A newly unsealed multicounty grand jury report in Oklahoma found mismanagement of millions of dollars in the Governor’s Emergency Education Relief Fund (GEER).

The report stated that they found a “grossly negligent handling of federal grant money” and misspending of $40 million leaving the citizens of Oklahoma unable to get the help they truly needed.

“Nevertheless, we find the grossly negligent handling of federal grant money and utter lack of internal controls and oversight over the grant-funded initiatives to be irresponsible, disappointing, and indefensible. What’s more, the waste and misspending of millions of dollars in emergency aid was easily preventable. This mismanagement prevented the most vulnerable Oklahomans from getting help they desperately needed during a global pandemic. Citizens deserve more from their Government,” the jury said.

Kevin Stitt, governor of Oklahoma, speaks during a meeting with U.S. President Donald Trump and governors in the State Dining Room of the White House in Washington, D.C., U.S., on Thursday, June 18, 2020. (Chris Kleponis via Getty Images)

The report claims there were other troubling practices and actions, but ultimately there was no sufficient evidence to prove beyond a reasonable doubt that a crime was committed.

“Although our investigation uncovered deeply troubling practices and actions (and inactions) by the state offices, non-state entities, and private individuals tasked with establishing and administering the BTG and SIS initiatives, we ultimately find insufficient evidence exists to establish, beyond a reasonable doubt, that a crime was committed. Nor do we find willful or corrupt misconduct or willful malfeasance,” the report stated.

WASHINGTON STATE DIVERTED $340M IN FEDERAL COVID FUNDS TO IMMIGRANTS, INCLUDING VIA $1,000 CHECKS

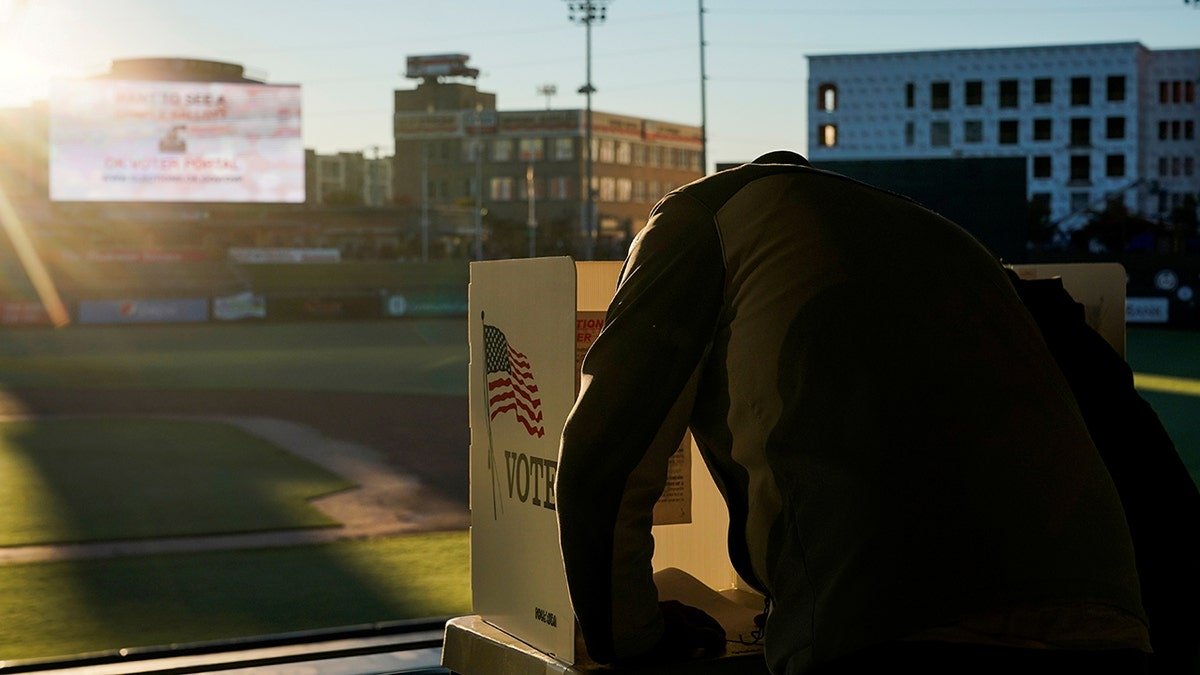

A voter fills out his ballot during early voting at ONEOK Field in Tulsa, Oklahoma, Oct. 30, 2020. (REUTERS/Nick Oxford)

The report highlighted that the grand jury ultimately found a majority of the issues resulted from the state’s disregard of existing administrative safeguards, “EKCO Director’s authorization of all integrated vendors on the platform effectively disregarded all internal control options offered by the Company.”

It went on to point out that as a result, “no limit was placed on the items families could purchase with BTG funds in the first instance, and nobody was monitoring purchases to ensure they complied with program requirements on the back end. It should come as no surprise then that a massive portion of BTG awards—over $1.7 million by the State Auditor’s assessment—went to the purchase of items that could not reasonably be deemed to serve an emergency educational purpose.”

Some of the items listed were common household luxuries and had nothing to do with the education system.

“Such unallowable purchases included but were not limited to: 817 televisions, 385 watches or smartwatches, 179 doorbell cameras, 174 cell phones and related accessories, 71 refrigerators, 27 Xbox systems, and 3 Christmas trees. Not only did the use of these funds to purchase non-education items breach the State’s duty to ensure GEER Fund money was only used for pandemic-related emergency educational assistance, but that money could have been directed to provide intended pandemic relief where it was actually needed,” the report stated.

DEM STATES, CITIES OVERRUN BY MIGRANTS FUNNELED MILLIONS IN FEDERAL COVID-19 AID TO SUPPORT ILLEGALS

An Oklahoma appeals court has agreed to a plan by state Attorney General Gentner Drummond to halve the pace at which executions are conducted. (AP Photo/Sue Ogrocki, file)

“The State bestowed these individuals and organizations with control over millions of dollars in federal funding without any vetting process or formal agreement assuring their accountability to the State,” the grand jury said.

CLICK HERE TO GET THE FOX NEWS APP

The Oklahoma State Department of Education also released a statement on the investigation’s findings.

“Superintendent Walters has prioritized carefully and efficiently using taxpayer funds. Unfortunately, in this case, the vendor involved did not adhere to the same standards. Superintendent Walters’s deep commitment to fiscal responsibility and taxpayer accountability has been borne out during his time as Secretary and now as State Superintendent. Under his leadership, OSDE has instituted the highest standards to ensure the most efficient use of taxpayer money possible,” the department said.