The federal Thrift Savings Plan continued to evolve throughout 2025. Assets for the world’s largest retirement plan crossed $1 trillion midyear, and TSP now serves more than 7.2 million accounts. The plan counts among its ranks nearly 195,000 TSP millionaires—those with account balances of $1 million or more—up 23% from the end of 2024.

TSP investment options don’t often change, but there were more updates than usual in 2025, with the retirement of one lifecycle fund—TSP L 2025—and the launch of another—TSP L 2075. The TSP Lifecycle funds are target-date funds that automatically become less risky over time by moving out of equities and into fixed-income as investors approach retirement. TSP L 2025 closed as it hit its retirement year and its investors rolled into TSP L Income. The new TSP L 2075 is for investors who have about 50 years until their retirement, roughly coinciding with today’s 17-year-old workers.

The TSP plan still consists of five individual asset class funds plus 11 target-date L funds that invest in various combinations of the five funds. The official Tsp.gov site provides some basic information on all these offerings.

This is the first of two articles meant to provide more context on how the funds have performed compared with their peers. Here, we cover the five TSP stand-alone funds; we’ll cover the TSP L Funds in the next article. Use the page menu on the left to navigate to specific fund performance results through the end of 2025.

Your input has shaped what you see here. Thank you to those who took the time to provide feedback. You can still provide input by taking our TSP feedback survey.

Stand-Alone/Individual TSP Funds

TSP’s individual funds are a well-edited menu of mostly index strategies. With limited exceptions, workers have access to most major world markets via low-cost funds. TSP I Fund recently added emerging markets to its mix of non-US stocks, adding welcome diversification. The plan still lacks high-yield and international bonds exposure—the former of which is common in US workers’ savings plans.

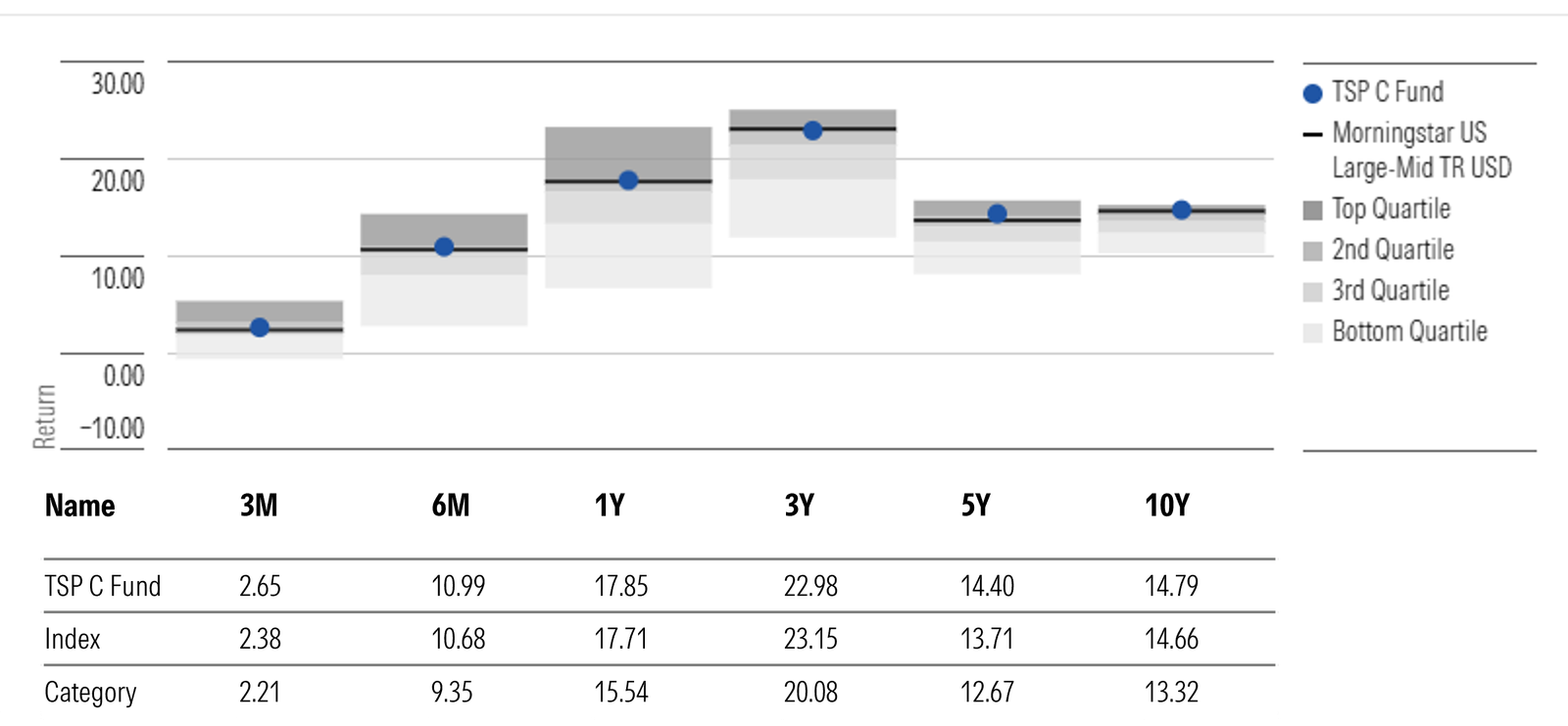

TSP C Fund—US Large-Cap Stocks

- Tracking Index: S&P 500 Index

- Funds with similar holdings: Vanguard 500 Index VFIAX, Fidelity 500 Index FXAIX, iShares Core S&P 500 IVV, Schwab S&P 500 Index SWPPX

- Morningstar Category Index: Morningstar US Large-Mid TR Index

- Morningstar Category: US Fund Large Blend

Also known as the TSP Common Stock Index Investment Fund, TSP C Fund seeks to replicate the S&P 500, an index of 500 of the largest US-based publicly traded companies that covers about 80% of the domestic equity market capitalization. By weighting holdings by market value, the fund reflects investors’ collective assessment of each company’s relative value. This approach is particularly effective with large-cap stocks, which tend to be very efficient; they tend to rapidly reflect new information in their share prices.

Index strategies continued to trounce active managers in 2025. TSP C fund’s 17.9% gain for the year ranked in the top quartile of large-blend Morningstar Category funds. Market efficiency and low fees have helped TSP C Fund win over the longer trailing three-, five-, and 10-year periods through December 2025, too; the fund ranks in the category’s top quartile over each period.

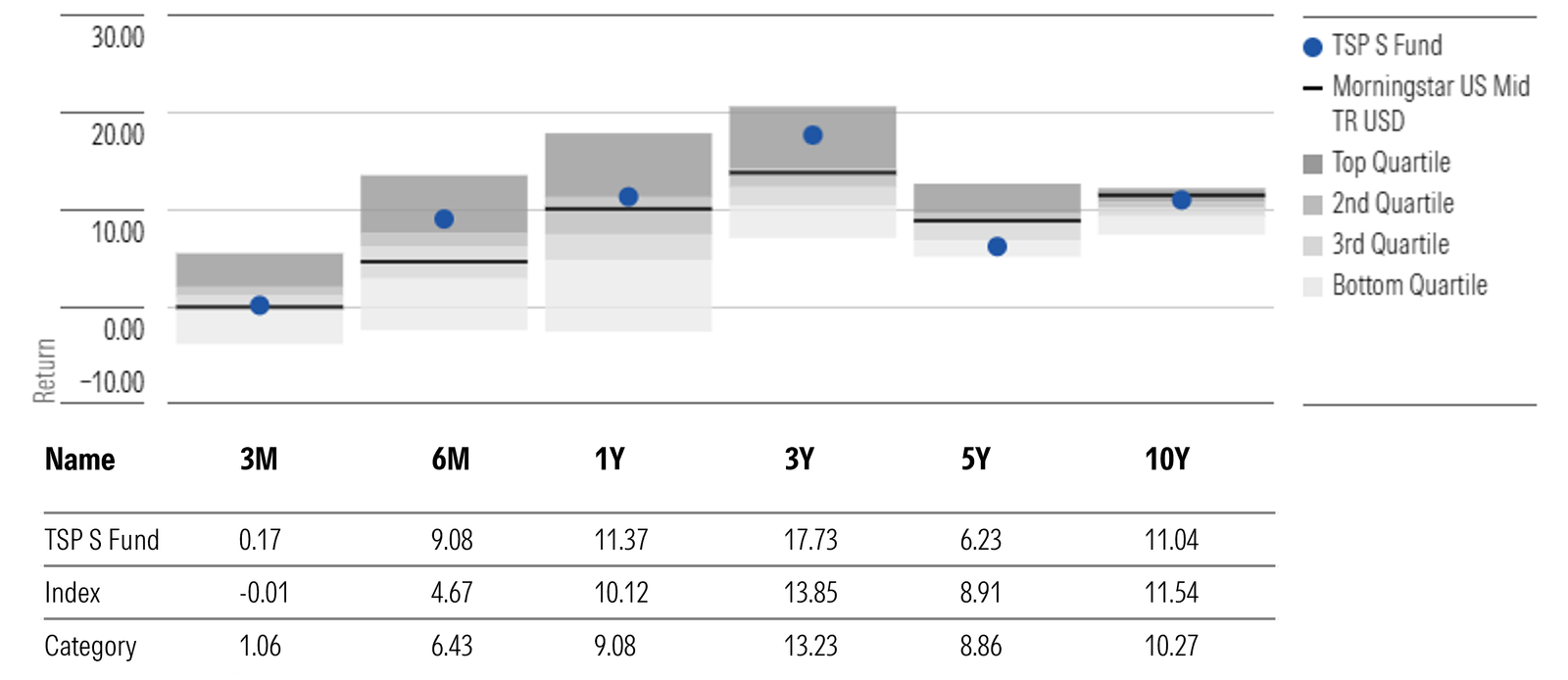

TSP S Fund—US Small- and Mid-Cap Stocks

- Tracking Index: DJ US Completion Total Stock Market TR Index

- Funds with similar holdings: Fidelity Extended Market Index FSMAX

- Morningstar Category Index: Morningstar US Mid TR Index

- Morningstar Category: US Fund Mid-Cap Blend

TSP S Fund, formally known as TSP Small Cap Stock Index Investment Fund, mirrors the Dow Jones US Completion Total Stock Market Index. This market-cap-weighted index tracks US stocks that the S&P 500 leaves out, so paired with the TSP C Fund, it resembles the entire US public equity market. TSP S Fund provides exposure to mid-, small-, and micro-cap companies, with a handful of larger firms that don’t make the S&P 500. It resembles mid-cap blend Morningstar Category funds the most.

Many of the fund’s largest positions are in companies that are large enough for the S&P 500 but fail its profitability requirements or were excluded by the benchmark’s index committee. These stocks are often more volatile, which can induce big swings in the fund’s results. Tesla TSLA, for example, helped the TSP S Fund beat the average mid-cap blend fund by almost 20 percentage points in 2020 before it joined the S&P 500 that year. Other larger-cap positions have weighed on results. The fund lagged peers by 11.0 and 12.3 percentage points in 2021 and 2022, respectively, as big holdings like Uber UBER and Block XYZ suffered deep declines. Those trends reversed in the last three years, as larger caps helped the fund achieve top-quartile one- and three-year returns, albeit with top-quartile volatility.

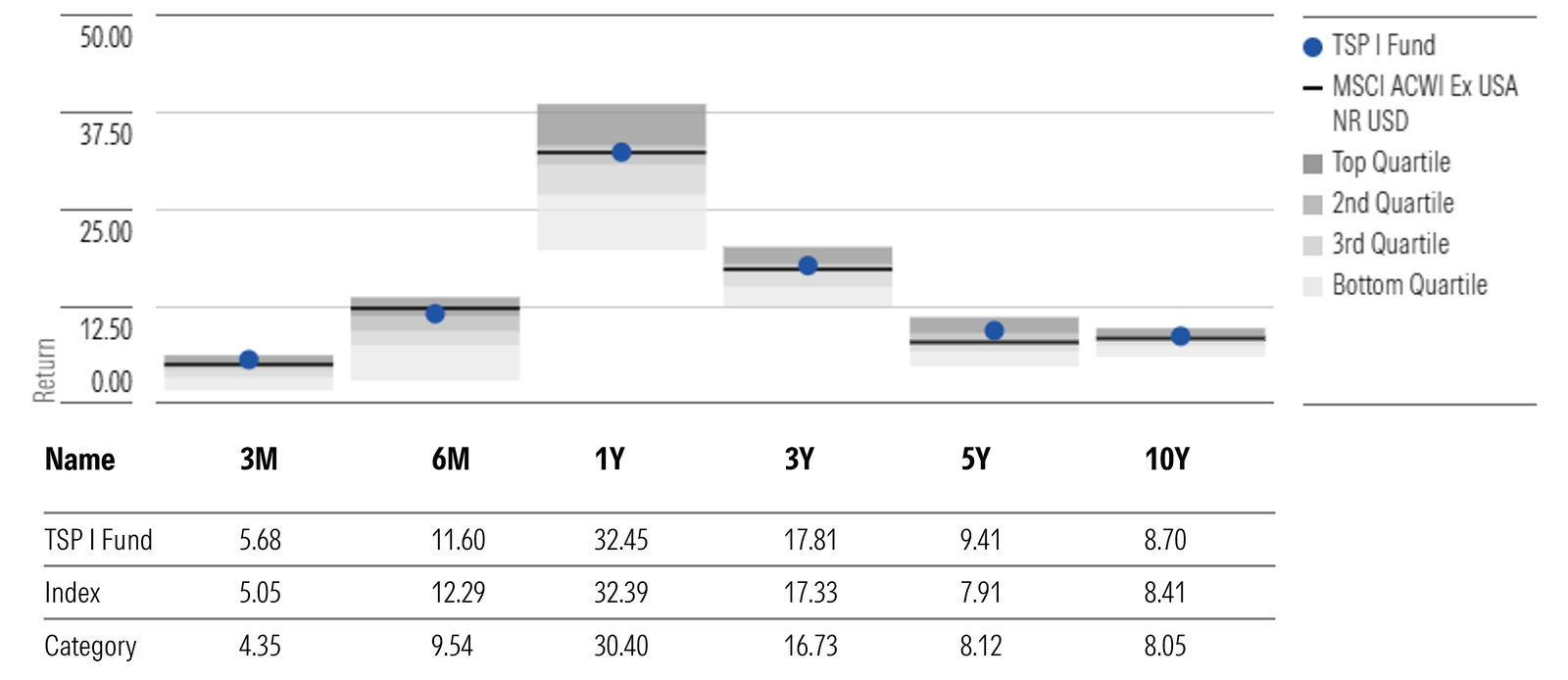

TSP I Fund—International Stocks

- Tracking Index: MSCI ACWI IMI ex China, HK, USA Index

- Funds with similar holdings: None that have the same China and Hong Kong market exclusions. Fidelity Total International Index FTIHX and iShares Core MSCI Total International Stock IXUS are the closest but include China and Hong Kong markets.

- Morningstar Category Index: MSCI ACWI Ex USA NR Index

- Morningstar Category: US Fund Foreign Large Blend

TSP I Fund, also known as TSP International Stock Index Investment Fund, has tracked the MSCI ACWI IMI ex China, HK, USA Index since the end of October 2024. Along with other updates, this benchmark change increased its helpings of small- and mid-caps and emerging markets. The fund now has more than twice the 10% of assets that the average foreign large-blend Morningstar Category fund has in emerging markets.

The timing of the emerging-market boost was fortuitous. Those stocks had a strong 2025, as did non-US equities in general. TSP I Fund’s 32.5% gain placed it just shy of the category’s top third. The bigger emerging-market stake could help the fund rallies, but the ride could be rockier.

TSP F Fund—US Bonds

- Tracking Index: Bloomberg US Aggregate Bond Index

- Funds with similar holdings: iShares Core US Aggregate Bond AGG, Schwab US Aggregate Bond SCHZ, SPDR Portfolio Aggregate Bond SPAB

- Morningstar Category Index: Bloomberg US Aggregate Bond Index

- Morningstar Category: US Fund Intermediate Core Bond

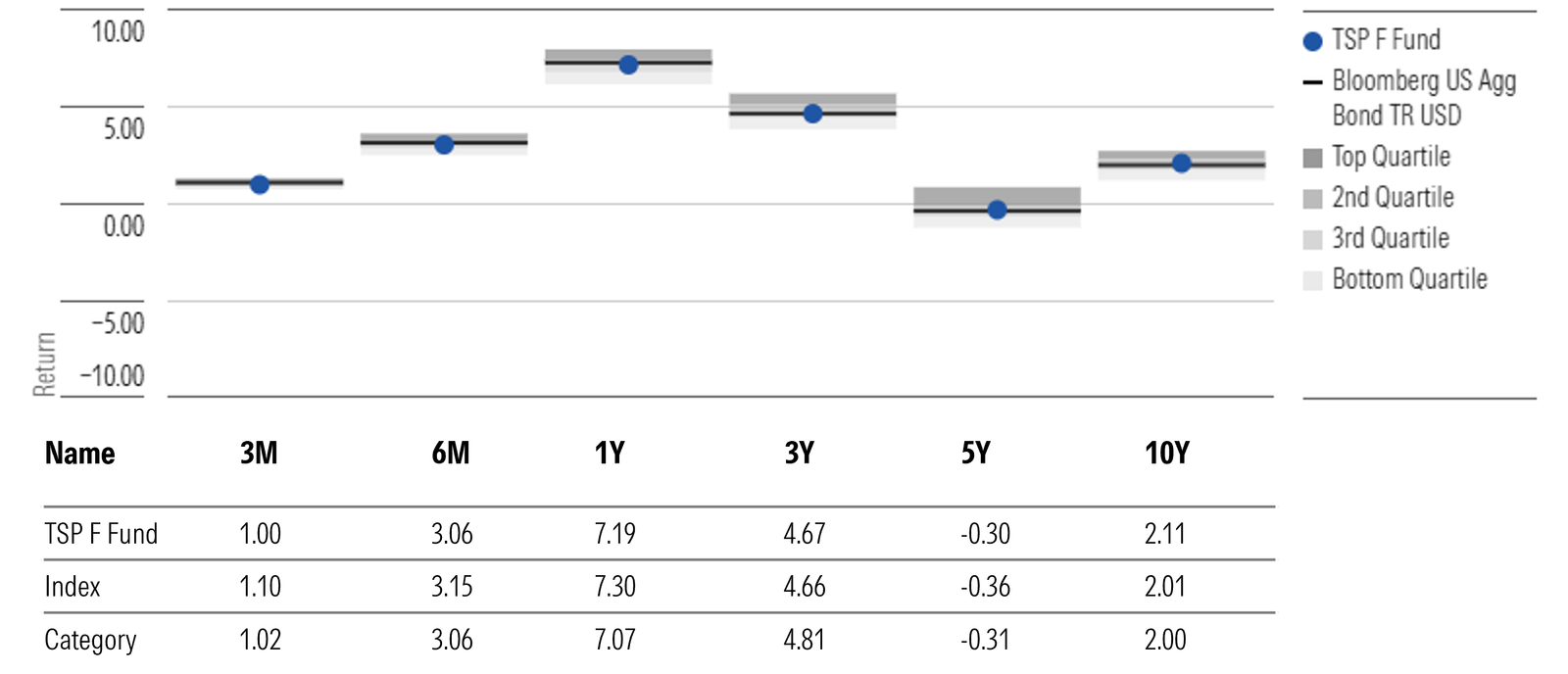

TSP F Fund, or the TSP Fixed Income Index Investment Fund, replicates the Bloomberg US Aggregate Bond Index of taxable, investment-grade US bonds with maturities of at least one year. This index strategy works well in the highly efficient and liquid US investment-grade bond market. TSP F Fund’s advantage is its rock-bottom price; higher-cost active funds often take additional risk to make up their higher fees.

Over the 10 years through December 2025, TSP F Fund gained 2.1% annualized, beating the typical intermediate core bond Morningstar Category peer by 11 basis points. Its performance has been consistent: It tends to perform well when credit spreads widen, reflecting its limited credit risk, but it lags when spreads tighten and investors become less picky about quality. That should have been a headwind in 2025, when credit spreads remained at near-historic lows and credit markets rallied. But the fund’s longer duration helped it keep up as declining interest rates boosted bond prices; the fund’s 7.2% gain ranked in the peer group’s top half for the year.

TSP G Fund—Ultrashort Bonds

- Tracking Index: Not applicable

- Funds with similar holdings: Not applicable

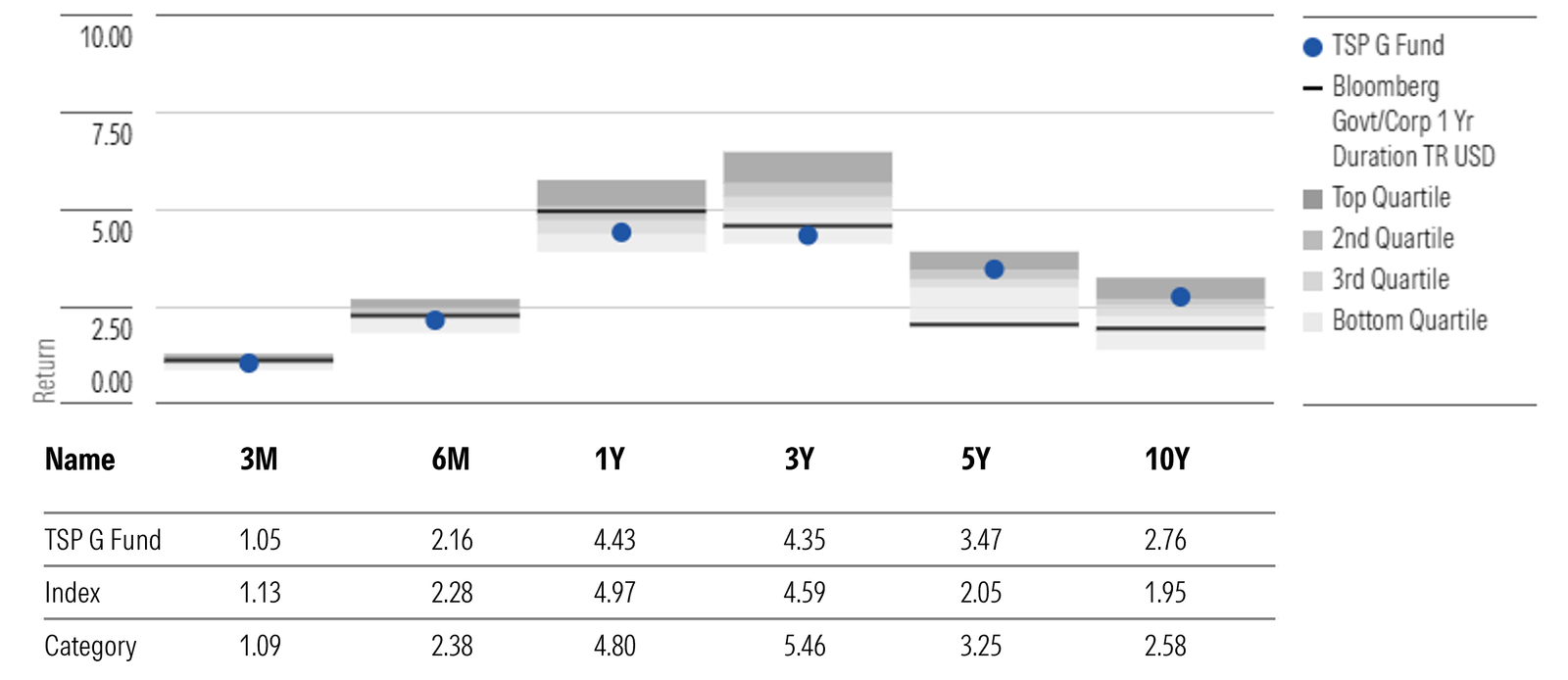

- Morningstar Category Index: Bloomberg Government/Corporate 1 Year Duration TR Index

- Morningstar Category: US Fund Ultrashort Bond

No other investment truly mirrors TSP G Fund. Also known as the TSP Government Securities Investment Fund, TSP G Fund offers investors the higher yield typically associated with longer-term US government bonds but without the day-to-day price volatility of those bonds. We compare TSP G Fund’s performance with the ultrashort bond Morningstar Category. The fund’s longer-maturity bonds give it a built-in edge over this category, though category constituents can offset that advantage by investing in corporate bonds.

Taking credit risk helped the category’s managers in 2025. The TSP G Fund’s 4.4% one- and three-year annualized gains through the end of December 2025 ranked in or near the ultrashort bond category’s bottom quartile. Over the five- and 10-year periods, it has come out on top by roughly 20 basis points. Its risk-adjusted returns have been superior because of its low volatility.