Intel Corp. said today it’s going to shrink its workforce by almost a third by the end of the year, as part of its previously announced efforts to create a “faster-moving, flatter and more agile” organization.

The disclosure came as Intel published its second-quarter financial results today. The chipmaker said it plans to end the year with a “core workforce” of around 75,000 staff, which would mean it loses almost a third of its employees in a space of about 12 months. The reductions will come via layoffs and attrition, the company said.

According to documents filed with the U.S. Securities and Exchange Commission earlier this year, Intel had around 108,900 employees last December, so if it ends the year with just 75,000 staff, that would amount to a 31% decrease.

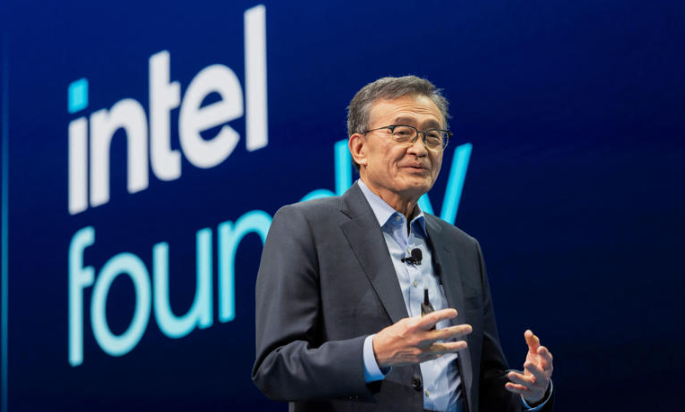

The layoffs are one of the first major decisions made by Intel Chief Executive Lip-Bu Tan (pictured), who took over the company’s top job in March, replacing former head honcho Pat Gelsinger in an effort to arrest a long, slow slide into financial trouble.

“It’s going to take time, but we see clear opportunities to enhance our competitive position, improve our profitability and create long-term shareholder value,” Tan said in a statement alongside the company’s earnings results.

There’s a sense of urgency for Intel, too, for the chipmaker continues to bleed money. In its latest earnings report, it posted a loss before certain costs such as stock compensation of just 10 cents per share, falling short of Wall Street’s target of a four-cent-per-share profit. Revenue for the period came to $12.86 billion, flat from the year before but ahead of the $11.92 billion analyst consensus estimate. However, it ended the quarter with a net loss of $2.9 billion, almost double its loss from the same period one year ago.

Tan said the layoffs announced today will help the company to achieve its goal of bringing down its operating expenses to just $17 billion a year by the end of fiscal 2025, and then to $16 billion by 2026.

In addition to the layoffs, Intel is looking to scale back some of its previously announced expansions. The chipmaker has opted to cancel the construction of new chip fabs in Germany and Poland, and will shut down its Costa Rica-based testing and assembly operation, consolidating it with existing facilities in Malaysia and Vietnam. It also plans to “slow the pace” of its planned new chip fab in Ohio, which is currently under construction.

Tan justified the measures, saying that in the last few years, Intel has “invested too much, too soon, without adequate demand.” He added that the company’s factory footprint has “become needlessly fragmented and underutilized” as a result.

The onetime chipmaking industry leader has become battered and bruised in recent years after failing to predict two major technology industry transformations and falling far behind its competitors. It first missed the boat on mobile devices, and it later failed to predict the emergence of artificial intelligence, leaving it with virtually no market share in either segment.

Last summer, before Gelsinger’s departure, Intel said it would cut about 15,000 jobs – some 15% of its total workforce – as part of a plan to slash its spending by $10 billion in order to turn itself around.

Holger Mueller of Constellation Research Inc. told SiliconANGLE that the sheer scale of the layoffs is alarming. He believes the disruption it causes will be felt across Intel’s customer, supplier and partner ecosystem and take a long time to smooth out. But even more worrying, he said, is that Tan’s plans to revive Intel by revitalizing the x86 ecosystem and refining its AI strategy don’t really offer anything new that might set the company apart from its peers.

“Intel has been trying to instill new life in the x86 franchise for over a decade now, and the focus on AI inference isn’t different to what any of its competitors are doing,” Mueller pointed out. “Add to that, Intel is now going to suffer huge reputational damage by abandoning its high-profile and extremely visible investments in Germany and Poland. One can only wish Intel luck, but its laid-off employees may have better luck as there are lots of exciting opportunities for those with the right expertise.”

For the current quarter, Intel said it anticipates revenue of $13.1 billion at the midpoint of its guidance range, ahead of the Street’s target of $12.65 billion. It’s expecting to break even on earnings, while analysts are targeting a profit of four cents per share.

Intel’s stock initially rose 3% on news of the layoffs, but those gains were quickly wiped out and it’s down just over 4% in extended trading. However, the stock is still up 12% in the year to date, which suggests that investors have confidence in Tan, despite the company’s uncertain future.

Photo: Intel

Support our open free content by sharing and engaging with our content and community.

Join theCUBE Alumni Trust Network

Where Technology Leaders Connect, Share Intelligence & Create Opportunities

11.4k+

CUBE Alumni Network

C-level and Technical

Domain Experts

Connect with 11,413+ industry leaders from our network of tech and business leaders forming a unique trusted network effect.

SiliconANGLE Media is a recognized leader in digital media innovation serving innovative audiences and brands, bringing together cutting-edge technology, influential content, strategic insights and real-time audience engagement. As the parent company of SiliconANGLE, theCUBE Network, theCUBE Research, CUBE365, theCUBE AI and theCUBE SuperStudios — such as those established in Silicon Valley and the New York Stock Exchange (NYSE) — SiliconANGLE Media operates at the intersection of media, technology, and AI. .

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a powerful ecosystem of industry-leading digital media brands, with a reach of 15+ million elite tech professionals. The company’s new, proprietary theCUBE AI Video cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.