Fox either forgot what business it’s in, or its executives are thinking 10 steps ahead of everyone else.

In a span of less than four weeks, Fox Entertainment announced a two-way first-look deal with publisher HarperCollins imprint Avon A, unveiled a business arrangement with vertical videos maker Holywater, took an equity stake investment in actor/writer B.J. Novak’s (The Office) pop-up elevated fast-food experience Chain, and purchased scripted rom-com podcast platform Meet Cute, which it intends to mine for projects across multiple platforms. And, as first reported by The Hollywood Reporter, Fox Sports bought a piece of its lead NFL analyst Tom Brady’s production and marketing company Shadow Lion.

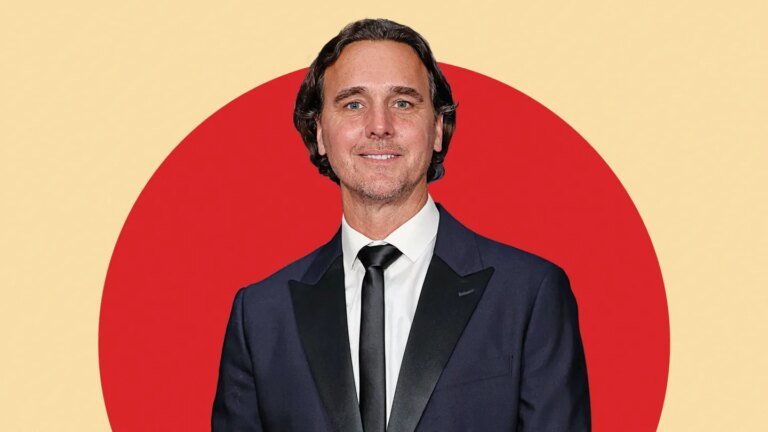

What’s CEO Rob Wade thinking? THR went straight to the man to find out.

“There’s been a lot of announcements recently, but I don’t think there’s been, like, some sudden change,” Wade says of the recent flurry of Fox deals. “It takes time to implement. It takes time to form a strategy and identify the right targets and then execute. I think that’s where we are at the moment.”

Wade notes that Fox’s relatively small size, brought about by the 2019 sale of most assets to Disney, allows for a level of nimbleness not available to much larger corporations. (The billions of dollars from the Disney deal helps here too.) In media’s “scale-or-die” era, Fox essentially chose neither option. While other companies are doing due diligence on the viability of pursuing Warner Bros. Discovery, Fox is rolling the dice on a series of low-risk deals instead.

Though these Fox Entertainment investments may seem disconnected, IP generation is the through-line. Adapt a YA book for Fox. Adapt a rom-com podcast story for Fox. Adapt a … pop-up food experience for Fox. (That last one will be “super fun,” Wade says.)

Wade’s “dream scenario” is for any of these small investments to become “so big that you’re building products and services off that,” he says. The one with the largest upshot is likely Fox’s partnership with Holywater, a Ukrainian-born microdrama maker and platform that services the U.S. market.

Fox is “in a learning phase at the moment” as it pertains to vertical video, Wade says. “It feels like it has great potential, but I think there’s a long road ahead.”

Along the way, Wade will have to convince Fox stars to make dramas he can dice up into 90-second bits and in an aspect ratio they typically reserve for FaceTime. And they have to do it for very cheap.

“I’ve heard a lot of people talking about, you know, bigger Hollywood creators getting involved in vertical video, and I think that’s fine, but they have to realize you cannot push the cost of these up too high,” Wade says. “Big Hollywood stars are used to making lots of money, and this is a lower margin business — even in success — and you have to be happy with that.”

There’s only one way that math maths.

“If a creator has a burning ambition and a desire and a passion to tell stories through vertical, then I think it could be successful,” Wade says, “but I think they have to be understanding of the business and the realistic upsides of it.”

Wade acknowledges there is “a big question mark” about sitcoms working on vertical video — they’re colloquially called microdramas for a reason. Verticals consist of many chapters, each of which must have “incredibly compelling endings,” the exec adds.

“Drama is set up for that, true crime is — even unscripted is set up for that. Comedy doesn’t tend to have cliffhangers,” Wade says. “I think there is a version of comedy that works. Maybe it’s a skit show, though, I don’t know.”