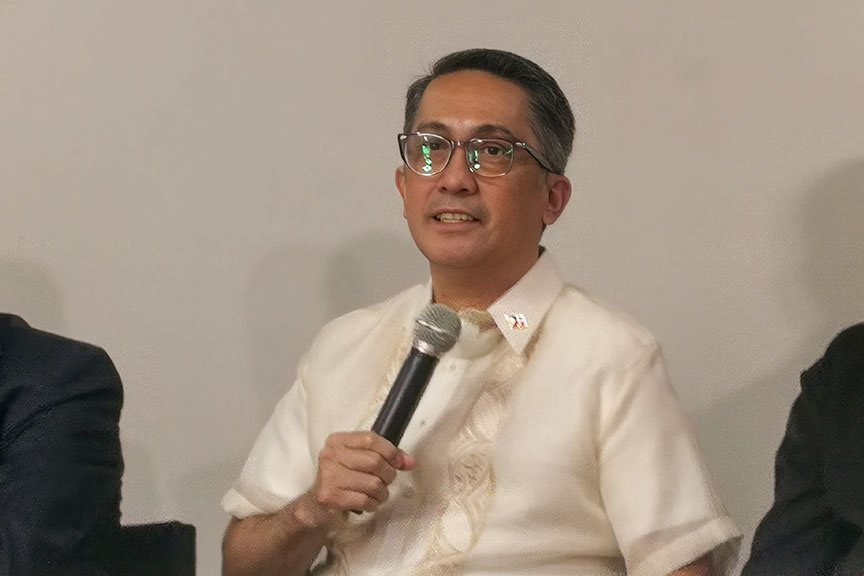

GENERAL SANTOS CITY (MindaNews / 5 December) – Qatari investment firm Al Mansour Holding is exploring the possibility of investing in the southern Philippines, Mindanao Development Authority (MinDA) Secretary Leo Tereso Magno said.

Magno and royal family member Sheik Mansour bin Jabor bin Jassim Al Thani, owner of Al Mansour Holding, discussed the possibility of the latter’s foray in Mindanao during a meeting in Qatar late last month.

In a statement on Thursday, he said the Qatari firm expressed interest “in supporting the region’s priorities in agriculture modernization, mining reforms, digital transformation, and fintech-driven financial inclusion—all contributing to building a better, more sustainable Mindanao.”

During the exploratory meeting, Magno laid out “a strategic portfolio reflecting MinDA’s long-term vision of building a better Mindanao, anchored on inclusive growth, world-class infrastructure, and resilient economic systems.”

Magno said both parties are keen on reaching a Memorandum of Understanding, with MinDA hoping it could contribute “to a broader national aspiration of building a better, more resilient and more prosperous Mindanao.”

“A Mindanao capable of driving national growth, advancing peace and stability, and serving as a cornerstone of the Philippines’ socio-economic rise,” he added.

Magno noted that if formalized, the partnership “could open new development corridors, enhance Mindanao’s competitiveness in energy, food production, and digital innovation, and contribute significantly to the country’s long-term goal of a unified, modern, and inclusive Philippine economy.”

A major Qatari company, Al Mansour Holding is recognized internationally for executing sovereign-backed mega projects across Africa, the Middle East, and Asia, the MinDA statement noted.

MinDA was created in 2010 through Republic Act 9996 to “promote, coordinate and facilitate the active and extensive participation of all sectors to effect the socioeconomic development of Mindanao.”

Mindanao’s investment climate has vastly improved due to the prevailing peace and order situation across the island in the past several years.

Parts of the island were devastated by the armed rebellion waged by the Moro National Liberation Front (MNLF) and its breakaway Moro Islamic Liberation Front (MILF) in the 1970s. Both Moro fronts have signed a final peace agreement with the Philippine government, in 1996 and 2014, respectively.

From 2019 to 2023, the Board of Investments-approved projects totaled P271.6 billion in the five regions of Mindanao, except the Bangsamoro Autonomous Region in Muslim Mindanao (BARMM) which has its own Bangsamoro Board of Investments (BBOI), according to the “Mindanao in Figures 2024,” a database published by the MinDA.

Investors’ confidence in Mindanao was particularly in the uptrend in the last three years – at P24.2 billion in 2021, P68.7 billion in 2022 and P97.9 billion in 2023, MinDA data showed.

Region 11 (Davao region) was the top investment destination in Mindanao with projects worth P120 billion, followed by Region 12 (Soccsksargen) at P68.8 billion, Region 10 (Northern Mindanao) at P67.3 billion, Region 9 (Zamboanga Peninsula) at P8.6 billion, and Region 13 (Caraga) at P6.8 billion, it added.

In the BARMM, the BBOI approved investments worth at least P4 billion in 2025, surpassing its target of P3 billion for this year.

The BARMM was established in 2019 with the ratification of Republic Act 11054 or the Bangsamoro Organic Law. The creation of an autonomous Bangsamoro region was provided under the Comprehensive Agreement on the Bangsamoro, signed by the government and the MILF in 2014 after 17 years of negotiations. (Bong S. Sarmiento / MindaNews)