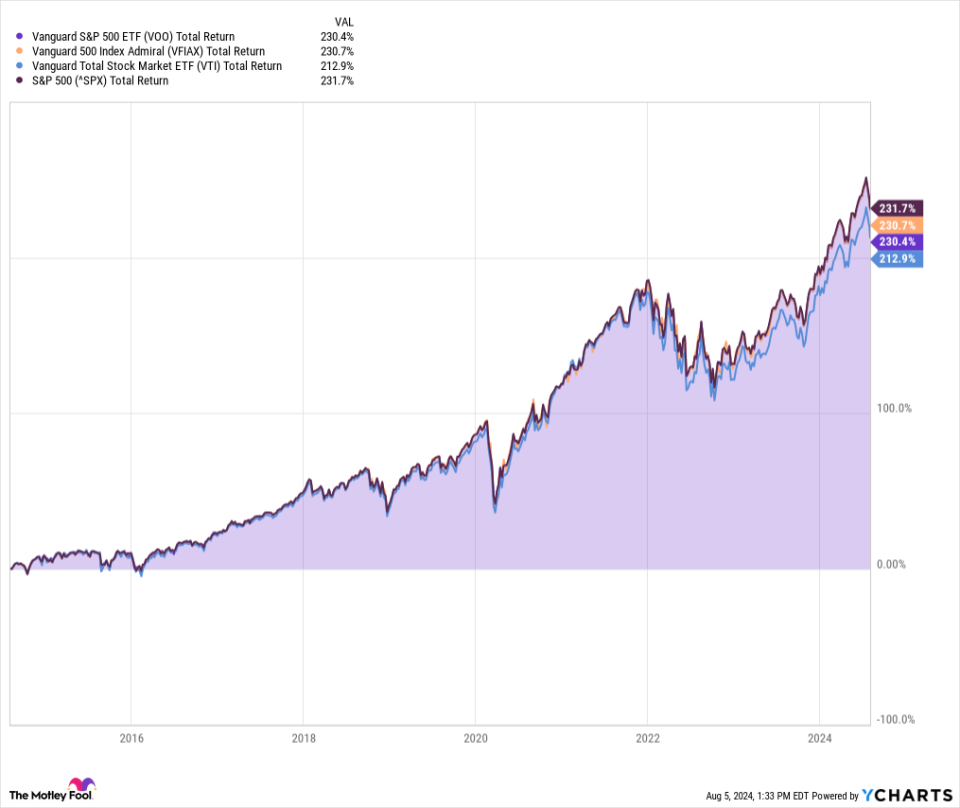

So Vanguard offers some of the lowest-cost and most reliable index funds on the market. There are alternatives such as the even older and larger SPDR S&P 500 ETF (NYSEMKT: SPY) or iShares Core S&P 500 ETF (NYSEMKT: IVV), both of which track the same S&P 500 (SNPINDEX: ^GSPC) market index as the Vanguard fund I recommended above. Vanguard offers other options, too, like the Vanguard 500 Index Fund (NASDAQMUTFUND: VFIAX), which offers a mutual fund version of the same S&P 500-tracking ETF idea.

Any of these names would be perfectly reasonable substitutes for the Vanguard ETF I selected. But in my eyes, Vanguard represents the gold standard of high-quality index funds, and its S&P 500 ETF is the go-to choice for diversified ETF investments. Sure, the Vanguard Total Stock Market ETF (NYSEMKT: VTI) tracks an even broader index with nearly 3,700 stocks and the same 0.03% annual fee, but the quality requirements for lifting a stock into the S&P 500 index help me sleep at night. It’s not a big difference, but every precious minute of worry-free shut-eye helps.

Next steps

There you have it. If you have $1,000 (or any other amount) available to invest today, it’s hard to beat the insta-starter idea of grabbing a few Vanguard S&P 500 ETF shares. The other ETFs and mutual funds seen earlier are also mighty fine choices, but again, you don’t have to make it complicated. I highly recommend going with the first respectable index fund that catches your eye, leaving refinement and more detailed investment choices for later.

The simplest, safest name of them all in my experience is the Vanguard S&P 500 ETF. So you should consider investing $1,000 in that fund to get started with life-changing investments. It’s that simple.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Anders Bylund has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard Total Stock Market ETF and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Got $1,000 to Invest In Stocks? Put It In This Index Fund. was originally published by The Motley Fool