If there’s one thing you can learn from history, it’s that you can’t count on mortgage REIT dividends. Cuts are a part of the story.

When it comes to investing, hope tends to spring eternal. That’s why investors continue to buy companies that are bad investments, even when it is pretty clear that this is the case. The meme-stock mania is a good example of this self-destructive habit. For income investors, a better reference point for this mistake would be buying an ultra-high-yield stock despite a history of dividend cuts.

That’s exactly the problem with Annaly Capital (NLY 1.12%), AGNC Investment (AGNC 1.82%), and Two Harbors Investment (TWO 2.08%). Here’s why dividend investors shouldn’t chase these ultra-high yields today.

Annaly, AGNC, and Two Harbors share an important similarity

Annaly Capital, AGNC Investment, and Two Harbors are all real estate investment trusts (REITs). In and of itself, that’s not a bad thing, given that REITs were specifically created to allow small investors access to institutional-level real estate investments. REITs receive special tax treatment, avoiding corporate-level taxation if they distribute at least 90% of their taxable income to shareholders (shareholders have to treat dividends as regular income). So, generally speaking, REITs tend to have high yields.

Image source: Getty Images.

But these three REITs are not property-owning REITs that operate under a pretty simple business model. They operate in the mortgage niche, which is far more complex. Both Annaly and AGNC invest in mortgages that have been pooled into bond-like securities. Two Harbors does that as well, but it also services mortgages, which basically means it manages the payments on mortgages. That is a fairly steady cash-generating business, but it is only part of Two Harbors’ overall operations.

While physical properties trade infrequently, mortgage bonds trade all day. So prices change along with market events, like interest rate changes, often leading to big swings in the value of the companies. Then there are some even more unique issues to consider, such as repayment trends, housing market dynamics, and the credit quality of the mortgages in the pools that back the bonds in the portfolio. While you might be able to keep an eye on a portfolio of apartment buildings fairly well, you probably wouldn’t be able to track a portfolio of mortgage bonds.

High yields often come with elevated risks

What normally attracts investors to mortgage REITs are the high dividend yields. Annaly’s yield is a massive 12.8%. Two Harbors’ yield is 13%. And AGNC’s yield is even loftier at 14%. Those are shockingly high when you consider that the S&P 500‘s yield is around 1.3% and the average REIT is yielding roughly 4.2%.

One big reason for the elevated yields in the mortgage REIT space is that dividend cuts are a constant risk. If you are trying to live off of the income your portfolio generates, a dividend cut could be a devastating blow to your finances.

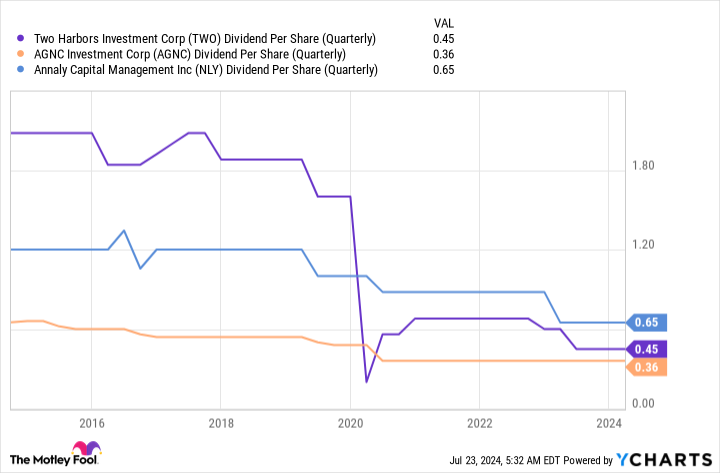

TWO Dividend Per Share (Quarterly) data by YCharts

The chart above shows the dividend histories of AGNC, Annaly, and Two Harbors over the past decade. All three have regularly cut their dividends. But that’s not really a bug; it’s more appropriate to see it as a normal thing in the complex mortgage sector. That’s because mortgage REITs really aren’t designed to be income investments. They are total return investments, which assumes that you reinvest dividends.

Tread carefully with mortgage REITs

All told, Annaly, AGNC, and Two Harbors have huge yields today and dividends that are highly likely to get cut at some point in the future. They could be increased, too, but cuts are a common occurrence. That’s an issue you need to consider with all mortgage REITs, though this trio especially stands out with regard to dividend cuts. If you need the income your portfolio generates to pay living expenses, you should probably avoid Annaly, AGNC, and Two Harbors, because more dividend cuts are likely coming at some point.