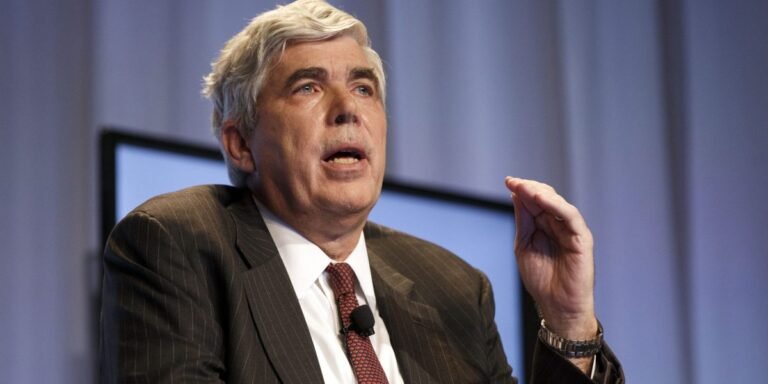

Ken Leech, the longtime Western Asset Management chief investment officer, left that role amid probes from the Justice Department and Securities and Exchange Commission into whether some clients were favored over others in allocating gains and losses from derivatives trades.

Leech, who manages some of the largest bond strategies in the US, will take an immediate leave of absence after receiving a Wells notice from the SEC, the company said in a filing Wednesday. Federal prosecutors in New York are conducting a criminal probe into the practice known as “cherry-picking,” where winning trades are credited to favored accounts, according to people familiar with the matter.

“The company launched an internal investigation into certain past trade allocations involving treasury derivatives in select Western Asset-managed accounts,” the firm said. “The company is also cooperating with parallel government investigations.”

Western Asset said Wednesday it’s closing its $2 billion Macro Opportunities strategy and named Michael Buchanan as sole CIO. Shares of parent company Franklin Resources Inc. tumbled 13% to $19.78, the most since October 2020, extending their decline this year to 34%.

Western Asset, with $381 billion in assets, is one of the original California bond giants and once rivaled Pacific Investment Management Co. and BlackRock Inc. in size. Its key funds have struggled in recent years amid the rise in interest rates, leading to outflows in its flagship strategy, which Leech helped run.

Franklin, which has about $1.6 trillion in assets overall, acquired Western as part of the 2020 purchase of Legg Mason. Leech has worked at Western Asset for more than 30 years, serving as CIO for the bulk of that time.

A Wells notice, which isn’t a formal allegation or finding of misconduct, provides a chance to respond to the agency and try to dissuade it from filing a case.

Leech was a star for years. He co-managed the company’s Core Plus fund as it trounced its peers, though it also stumbled in 2018 when the Fed was raising rates. Since 2021, it has been battered by wagering on a pivot by the central bank.

The $19 billion mutual fund, which is up 2.4% this year, is trailing more than 90% of rivals over the last three and five year periods, and investors have yanked money.

That pullback from Western Asset’s fund stands in contrast to rival ones managed by the likes of Pimco, Capital Group Inc. and BlackRock Inc., which have taken in cash this year as the Federal Reserve prepares to cut interest rates.

“At Franklin, it’s somewhat problematic as the whole reason for buying Legg Mason was to help offset the loss of commission-based sales to drive flows,” Greggory Warren, a strategist at Morningstar, said in a phone interview. “Buying Legg was seen helping provide then with more fixed income and institutional client exposure and being less exposed to fee pressures.”

Western had quietly named Buchanan co-chief investment officer alongside Leech in August 2023. John Bellows, who co-managed Core Plus since 2018, abruptly left at the start of May. A spokesperson for Western earlier said that the firm thanked Bellows for his contributions.

Jim Hirschmann, Western’s president and chief executive officer, said in the statement that Buchanan “has played an integral role in Western Asset’s strategy and growth, and we look forward to having him lead the next chapter of our storied investment team.”