Over the last five years, smallcaps have seen a remarkable run-up.

The Nifty Smallcap 250 – Total Return Index (TRI) has clocked a compounded average growth rate (CAGR) of 28.1%, outperforming the midcap and the largecap index.

Enticed by such returns, individual investors (retail and HNI) have developed a keen interest in small caps as shown by the inflows data released by AMFI.

If you are an aggressive investor, small cap funds may be considered for your satellite portfolio. However, you need to have the stomach for very high risk, as these funds are placed at the higher end of the risk-return spectrum of diversified equity funds.

Also, the investment should be for at least 8-10 years so that short-term risk is offset by long-term gains.

In this editorial, we take you through 3 small cap funds that have fared well on 3-year and 5-year rolling returns, as well as risk ratios (3-year standard deviation, Sharpe ratio, Sortino ratio, and up/down capture ratio), which you could consider for SIPs.

#1 Nippon India Small Cap Fund

Launched in September 2010, this scheme has become one of the most popular small cap funds. The AUM at present is over Rs 659 billion (bn), the highest in the category.

The fund invests in quality stocks and holds on to them with a long-term view.

The fund manager looks for small-sized companies with high-growth potential that are available at relatively attractive valuations. It looks at reasonable size, quality management, and rational valuations to identify high-growth companies.

The fund invests in a wide range of sectors and stocks to generate appealing risk-adjusted returns for its investors. It holds a portfolio of over 200 stocks, making it widely diversified.

As per its July 2025 portfolio, the fund has 235 stocks, which are predominantly in smallcaps (68.1%). The top 10 stocks comprise 13.8% of the portfolio, and include names such as MCX (2.2%), HDFC Bank (2%), Kirloskar Brothers (1.3%), etc.

Among the diverse range of sectors, the top 3 are capital goods (11.9%), healthcare (8.4%), and chemicals (8%).

Its turnover ratio has remained between 12–25% over the past year, showing that only a small portion of its holdings was changed.

This shows that the fund only changes a small portion of its underlying holdings, which is different from many other small cap funds that churn their portfolio often as they chase momentum to deliver returns.

The investment strategy followed by Nippon India Small Cap Fund has helped it to outperform its benchmark index and its peers. It has been in the top quartile performers in the small cap fund category across time frames and generated substantial wealth for its investors over the long term.

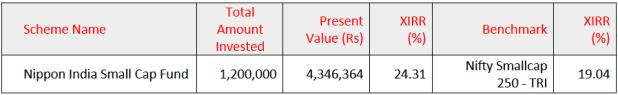

The fund’s XIRR or SIP return over the past ten years is 24.31%, while its benchmark, the Nifty Smallcap 250-TRI (as of August 26, 2025), is 19.04%.

Nippon India Small Cap Fund – 10 Year SIP

A monthly SIP of Rs 10,000 in the fund over 10 years, i.e., a total investment of Rs 1.2 million (m), would now be valued at Rs 4.35 m.

#2 Bandhan Small Cap Fund

Launched in February 2020, this fund has also shown an impressive long-term performance. Its AUM has increased in the past couple of years, and as per the July 2025 portfolio is over Rs 140 bn.

The fund primarily focuses on quality, growth, and valuations when investing in smallcaps, and follows a growth style of investing.

It also holds the mandate to invest up to 35% of its total assets in overseas equities, and up to 50% in equity derivatives for non-hedging purposes.

The fund holds a large portfolio of over 180 stocks. Currently, it has 199 stocks as of July 2025. A predominant portion (69.2%) is in smallcaps, 9.3% in midcaps, and 8.8% in largecaps. It is currently holding 12.7% of its assets in cash & cash equivalents and rights.

The top 10 holdings comprise 19.1% of the portfolio and consist of names such as Sobha (3.4%), LT Foods (2.4%), South Indian Bank (2.7%), etc.

Among a diverse range of sectors, the top 3 are finance (12.3%), healthcare (11.8%), and realty.

It takes a buy-and-hold approach for its portfolio, but at times, it hasn’t resisted churning its portfolio to achieve its investment goal of long-term capital appreciation. Its portfolio turnover has ranged from 35-80% in the last one year.

The approach followed by the fund has helped the fund to deliver appealing risk-adjusted returns over the long term.

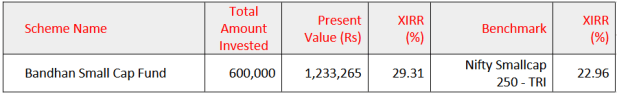

In the last 5 years, the Bandhan Small Cap Fund has delivered an XIRR or SIP return of 29.3% compared to 22.96% by the Nifty Smallcap 250 – TRI (as of 27 August 2025).

Bandhan Small Cap Fund – 5 Year SIP

A monthly SIP of Rs 10,000 in the fund over 5 years, i.e., a total investment of Rs 6 lakh, would now be valued at Rs 1.23 m.

#3 Invesco India Small Cap Fund

Launched in October 2018, this scheme has seen its AUM grow over the years. This is mainly because of its good performance . As of July 2025, the fund is managing assets of over Rs 75 bn.

It aims to hold a diversified portfolio of smallcap companies selected based on a bottom-up investment approach.

The stock selection is guided by Invesco’s internal proprietary stock categorisation framework. The parameters include the following, among others:

- Revenue growth

- EBITDA margin or PAT Margin

- Operating leverage

- Return on Equity (ROE) and its expansion

- Profit leverage

- The net worth of the company

- Valuations of assets or businesses

At times, the fund also invests in various derivative instruments (for hedging and non-hedging purposes) in line with the investment objective and strategy of the scheme.

The fund usually holds around 65-75 stocks in its portfolio. As per the July 2025 portfolio, the fund has 69 stocks in its portfolio, wherein smallcaps are 64.8%, midcaps, 26.7%, and largecaps are 6%.

The top 10 stocks comprise 32.1% of the fund’s portfolio and include names such as Sai Life Sciences (4.1%), Krishna Institute of Medical Sciences (4.1%), MCX (3.5%), etc.

The top 3 sectors of the fund are healthcare (20.2%), finance (19.4%), and retail (8.6%).

Currently, approximately 2.5% of the fund’s assets are held in cash & cash equivalents.

Overall, the fund buys stocks for the long-term, as the portfolio turnover ratio has ranged between 30-55%.

This approach followed by the fund, has helped it outperform many of its peers and the Nifty Smallcap 205 – TRI on a risk-adjusted basis.

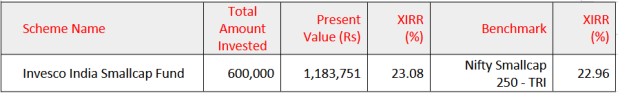

In the last 5 years, the Invesco India Small Cap Fund has delivered a XIRR or SIP return of 27.58% compared to 22.96% by the Nifty Smallcap 250 – TRI (as of 26 August 2025).

Invesco India Small Cap Fund – 5 Year SIP

A monthly SIP of Rs 10,000 in the fund over 5 years, i.e., a total investment of Rs 6 lakh, would now be valued at Rs 1.18 m.

Conclusion

Keep in mind that while smallcaps have the potential to generate high returns, the risk of investing is also very high. If you do not have the stomach for it or are faint-hearted, then stay away from them.

At present, the trailing PE of the Nifty Smallcap 150 index is 33, slightly higher than the 5-year average of 29. This means that smallcap valuations are frothy.

In volatile times, SIPs can help you mitigate risk with its inherent rupee-cost averaging feature, but don’t get carried away.

Make sure you are only considering funds that align with your personal risk appetite, investment objectives, and investment horizon.

Be a thoughtful investor.

#Table Notes: Returns data as of 26 August 2025. Returns are XIRR in percentage. Monthly SIP of Rs 10,000 over a 10-year and 5-year period in the Direct plan – Growth option considered.

“Past performance is not an indicator of future returns. The securities quoted in the table are for illustration only and are not recommendatory.”

Speak to your investment advisor for further assistance before investing.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.