Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

Good morning. Israel carried out multiple strikes on Iran last night. At the time of writing, oil prices are up more than 7 per cent, and US stock futures are down sharply. It’s too early for us to comment on what this means for markets and the world. But do send us your thoughts: unhedged@ft.com

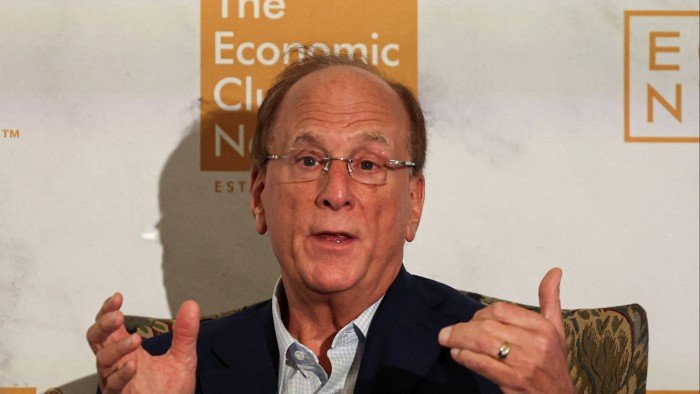

BlackRock and private markets

If BlackRock, the biggest asset manager in the world, succeeds in making big inroads into private investments, that will make a big difference to markets. But what difference? Will the private capital industry end up looking more like BlackRock? Or will BlackRock end up looking more like the private capital industry?

More prosaically: is BlackRock going to take market share by undercutting the fees its rivals charge for alternative investments, or is it going to allow the status quo to continue and focus on widening its margins?

Here is our colleague Eric Platt, reporting from BlackRock’s investor day yesterday:

BlackRock has set an ambitious $400bn fundraising target for its private investment businesses, as executives laid out a plan to almost double the market value of the world’s largest asset manager by 2030 . . .

Martin Small, BlackRock’s chief financial officer, said shifting just a small portion of client assets from public market funds into its new private investment strategies could generate $1bn of base fee growth for the group. BlackRock expects 30 per cent or more of its revenues will be generated from those areas by 2030, up from 15 per cent at the end of last year. The new fundraising target for the private investment divisions works out at about $65bn a year between 2025 and 2030.

Here’s the critical slide from yesterday’s presentation. Focus on the two red bits:

A big part of the growth in the private capital industry is expected to come from what BlackRock calls “democratisation” — that is, selling private investments to retail investors. A cynic might suggest that the industry is setting its sights on retail buyers because institutions appear to have had their fill of alternatives. Here, from Moody’s, is a chart of private market assets under management and fundraising trends:

How to, or whether to, sell alternatives to retail investors is a matter of lively debate. Questions about transparency, liquidity and safety dominate the conversation.

But all of those issues are secondary. The main thing retail investors need, if they are to benefit from alternatives, is much lower fees. If BlackRock can use its scale to deliver that, it could cement its industry leadership and change private markets for the better. If it does not, all it is doing is showing up to the alternatives party late, after the real fun is over.

US isolationism and capital flows

The Pentagon’s review of the Aukus nuclear submarine deal with the UK and Australia has thrown the future of that crucial security pact into doubt. This comes on top of a series of decisions and statements that suggests that the US means to relinquish its postwar role as global security guarantor.

George Saravelos, head of FX strategy at Deutsche Bank, argues that this shift has an effect not only on defence budgets, but also on global capital flows. In a note to clients, he writes that:

It is not just the trade war that is influencing the dollar but the broader withdrawal of US leadership and the geopolitical realignment this is triggering . . . the Aukus defence pact is highly relevant for the dollar, in our view. A weaker geopolitical alignment between the US and its allies undermines US inflows. We held a large investor call with Australian investors this morning where it was immediately a topic of the presentation . . .

In general, Unhedged is very leery of overstating the influence of politics on markets, but it seems natural that global capital flows might track large changes in international politics. But how to isolate and quantify this effect?

We can see two possible channels connecting geopolitical alignments to capital flows. The first is pure sentiment change. People who don’t like the US seem less likely to invest in it. The second channel is economic perception. The second channel is economic perception. If the US becomes increasingly isolated — with less trade, less investment, less immigration — global investors may start to perceive it as slower growing and a less attractive destination for capital. We put this to Saravelos. He said:

Both channels are additive to dollar weakness. But given that the dollar is significantly weaker than what would be implied by indicators of the relative economic cycle (relative interest rate differentials) this certainly points to the former effect (sentiment) being very important.

The European Central Bank has noted in a recent paper that countries aligned with the EU and US (such as Canada, Japan and Australia) hold more of the EU’s and the US’s debt than nonaligned countries (e.g., Vietnam, India), and that aligned countries’ shares of the debt have gone up since the Ukraine war:

But it is hard to untangle all the possible explanations for this pattern. We are intrigued by Saravelos’s view, but we are still looking for the data to prove it.

(Kim)

One good read

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.