Trustnet looks at the most popular options last year and those that struggled to stem the tide of withdrawals.

Artemis UK Select was the only active IA UK All Companies fund to take in more than £500m in new money from investors last year, data from FE Analytics shows.

The fund has been a consistent winner for investors, topping the sector in 2024 and delivering 28.4% in 2025 – a top 10 performance.

Its recent success has propelled the fund to second place in the peer group over three and 10 years, while its five-year gain of 107.9% is a top-five effort.

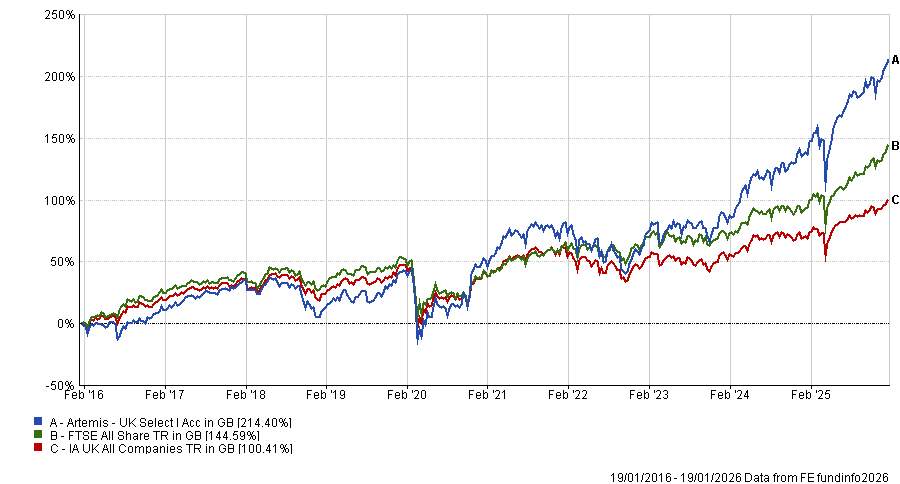

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Managed by Ambrose Faulks and FE fundinfo Alpha Manager Ed Legget, the £5.2bn fund is a high-conviction strategy of 40-60 holdings that has the option to take short positions to boost returns or mitigate losses as appropriate. It is currently shorting four stocks.

It is unconstrained by market capitalisation, although at present is largely invested in large caps (76.4%), with 20.7% in mid-caps and less than 1% in smaller companies.

Four of its top five holdings are banks, with Standard Chartered its biggest position at 6.5%, while Barclays, NatWest and Lloyds are also included.

It was the 14th most-researched fund on Trustnet last year, with Darius McDermott, managing director at Chelsea Financial Services, describing it as one of the “premier UK equity funds”.

By far the most popular strategies, however, were those that incorporated a ‘passive plus approach’. Royal London UK Broad Equity Tilt and Royal London UK Core Equity Tilt took in £755m and £606m respectively last year.

The Royal London funds are both managed by Michael Sprot and Nils Jungbacke, who aim to replicate the performance of the FTSE 350 with a carbon intensity of at least 10% lower than the market.

Abrdn UK All Share Tracker was the only traditional equity tracker on the list (£700m new inflows in 2025), while iShares UK Equity ESG Screened and Optimised Index (UK) garnered £508m in net new cash over the course of 2025. It tracks the Morningstar UK ESG Enhanced Index.

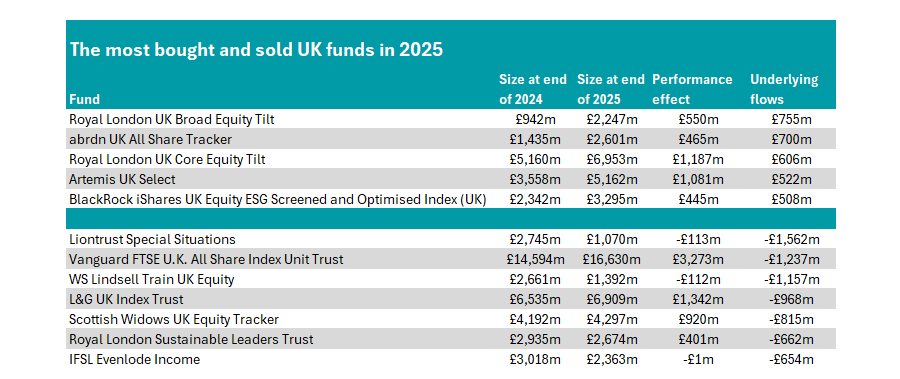

Source: FE Analytics

Conversely, there were seven funds that investors pulled more than half a billion pounds from in 2025. Top of the heap was Liontrust Special Situations, which went into 2025 without longtime Alpha Manager Julian Fosh who retired, although co-manager Anthony Cross remains on the fund.

The fund, which was once home to more than five times its current £1bn in assets under management, has had a rotten few years, sitting in the bottom quartile of the peer group in both 2025 and 2024. As such, it is below the average peer over one, three, five and 10 years, the latter of which is the only time period that it escapes the bottom 25% of the sector.

It uses the team’s ‘Economic Advantage’ approach, buying companies across the market capitalisation spectrum that have a durable competitive advantage, giving it a quality bias. All small-caps, meanwhile, must have at least 3% ownership by senior management.

The fund’s use of mid- and small-caps has been a detractor in recent years, with the FTSE 100 outperforming the FTSE 250 and FTSE Small Cap indices.

Despite its poor returns, it remains recommended by analysts at Titan Square Mile, who said it has a “number of compelling attributes”, such as a “well-considered and clearly defined investment approach”.

It was one of three quality-growth names on the list of most sold UK All Companies funds in 2025, including the £1.3bn WS Lindsell Train UK Equity (£1.2bn in outflows) and £2.3bn IFSL Evenlode Income (-£654m). Both also sit in the fourth-quartile of the peer group over one and three years.

Alpha Manager Nick Train has repeatedly apologised for the poor performance of his WS Lindsell Train UK Equity fund over the past few years, which has failed to make an above-average gain versus its peers in a calendar year since 2021.

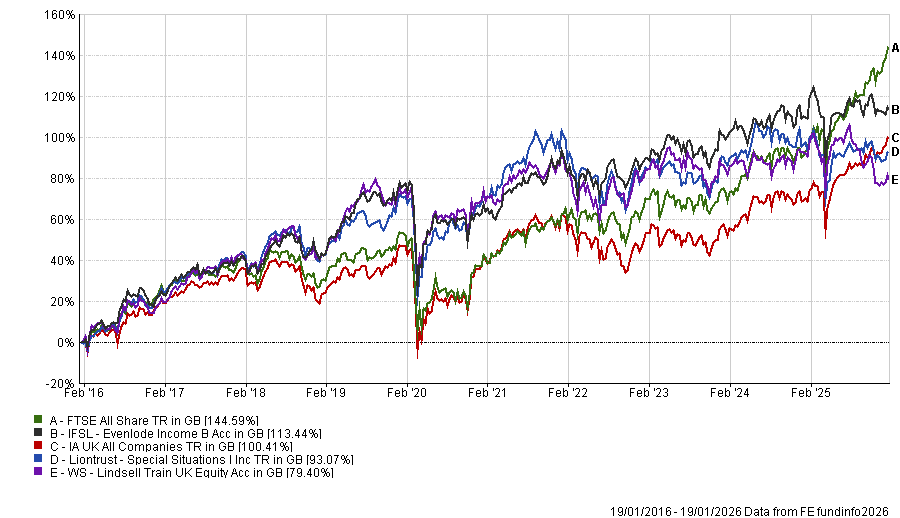

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Despite this, it remains backed by analysts such as interactive investor, who said the manager’s “deep understanding of company strategies and his ability to see through the noise and buy stocks that are best placed to defend their businesses over the long term” are a key strengths.

However, they conceded that investors “must be comfortable with periods of short-term volatility” and that the fund “will face headwinds if any of the sectors it is underweight outperform”, as has been the case in recent years.

IFSL Evenlode Income also retained backing. Its 10-year numbers remain above the sector average despite recent wobbles, with AJ Bell placing it on the firm’s best-buy list.

“We like this boutique asset manager who holds a clear investment philosophy around investing in high-quality businesses, which is consistent across all the funds managed by the team. We believe investors benefit from the disciplined nature of the investment process, which the fund manager consistently adheres too. Additionally, the long-term nature of the approach is another compelling feature” they said.

They were joined on the most-sold list by passive funds Vanguard FTSE U.K. All Share Index Unit Trust, L&G UK Index Trust and Scottish Widows UK Equity Tracker, as well as fellow active strategy Royal London Sustainable Leaders Trust.

This is the first of a series in which Trustnet looks at the unit trusts and open-ended investment companies (Oeics) fund flow data available through FE Analytics. Flows for exchange-traded funds and SICAVs are not included in this data.