This year our journalists threw caution to the wind and selected predominantly equity funds.

Funds run by Fidelity, BlackRock and Liontrust have all been selected by the Trustnet editorial team as their favoured picks for 2026.

Most chose an equity fund, but there were diverging opinions on which would be the dominant market next year. Europe, Asia, the UK and global equities are all represented.

Below, head of editorial Gary Jackson, Trustnet editor Jonathan Jones, deputy editor Matteo Anelli, senior reporter Emmy Hawker and reporter Patrick Sanders give their fund picks for 2026.

Investors should note that this is an exercise the team does every year with varying degrees of success. These are personal views and should not be taken as investment advice

Gary Jackson, head of editorial at FE fundinfo

I’m a big believer in artificial intelligence (AI) and am convinced that it will reshape the global economy over the coming decade. But US tech valuations have reached levels that make me uneasy and the circular financing between hyperscalers and AI startups creates risks that could unwind quickly.

Asia offers a more attractive entry point into the same structural trend, as well as benefiting from some favourable demographic and macroeconomic features. The region supplies the critical infrastructure for AI development through semiconductor manufacturers and hardware producers, yet trades at a materially lower valuation than its US counterparts.

Plus – as we saw with the launch of China’s DeepSeek model at the start of 2025 – it has the potential to disrupt some of the early AI incumbents in the US.

So my 2026 pick is Fidelity Asia. Manager Teera Chanpongsang runs a concentrated portfolio with 37.4% in information technology companies, an overweight versus the benchmark, while offering exposure to the likes of Taiwan Semiconductor Manufacturing Company and Samsung Electronics.

Chanpongsang’s experience is a big draw in these uncertain markets. He has managed Asian equities for over two decades at Fidelity, navigating multiple cycles whilst maintaining a disciplined focus on quality growth at reasonable prices.

His bottom-up approach suits the current environment. Rather than chasing momentum or betting on macro themes, he builds positions through company meetings, site visits and rigorous analysis of business models and management quality. I think this will be useful if the market starts to value fundamentals more in 2026.

Jonathan Jones, editor of Trustnet

Seemingly every year someone has to take a punt on UK smaller companies, so I have taken up the mantle for 2026. There are some real reasons for optimism, although this may be a selection that is the ‘least worst’ rather than the best.

As I wrote last week, there are many pros and cons to markets across the world. It makes it difficult to know where to place your money – so spreading it out is best.

The rationale for taking a punt on domestic small-caps is pretty straightforward: they are cheap, underperforming large-caps by a wide margin in recent years.

While I do now know if there will be a catalyst for change in 2026, low starting valuations is a good place to begin.

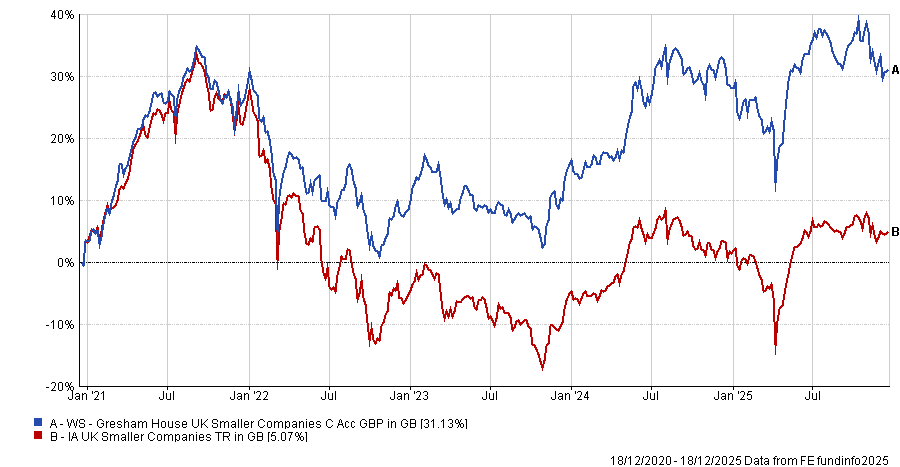

Performance of fund vs sector over 5yrs

Source: FE Analytics

One of the funds I own in my ISA is WS Gresham House UK Smaller Companies, which has been a good performer in the IA UK Smaller Companies sector over the past five years, up 31.1%, although it has struggled in more recent times.

The fund, run by Ken Wotton, benefits from the firm’s private equity specialism, which gives the manager advanced access to research on unquoted companies that could be ready to list.

Matteo Anelli, deputy editor of Trustnet

I am picking a fund for the fourth year. After two broad choices, last year I took a stand with a concentrated fund. It did not work. Premier Miton US Opportunities is down 11% at the time of writing – a reminder of how unforgiving markets can be to anyone second-guessing direction.

If this were a real portfolio decision, I would not be selling now and locking in losses. US small-caps may be starting to turn and, from a purely rational asset-allocation perspective, adding would make sense, given the fund’s track record and how sharply small-caps can recover.

But investing is not purely rational. Emotionally, I cannot bring myself to pick it again. The losses still sting. So while I am not selling, I am also not adding.

Instead, I am choosing Nutshell Growth, which is not a bet on a single outcome. Its flexibility and high turnover approach allow it to adapt as conditions change (it was quick to cut 8% from its US exposure in October).

Its fast pace adds something different to a portfolio and feels better suited to markets that are likely to move sharply and unpredictably in 2026.

Emmy Hawker, senior reporter at Trustnet

After years of writing about environmental, social and governance (ESG) and sustainability, picking a mining trust feels like inviting an ethical headache. Mining is essential for the global transition to low-carbon energy, yet the industry faces ESG-related challenges – from environmental impact to safety concerns.

Still, as we head into 2026, the energy transition and AI build-out can’t happen without metals. Copper, lithium, nickel: these are the building blocks of electrification, data centres and renewable infrastructure.

It also helps that the IT Commodities and Natural Resources was the best-performing AIC investment trust sector over the past year, gaining 47.5%.

The BlackRock World Mining Trust, managed by Evy Hambro and Olivia Markham, crucially also adds exposure to gold – 2025’s favourite safe haven – but all that glitters isn’t just gold. Other metals look equally compelling.

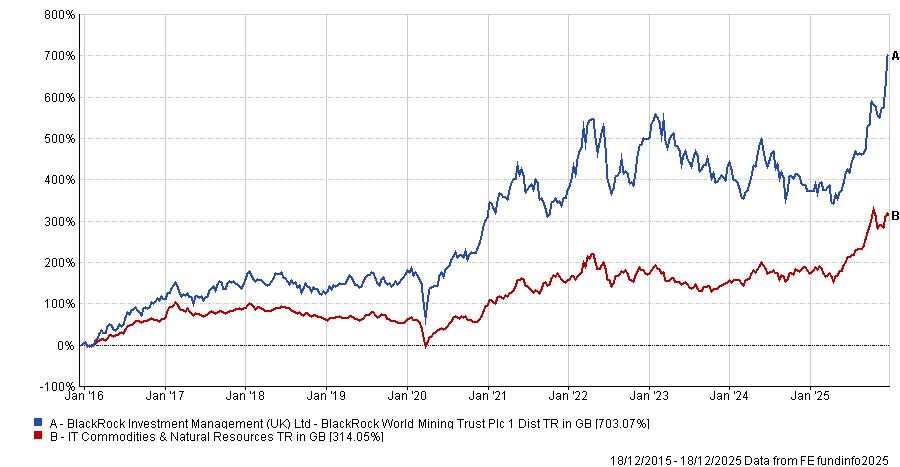

Performance of fund vs sector over 10yrs

Source: FE Analytics

The trust’s latest update shows 21% in copper and 1% in silver, though true exposure is higher via diversified miners and gold producers. The managers favour copper and silver for their overlooked role in powering everything from solar panels to AI servers.

Copper benefits from rising power demand and infrastructure spend, while silver is supported by its use in photovoltaics and as a hedge against currency risk.

With a 716.2% gain over 10 years and a narrow 1.5% discount to NAV, the trust offers access to structural themes. Volatility is inevitable, but supply constraints and long-term demand suggest a supportive backdrop – even for those who never thought they’d pick a mining fund.

Patrick Sanders, reporter at Trustnet

I’m throwing my hat into the ring with a European fund this time around – Liontrust European Dynamic. Managed by Samantha Gleave and James Inglis-Jones, the strategy targets stocks with good cashflow characteristics, based on historic evidence.

I spoke to the managers a the start of 2025 and was impressed by their flexible and dynamic process. This flexibility is part of why the fund has delivered a supranormal performance compared to the average peer in the sector over the past half a decade.

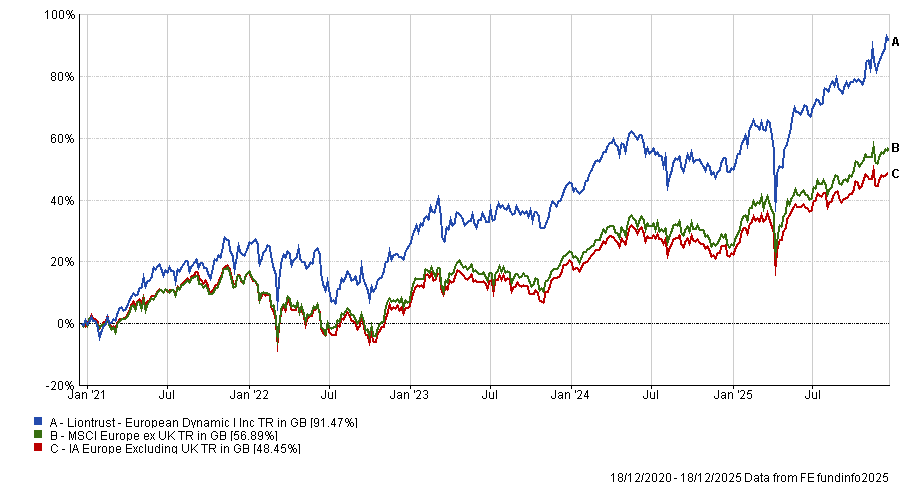

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

European stocks have proven to be one of the standout performers of 2025 and, while that might mean I’m chasing a bit of a momentum trade with this one, valuations, potential stimulus and the ongoing need for defence spending all seem supportive heading into 2026.

If the good times keep rolling in Europe, I expect Liontrust European Dynamic will make me very happy this time next year.