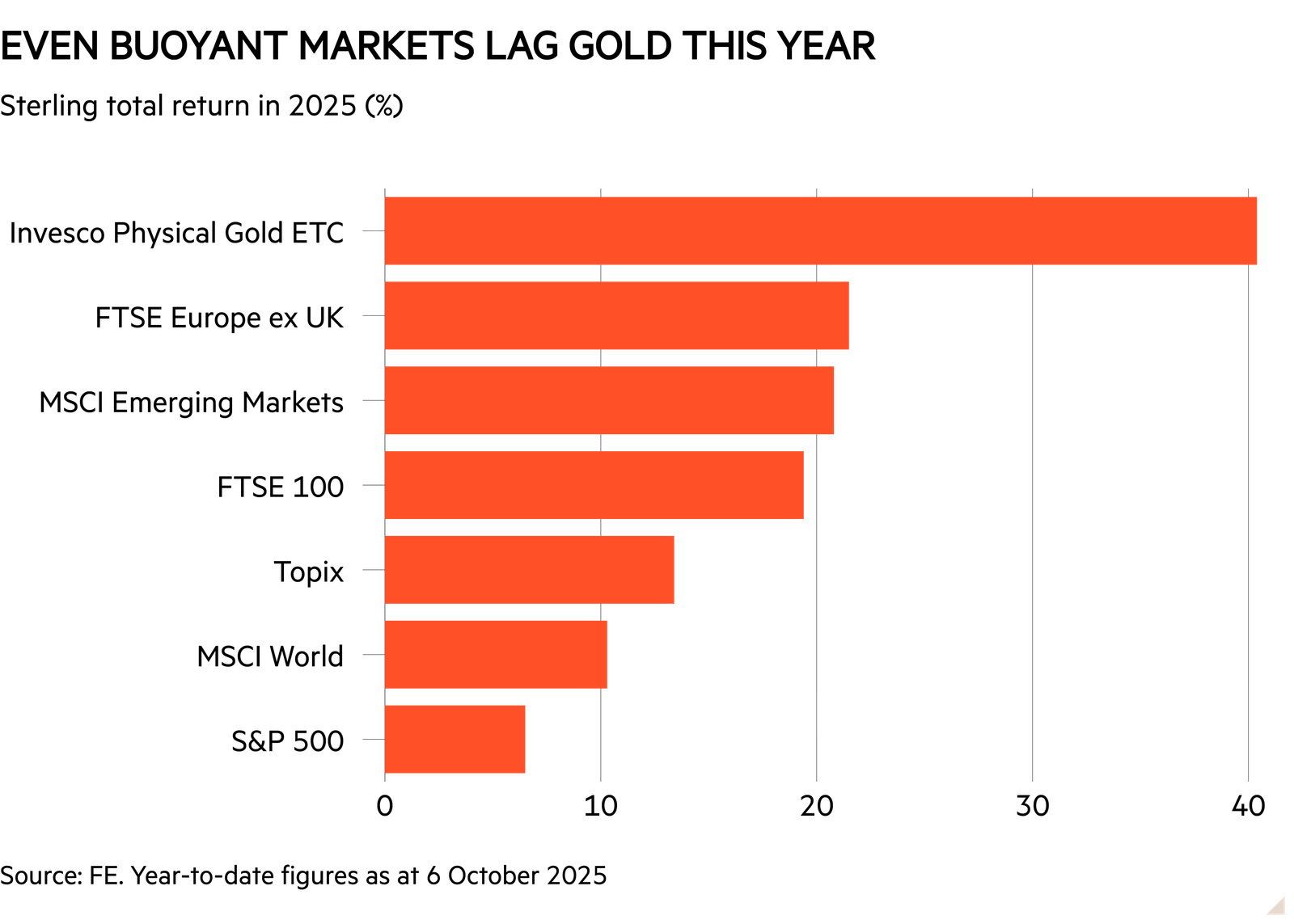

Markets may have rallied hard this year, but they are still well behind the quintessential safe-haven asset.

With geopolitical uncertainty still high and demand surging, the gold price has hit a series of fresh highs, recently surpassing the $4,000 mark for the first time.

This has unsurprisingly translated into a bumper year for gold funds. The humble gold exchange traded fund (ETF), which simply focuses on tracking the price of the precious metal, has made a sterling return of around 40 per cent for the year to date as at 6 October.

Investors will naturally have different opinions on whether the gold boom can continue, and whether they wish to take profits on such gains or double down.

Either way, it’s worth examining precisely how different gold funds have performed this year and what type of exposure they offer.

Gold rush

Different forms of gold investment can behave in different ways. A physical gold ETF will, as mentioned, simply track the gold price.

As such, it’s affected by an array of factors from the strength of the US dollar to the trajectory of interest rates and bond yields, as well as investor sentiment, structural demand and the degree of geopolitical uncertainty in a given period.

This simple form of exposure remains a good option for those who want to use gold as a form of portfolio insurance, in the hope that its value will rise if stock markets struggle or times appear especially unpredictable.

Read more from Investors’ Chronicle

By contrast, active gold funds (as well as some passives, such as the VanEck Gold Miners ETF (GDX)) focus on mining companies.

These are much more volatile, with broader stock market moves and company fundamentals having an effect on prices, often more so than the factors above.

Such funds can suffer greatly when markets struggle, but tend to really make hay when the gold price and stock markets thrive at the same time.

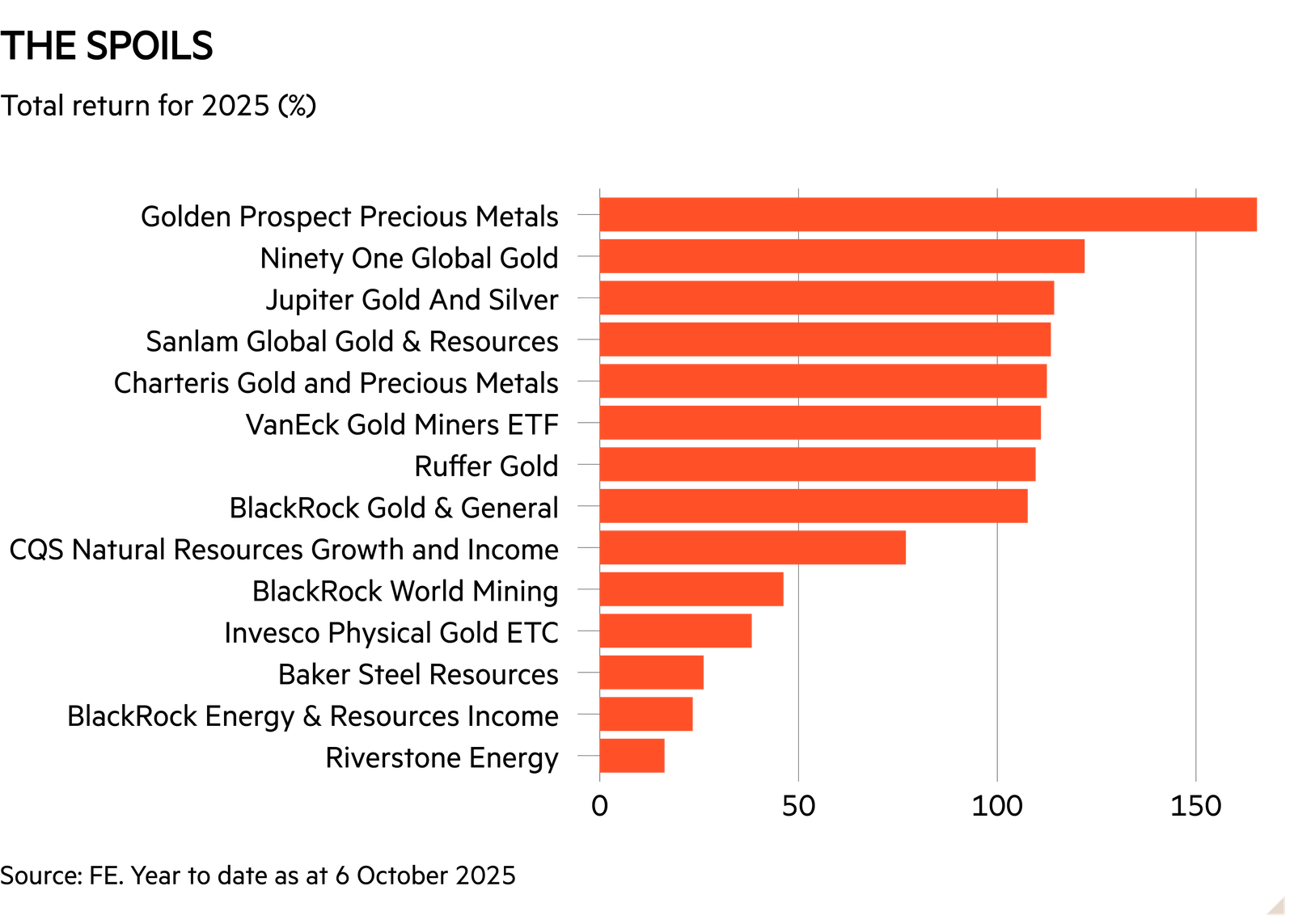

Golden Prospect Precious Metals’ (GPM) shareholders will be more than familiar with this dynamic.

They have made a share price total return of around 165 per cent so far in 2025, having made around 20 per cent the previous year.

But medium to long-term shareholders will have needed some patience to reap these rewards, given that they would have suffered double-digit paper losses in each of the previous three calendar years.

This illustrates the fact that niche gold mining funds might be best held as small positions in a wider portfolio, and that investors should strongly consider taking some profits after making enormous gains.

The second chart outlines how some of the funds on offer have done this year.

As you’d expect, those names that focus narrowly on gold, or on gold and silver, have done especially well.

Diversified funds such as BlackRock World Mining (BRWM) have also made big gains, if less outlandishly large in nature.

Of the current highest flyers, Golden Prospect Precious Metals has an 85.7 per cent allocation to gold miners, with 12.2 per cent in silver.

In terms of the type of companies it backs, 69.7 per cent of the portfolio is in producers of the yellow metal, with 23.3 per cent in developers and 7 per cent in explorers.

The fund has some reasonably chunky position sizes: top holding Equinox Gold (CA:EQX) accounts for 8.1 per cent of the portfolio, with West African Resources (AU:WAF) on 6.8 per cent and Emerald Resources (AU:EMR) on 5.1 per cent. The top 10 holdings make up almost half the fund.

The trust’s shares trade on a relatively modest discount of around 6 per cent to net asset value (NAV).

It’s also worth noting that, like some of its peers, the trust does not pay dividends.

Some of the more diversified names differ here: both BlackRock World Mining and stablemate BlackRock Energy and Resources Income (BERI) have share price dividend yields of nearly 3.5 per cent.

A wider reach

Those more diversified names do have plenty going for them. BRWM, for example, may not be immune to the ups and downs of the commodity world but it has a degree of diversification compared with peers.

It made some handsome gains in 2022 when active gold funds fared badly, for instance. Having said that, the fund did struggle last year, when mining dividend cuts hit the portfolio.

Its portfolio has a good spread of exposure to different metals, with a 36 per cent allocation to gold, 24.3 per cent in ‘diversified’ miners and 20.6 per cent in copper plays.

The fund has much smaller allocations to a number of other resources, including steel, iron ore, industrial metals and platinum group metals.

BlackRock Energy Resources and Income, meanwhile, is more diversified still. Some 37 per cent of the portfolio is in mining shares, with 30 per cent in traditional energy and a further third focused on the energy transition.

The fund is not a play on bullion as such, given gold miners make up just 4 per cent of the portfolio. Diversified miners account for 18 per cent, with ‘integrated’ traditional energy plays on 15.6 per cent and the electrification segment of its energy transition portfolio on 11.5 per cent.

So the two BlackRock vehicles can behave very differently: BERI has captured much less upside this year, but managed a modest positive share price total return in 2024 as BRWM shareholders struggled.

BERI shares currently trade on a bigger discount, of around 8 per cent versus 4 per cent for BRWM.