by The Alliance of Bioversity International and the International Center for Tropical Agriculture

Foreign direct investments (FDI) in tropical countries in extractive industries like mining, logging and fossil fuels have a long, environmentally destructive track record in tropical countries. Are FDI in food systems another extractive industry?

Agriculture is the leading driver of deforestation, particularly in tropical countries that are home to some of the largest remaining tracts of intact primary forest. New regulations, particularly in Europe, aim to curb tropical deforestation in food supply chains. While the measures are welcome, they do not address the full extent to which FDI are linked to deforestation in global food systems.

New research examines underlying drivers of deforestation from a food system perspective in 40 countries. The researchers found that FDI and urbanization were primary drivers of tree cover loss, ahead of growth in GDP, population and exports. The research suggests that FDI contribute to deforestation and biodiversity loss through the “supermarketization” of global diets.

“Focusing only on exports is not going to have a major impact on tropical deforestation trends if that is the only thing we do,” said Janelle Sylvester, the study’s lead author and a researcher at the Alliance of Bioversity International and CIAT. “Domestic food consumption, which has changed due to FDI and urbanization, should also be recognized as a major driver of deforestation.”

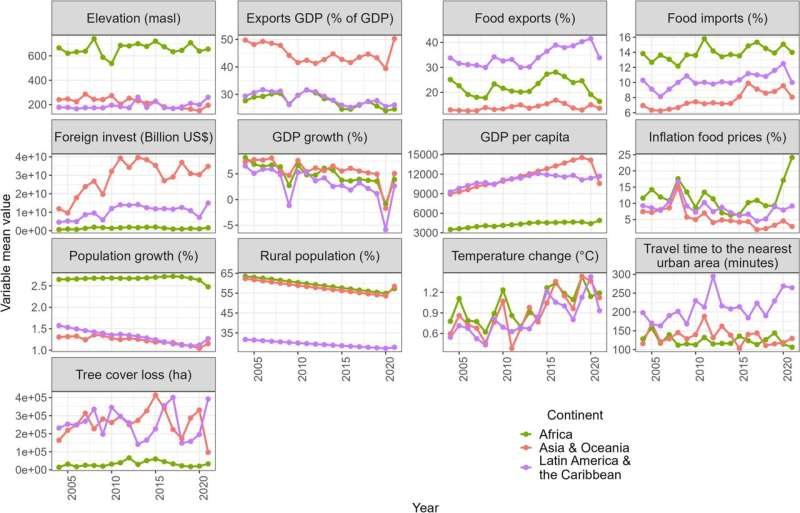

The research tracked tree cover loss in 40 tropical and subtropical countries from 2004 to 2021 and ran key indicators through an advanced machine learning algorithm to parse the variables’ links to forest loss. The research was published in Scientific Reports on June 16.

The study is one of the first to use advanced machine learning to improve understanding of regional and global drivers of deforestation. The study is also unique because it uses a food system lens (as opposed to strictly a food production lens) to parse the drivers of forest loss.

The results challenge investors and policymakers to address FDI’s unacknowledged role in driving deforestation and other negative impacts on human and planetary health.

Focus beyond food exports

Food system research means taking into consideration everything related to food – from the land it’s grown on, to the often-faraway tables where it is consumed. In the study, researchers used 12 drivers encompassing food production, consumption and distribution.

Researchers analyzed the drivers using machine learning models (the eXtreme Gradient Boosting algorithm, or XGBoost) to determine how different drivers explained deforestation trends in the target countries and compared them with forest cover change data from Terra-i, a tool developed by the Alliance of Bioversity and CIAT. Models were constructed at the global scale and for Africa, Asia and Latin America.

The researchers found that trade dynamics, specifically foreign direct investments, and demand from urban areas were significant drivers of deforestation, particularly in Asia and Latin America. (Results from Africa suggested that deforestation was driven by factors outside the food system.)

“This suggests that to effectively reduce deforestation, we need to focus on improving the entire food system, not just how food is produced,” Sylvester said. “This study highlights the importance of addressing both local and global factors to protect forests and suggests that interventions targeting the food system could help achieve sustainable development goals.”

FDI’s outsized influence on deforestation may be explained by the global shift of food consumption habits toward ultra-processed food, which is highly dependent on ingredients produced on deforested land: palm oil, sugarcane, soy and other cereals to feed livestock for increasing meat consumption.

These dietary shifts are strongly tied to the FDI-driven “supermarketization” of food supplies, which are not only bad news for climate change and biodiversity loss but are increasingly contributing to malnutrition and associated diseases such as obesity and type-2 diabetes.

“This research has the potential to revolutionize our understanding of the leading causes of deforestation,” said Augusto Castro, a co-author from the Alliance. “This is a new way of putting all the pieces of deforestation together and developing new strategies to address it.”

FDI policy implications

FDI is a coveted source of income for developing countries and has long stirred debate about the extent of its potential benefits (increased employment, more competition to reduce consumer prices, tax revenue) and its potential tradeoffs (environmental degradation, exploitation and high government expenditure to attract investment). Maximizing the pros and reducing the cons is still a work in progress.

To help policymakers mitigate FDI-linked deforestation, researchers propose several considerations.

FDI proposals should be evaluated for environmental sustainability, and incentives like tax breaks or subsidies should encourage investments that are aligned with country priorities to reduce deforestation. Standards like the European Union Regulation on Deforestation-Free Products should be applied to foreign investors in domestic markets. Public awareness campaigns around health and sustainability should likewise be a focus in domestic markets.

“With urbanization, we become more disconnected from our food sources and have a lesser understanding of the environmental impacts and production practices linked to the food we’re eating,” Sylvester said. “It’s a narrative you hear a lot in developed countries, but it is happening now in low- and middle-income countries as well.”

FDI and land value

When demand for land increases, so does its monetary value. While not explicitly mentioned in the research, FDI, whether in food systems or not, have broader implications for infrastructure and other sectors that may also have impacts on land use, including deforestation.

“Future research will have to focus on how FDI causes land prices to change,” Castro said. “Land prices may be relatively inexpensive at the outset of an agricultural venture but are likely to increase over time. Investment in food production, whether for national or international markets, is also an investment in real estate.

“Therefore, we need to pay close attention to the long-term impacts of FDI on land prices and how expected changes in land prices affect land use dynamics.”

More information:

Janelle M. Sylvester et al, Analysis of food system drivers of deforestation highlights foreign direct investments and urbanization as threats to tropical forests, Scientific Reports (2024). DOI: 10.1038/s41598-024-65397-3

Provided by

The Alliance of Bioversity International and the International Center for Tropical Agriculture

Citation:

Foreign direct investments may fuel tropical deforestation (2024, July 16)

retrieved 16 July 2024

from https://phys.org/news/2024-07-foreign-investments-fuel-tropical-deforestation.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.