Most actively managed bond funds outperformed their benchmark in the first six months of 2024, with the higher interest rate world creating greater opportunities for active managers across the fixed income space.

This will come as great relief for managers, with fewer than half of all European, UK and US active government bond funds surviving the decade to the end of 2022.

According to the SPIVA Global scorecard, nine out of 12 fixed income categories saw majority outperformance in the first half of 2024, with outperformance greatest among funds exposed to lower-credit and less-liquid issues.

With no major blowups and spreads narrowing over the period, bonds at the riskier end of the spectrum enjoyed a strong six months with active managers able to capture the risk premia.

The best pocket of outperformance came in US-domiciled short and intermediate investment grade (IG) funds, with just 13% of active managers underperforming the index.

Europe-domiciled funds covering US fixed income, meanwhile, also enjoyed a strong six months, with 60% of funds in the corporate bond space outperforming the benchmark. High-yield funds did particularly well with 63% outperforming.

Active funds covering European fixed income fared better still, with only 35% of corporate bond funds, 34% of government bond funds, and 27% of high-yield bond funds underperforming the benchmarks.

For active equity managers, on the other hand, the first six months of 2024 proved a challenging environment.

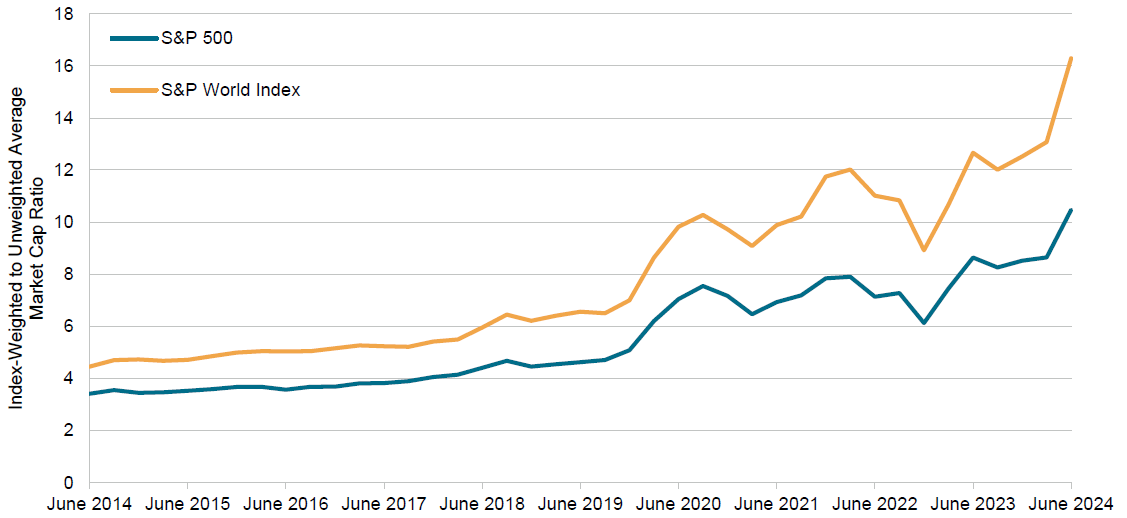

While the US stock market has captured most of the international attention around mega-cap concentration, the strong performance of large-caps created challenging conditions for stockpickers across the globe.

Chart 1: Market cap comparison – US vs global

Source: SPDJI

Underperformance in the US was surprisingly low in the US given the difficult backdrop, with only 43% of active large-cap equity managers underperforming the S&P 500.

In Europe, however, conditions were particularly demanding for active managers, with 83% of pan-European equity funds lagging the S&P Europe 350 over the period.