FY 24 state revenue exceeds estimate, deposits made to reserve funds

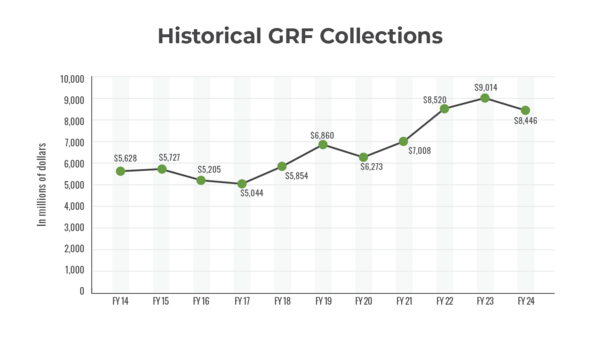

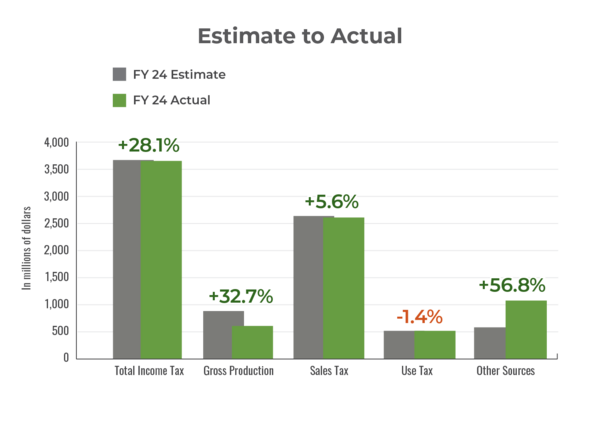

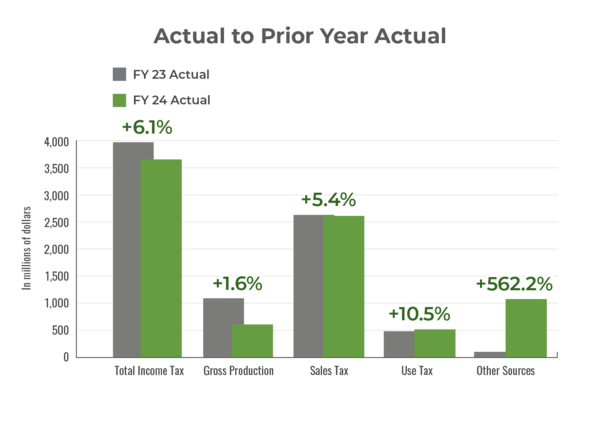

OKLAHOMA CITY (Aug. 7, 2024) – General Revenue Fund collections for fiscal year 2024 were approximately $8.5 billion, which is $177.7 million, or 2.1%, above the estimate for the year and $547.2 million, or 6.1%, below the all-time high record collections of the previous year. In addition, fiscal year 2024 registered $262.2 million and $91.3 million in deposits to the Revenue Stabilization Fund and Constitutional Reserve (Rainy Day) Fund, respectively. The combined balance in both funds is slightly above $2 billion.

“In the wake of two consecutive years of record collections, total general revenue collections from fiscal year 2024 still pulled ahead of the estimate and enabled additional deposits into state savings accounts,” said Katie DeMuth, interim director of OMES. “These reserves position the state to enter the new fiscal year with a strong foundation.”

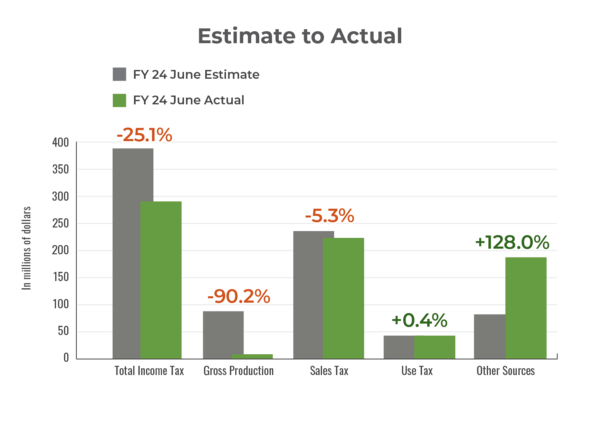

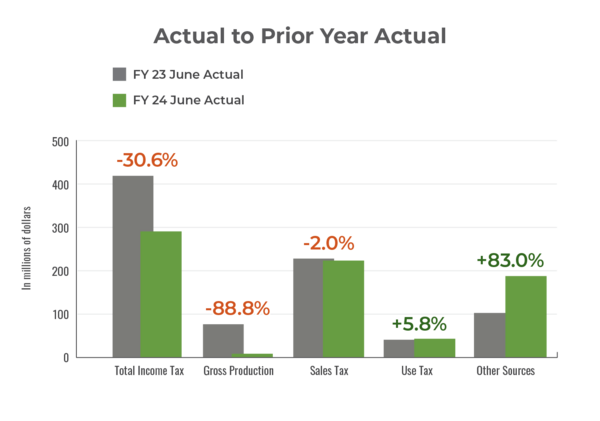

General Revenue Fund collections for the month of June totaled $753.3 million, which is $84.2 million, or 10.1%, below the monthly estimate after $154.9 million in collections was deposited into state reserve funds. This is $113.4 million, or 13.1%, below collections in June 2023. In the month of June, there was a $130.2 million deposit to the Revenue Stabilization Fund and a $24.7 million deposit to the Rainy Day Fund, bringing the current balances to $663.6 million and $1.3 billion, respectively.

Revenue tables are available on the OMES website.

As state government’s main operating fund, the GRF is the key indicator of state government’s fiscal status and the predominant funding source for the annual appropriated state budget. GRF collections are revenues that remain for the appropriated state budget after rebates, refunds, other mandatory apportionments and after sales and use taxes are remitted back to municipalities. In contrast, gross collections, reported by the state treasurer, are all revenues remitted to the Oklahoma Tax Commission.

As state government’s main operating fund, the GRF is the key indicator of state government’s fiscal status and the predominant funding source for the annual appropriated state budget. GRF collections are revenues that remain for the appropriated state budget after rebates, refunds, other mandatory apportionments and after sales and use taxes are remitted back to municipalities. In contrast, gross collections, reported by the state treasurer, are all revenues remitted to the Oklahoma Tax Commission.

Media Contact

Christa Helfrey

christa.helfrey@omes.ok.gov

About the Office of Management and Enterprise Services

The Office of Management and Enterprise Services provides financial, property, purchasing, human resources and information technology services to all state agencies, and assists the Governor’s Office on budgetary policy matters. Our mission: Provide excellent service, expert guidance and continuous improvement in support of our partners’ goals. For more information, visit oklahoma.gov/omes.