One of the world’s most valuable drug manufacturers by market capitalization reported its second-quarter earnings results Thursday, and they were impressive.

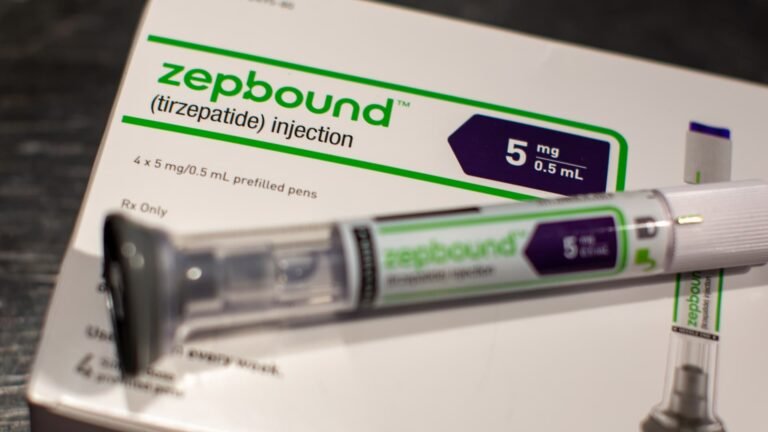

Even if you’ve never heard of pharmaceutical company Eli Lilly, it’s likely that you’re familiar with some of its most popular products: Mounjaro, a prescription medication for Type 2 diabetes, and Zepbound, a prescription medicine for weight loss.

Zepbound was approved Nov. 8 by the U.S. Food and Drug Administration as a treatment for weight management and obesity, according to Eli Lilly.

In its first full quarter in the U.S. market, Zepbound brought in $517.4 million in revenue, Eli Lilly reported in April. In the second quarter, it generated $1.24 billion in U.S. revenue, per the company’s Q2 earnings report.

“We just see unbelievable demand, and we’re not even trying that hard to promote this drug,” Eli Lilly CEO David Ricks told CNBC during a “Squawk Box” interview Thursday. “What you’re seeing is just consumer organic demand here as we’ve shipped more product, as we bring more supply online in the United States.”

DON’T MISS: Achieve Financial Wellness: Be Happier, Wealthier & More Financially Secure

Obesity affects nearly 42% of adults in the U.S., according to the latest data from the Centers for Disease Control and Prevention, and the majority of Americans say willpower alone isn’t enough to lose weight and keep it off, according to a February survey by the Pew Research Center.

The demand for weight loss drugs is on the rise around the world, too. The global market for obesity medication is expected to hit $105 billion in 2030, according to Morgan Stanley’s research. That’s up from the firm’s forecast in September of $77 billion.

And drug manufacturers such as Eli Lilly and Novo Nordisk, the pharmaceutical company that makes Ozempic and Wegovy, are racing to meet that demand. Both companies are investing billions to build new manufacturing plants to boost supply of the popular medications.

How much you’d have if you invested $1,000 in Eli Lilly

Although Eli Lilly has been making headlines recently, thanks to its latest medications, the company has been around for nearly 150 years. It was founded in 1876 and became a publicly traded company on the New York Stock Exchange in 1952.

CNBC calculated how much a $1,000 investment in Eli Lilly would be worth now if you had invested in the company one, five or 10 years ago. CNBC’s calculations are based on Eli Lilly’s Aug. 7 closing share price of $772.14.

If you invested one year ago

- Percentage increase: 49%

- Total as of Aug. 7: $1,490

If you invested five years ago

- Percentage increase: 594%

- Total as of Aug. 7: $6,939

If you invested 10 years ago

- Percentage increase: 1,214%

- Total as of Aug. 7: $13,143

Don’t try to predict the future of the stock market

By nature, the stock market is unpredictable, and factors beyond investors’ or a company’s control can cause a sudden fluctuation or drop in share price. That’s why investors shouldn’t attempt to use a company’s short-term performance to predict how well or how poorly it may do in the future.

Instead of attempting to hand-select individual stocks to invest in, try parking your money in a low-cost index fund such as an exchange-traded fund, an investing strategy billionaire Warren Buffett swears by.

An index fund aims to mirror the performance of a market index such as the S&P 500, which tracks the stock performance of around 500 large U.S. companies. When you invest in an S&P 500 ETF, for instance, your dollars are actually spread across a wide range of top-performing companies, such as Eli Lilly, Apple and Nvidia.

To that point, as of Aug. 7, the S&P 500 is up by nearly 16% compared with 12 months ago, per CNBC’s calculations. Since 2019, the index’s value has soared by nearly 76%, and it has skyrocketed by a little over 169% since 2014.

Want to stop worrying about money? Sign up for CNBC’s new online course Achieve Financial Wellness: Be Happier, Wealthier & More Financially Secure. We’ll teach you the psychology of money, how to manage stress and create healthy habits, and simple ways to boost your savings, get out of debt and invest for the future. Start today and use code EARLYBIRD for an introductory discount of 30% off through September 2, 2024.

Plus, sign up for CNBC Make It’s newsletter to get tips and tricks for success at work, with money and in life.