The travails of the UK’s best-known stockpicker are well known at this point. Fundsmith Equity (GB00B41YBW71), the Terry Smith vehicle known for a decade or so of superior returns, has not managed to outperform the MSCI World Index for a full calendar year since the end of 2020.

Its returns, while still in positive territory, now notably lag the index over one, three and five-year periods.

We carried out an in-depth analysis of the fund last year, looking at issues ranging from the challenges of competing with a concentrated market to the portfolio’s own chunky positions and questions over the timing of buys and sells. The latter two points are still relevant in light of a big allocation to Novo Nordisk (DK:NOVO.B) hurting recent returns.

Shares in the pharma giant were struggling afresh at the time of writing after it this week lowered its sales and operating profit outlook for 2025.

There is still an argument for sticking with the fund. As Evelyn Partners’ Jason Hollands notes, most stockpickers have struggled in comparison with a market led by a band of US megacap stocks in the past three years.

“Smith’s approach that has delivered such strong excess returns since inception hasn’t changed, and so I would encourage investors not to throw the towel in,” he says.

Having said that, many investors might find that the fund has grown to be a large component of their portfolio over time and want to diversify into other options, whether that be due to recent underperformance or otherwise.

They are certainly spoilt for choice when it comes to global funds that do something similar or, by contrast, add diversification, and the options are worth considering.

Read more from Investors’ Chronicle

Other funds

Fundsmith’s struggles present a fresh challenge to the credibility of active management, and some may consider taking exposure to the US megacaps via the likes of Fidelity Index World (GB00BJS8SJ34).

That offers cheap, concentrated exposure to the market leaders, and may at least offset some of Fundsmith’s struggles if we continue to see the big US names in the lead.

However, a fund that Charles Stanley chief analyst Rob Morgan describes as “semi-passive” can deliver a Fundsmith-esque exposure at a lower cost.

The iShares Edge MSCI World Quality Factor ETF (IWFQ) holds global stocks that have a high return on equity, low leverage and year-on-year earnings visibility.

It’s not wildly dissimilar from a conventional global tracker, with big positions in Nvidia (US:NVDA), Microsoft (US:MSFT) and Apple (US:AAPL) and an even larger weighting to the US, but has managed to beat Fundsmith over recent time periods. It’s competitively priced for a more specialist ETF, with a fee of 0.25 per cent.

The IC’s own global High Quality Large Caps stock screen, meanwhile, has outperformed even the iShares ETF since inception. Its latest selections can be found here.

We also note that plenty of stockpickers with similar approaches to Fundsmith have managed to deliver strong returns, even if they, like it, have struggled to keep pace with the index for now.

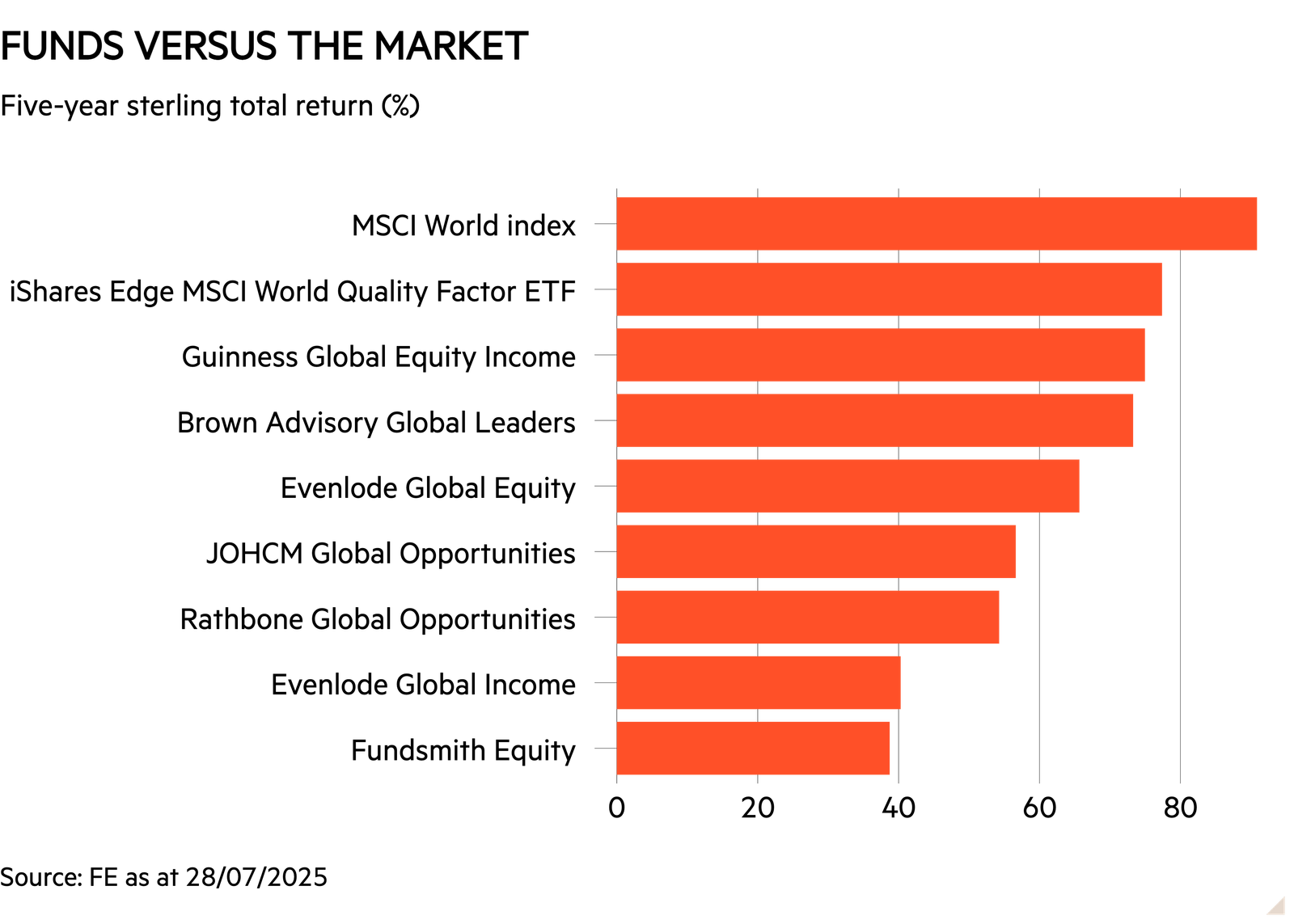

To present one snapshot of performance, the chart above shows five-year sterling total returns for the different options.

The stockpickers

When asked to come up with alternatives, specialists suggest a multitude of global funds with a defensive, quality-minded remit.

This has thrown up a couple of names that favour dividend-paying stocks. AJ Bell head of investment analysis Laith Khalaf sees Evenlode Global Income (GB00BF1QNC48) as one portfolio with a similar outlook to Fundsmith.

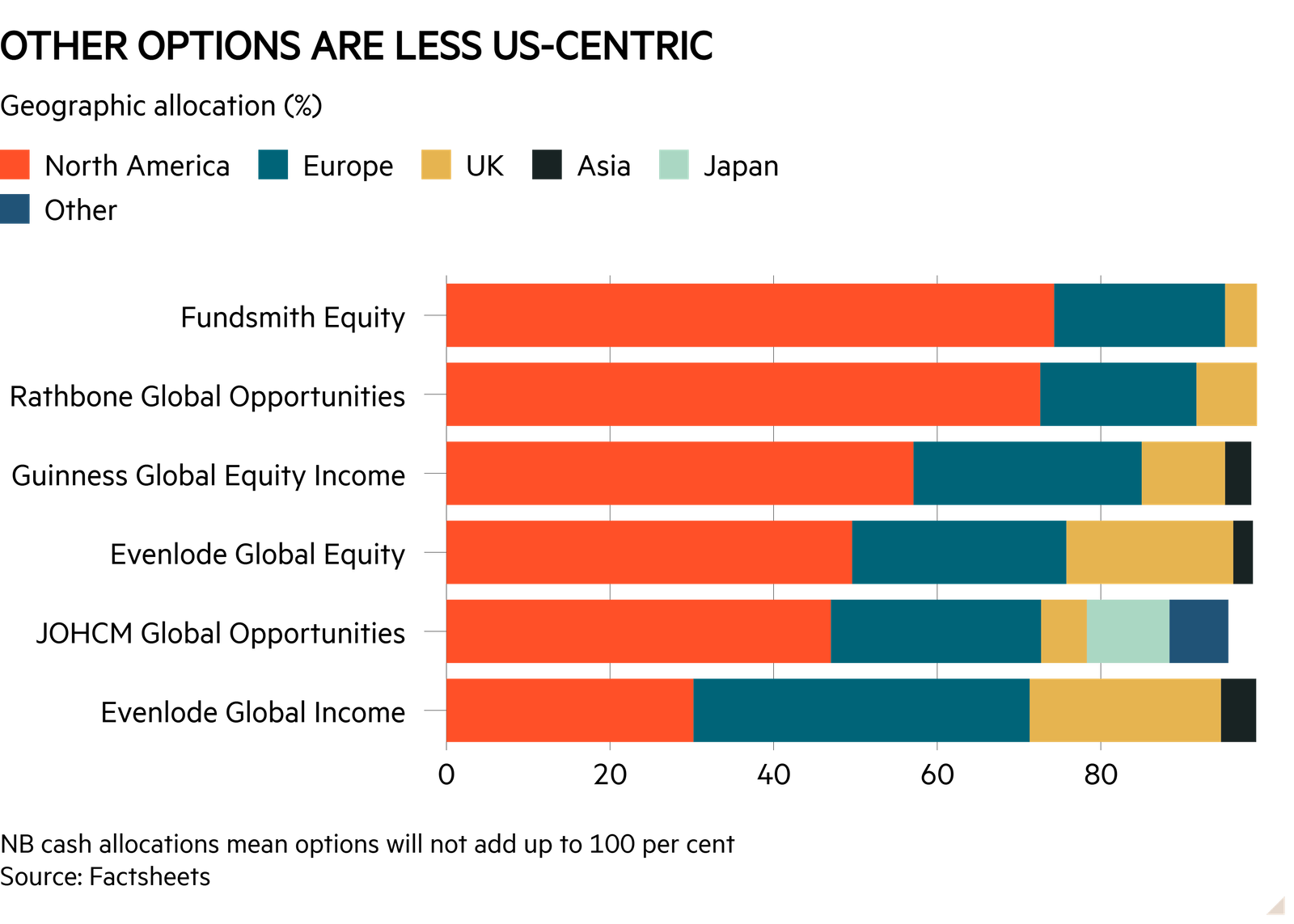

The team focuses on companies with high returns on capital and strong free cash flow, has a fairly focused 39 holdings, looks for companies with sustainable real dividend growth and tries to keep portfolio turnover down. It’s much less US-centric than Fundsmith but shares its fondness for the likes of consumer staple stocks. Top holdings include L’Oréal (FR:OR), Microsoft, Unilever (ULVR), Reckitt Benckiser (RKT) and Experian (EXPN).

The fund has a relatively modest 2.5 per cent dividend yield, which is slightly higher than the other expert ‘income’ suggestion, Guinness Global Equity Income (IE00BVYPP131).

A constituent of our Top 50 Funds list and the inspiration for another IC stock screen, this fund uses a long history of paying dividends as an indication that a company might be well run.

The team looks for companies that are “unusually consistent in generating returns on capital above their cost of capital”. It has just 35 holdings, with Cisco Systems (US:CSCO), Broadcom (US:AVGO), Deutsche Börse (DE:DTE) and CME Group (US:CME) among them.

Another Evenlode fund also makes the list, with Magnus Financial Discretionary Management chief investment officer Rory McPherson pointing to Evenlode Global Equity (GB00BMFX2893). Run by a different team from its income-minded stablemate, it still focuses on good cash flow and high returns on capital.

McPherson notes that of his suggestions, this fund is “probably the most similar in philosophy to Fundsmith”.

“But I would argue it is more valuation sensitive, which manifests in less tech and less US, and it is more “core quality at a reasonable price” as opposed to “quality growth”, which is how we would characterise Fundsmith,” he says.

It should be noted that Evenlode’s flagship offering is a UK income fund, and both these global portfolios also have a decent allocation to the domestic market. Holding them might create some overlap for anyone already invested, directly or via funds, in UK blue chips. Evenlode Global Equity’s second-biggest position, for example, is in Relx (REL).

Other options

A few other fund options also crop up. To touch on some lesser-known names, Morgan likes JOHCM Global Opportunities (GB00BJ5JMC04).

Its managers “typically take a more cautious stance compared with most in the sector, emphasising capital preservation, as well as prioritising durable businesses with strong balance sheets and consistent cash generation”. This caution can sometimes mean running a big cash allocation.

Hollands, meanwhile, highlights Brown Advisory Global Leaders (IE00BD9MKL82), which again has a quality focus.

The fund discloses its market exposures in an unusual fashion, noting that it has a 42.6 per cent weighting to North America, 21.8 per cent to Europe and 31.8 per cent to “the rest of the world”, but it does have at least some emerging markets exposure.

India’s HDFC (IN:500180) sits in its top 10 holdings, though its most prominent holdings are Microsoft, London Stock Exchange Group (LSEG), Deutsche Börse and Visa (US:V).

A more familiar name also crops up in the form of Rathbone Global Opportunities (GB00B7FQLN12), which targets growth but in a balanced fashion and sits in our Top 50 Funds list.