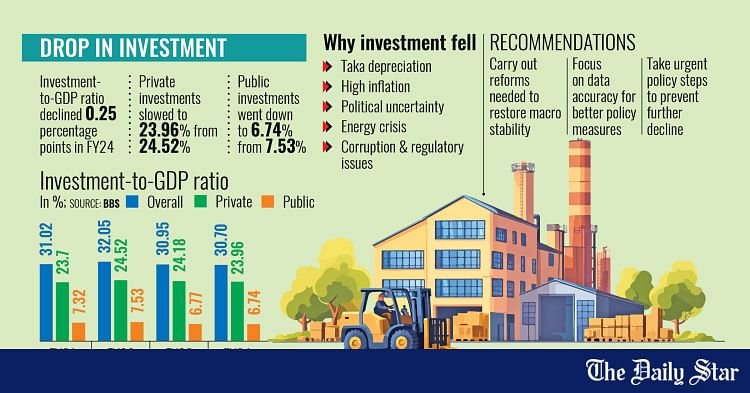

Bangladesh’s investment-to-GDP ratio declined by 0.25 percentage points to 30.70 percent in the fiscal year (FY) 2023-24, according to official data, signalling a potential slowdown in future economic growth.

Businesses say fragile confidence, due to a combination of factors such as a depreciating taka, spiking cost of living and political uncertainty, has deterred fresh investments since the Covid-19 pandemic.

According to economists, this plummeting investment could translate into fewer jobs and lacklustre economic growth in the near future.

The investment-to-GDP ratio refers to the percentage of a country’s gross domestic product (GDP) dedicated to investment activities.

It shows how much of a nation’s economic output is being reinvested in its future through the purchase of capital goods like machinery, infrastructure and buildings to facilitate growth.

The latest data from the Bangladesh Bureau of Statistics (BBS) shows that both private and public sector investment have been falling in recent years.

The Russia-Ukraine war, which broke out in 2022, caused global supply chain disruptions, pushing up Bangladesh’s import bills. Consequently, the country’s fast-depleting foreign exchange reserves led to the local currency falling steeply against the US dollar.

The devaluation of the taka made imports more expensive, raising the cost of capital goods and raw materials essential for investment.

Besides, stubbornly high inflation, which has remained above 9 percent since March 2023, has squeezed disposable incomes and corporate profits, reducing funds available for reinvestment.

Political uncertainty has further compounded the situation. Frequent policy shifts, regulatory changes and political unrest have made investors cautious, even leading them to delay or cancel planned investments.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, identified corruption, political unrest and the energy crisis as key deterrents to investment, particularly in the private sector.

Many enterprises have been operating at reduced capacities in recent years due to constraints in gas supply and high demand for captive energy generation while power outages are also a concern.

She said, “The low investment-to-GDP ratio reflects the unfavourable conditions for private sector investment due to political uncertainty and high financing costs.”

She emphasised that inflation and overall macroeconomic instability have created uncertainty among investors, discouraging them from making fresh investments or expanding their businesses.

Meanwhile, Asif Ibrahim, former chairman of Business Initiative Leading Development (BUILD), identified corruption as a key factor behind escalating business costs.

To improve the investment-to-GDP ratio, he called to curb corruption and focus on economic diversification, reassessment of the incentive structure, protection of small businesses and low-income groups, and reforms in tax incentives.

‘ALMOST NO NEW INVESTMENT SINCE COVID’

Businessmen said the country’s investment landscape has hit a snag since the pandemic, with private investments almost consistently on a downward trend since FY21.

Al Mamun Mridha, secretary general of the Bangladesh China Chamber of Commerce and Industry, said private investment has been declining since the Covid-19 pandemic.

For the downturn, he blamed an unfavourable investment environment marked by inconsistent energy supplies and macroeconomic vulnerability.

“Some foreign investors closed their businesses in Bangladesh as the cost of doing business increased while the dollar became more expensive,” he said.

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association, said investment has virtually come to a standstill due to “anti-industrialisation policies”, the ongoing energy crisis and a fragile banking sector.

Hatem criticised the government’s lack of effective investment policies, citing outdated regulations and poor service delivery. “The regulatory hurdles are delaying our investment process.”

Meanwhile, Professor Selim Raihan, executive director of the South Asian Network on Economic Modelling, expressed doubts over the investment figures released by the national statistical agency.

He argued that the reported investment-to-GDP ratio does not align with the economic reality.

“Fresh investment has been almost stagnant — so how did BBS reveal an investment-to-GDP ratio of more than 30 percent?” Raihan questioned, criticising BBS’s methodology and the lack of transparency in data disclosure.

According to him, incorrect national accounting data misleads policymakers and prevents the government from addressing real economic challenges effectively.

Similarly, former BUILD chairman Asif Ibrahim underscored the need for accurate and non-inflated economic data to facilitate effective policy decisions.

With the BBS revising the GDP growth projection for FY24 to 4.22 percent, Ibrahim urged the interim government to focus on restoring macroeconomic stability.

MACRO OUTLOOK NEEDS IMPROVEMENT

M Masrur Reaz, chairman and CEO of Policy Exchange Bangladesh, stressed the need to ensure macroeconomic stability, enhance business confidence and foster an investor-friendly environment.

“The private sector investment-to-GDP ratio has been hovering between 22 to 23 percent for the last few years, which is lower than the target,” he said.

Reaz acknowledged that while government investment has seen some growth, the private sector continues to face critical issues that hinder progress.

He emphasised that addressing regulatory inefficiencies and improving investor confidence are crucial to reversing the declining investment trend.