“There will be a lot of wait-and-see approach with new investments and greenfield investments,” said Sharmila Suntherasegarun from Malaysian public policy think tank IDEAS.

The researcher at IDEAS’ economics and business unit added that attracting investments in research and development, as well as a higher value-added segment of semiconductors would be more challenging amid such uncertainty.

Ongoing trade tensions between the US and China have also cooled the investment appetite of small- and medium-size enterprises (SMEs).

“My point is that we don’t invest in uncertainty. We don’t invest in possibilities. We invest in certainty. So, I would say SMEs should not react on the basis of perceived opportunity at this point in time,” said William Ng, president of the SME Association of Malaysia.

RETAINING BIG CORPORATIONS

Some American multinational chipmakers such as Intel are also facing pressure from the Trump administration to reshore their operations back to the US.

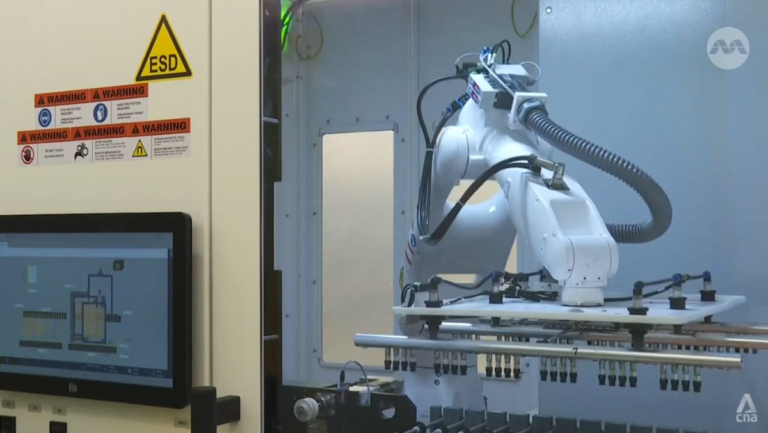

Semiconductor and electronic goods from chipmakers, including American firms, currently form 60 per cent of Malaysian exports to the US, said Malaysia’s Investment, Trade and Industry Minister Zafrul Abdul Aziz.

Any tariff imposed by Washington on Malaysian semiconductor goods would impact these companies, affecting employment and making it more expensive for them to increase investment in Malaysia, according to Tricia Yeoh, an associate professor of politics and international relations at the University of Nottingham Malaysia.

She added that the semiconductor manufacturing sector “represents precisely the type of manufacturing jobs that the US would like to bring back (to) its shores”.

The Malaysia Semiconductor Industry Association is hoping that these chipmakers continue to operate in the country.