TPG invested $1.2 billion in real estate in the second quarter, acquiring two Manhattan office buildings for conversion into residential spaces. The firm purchased 222 Broadway for $150 million, partnering with Jeff Gural’s GFP Real Estate, and acquired 101 Franklin Street for more than $100 million. Both properties suffered significant losses in value and were bought at substantial discounts compared to their previous trades.

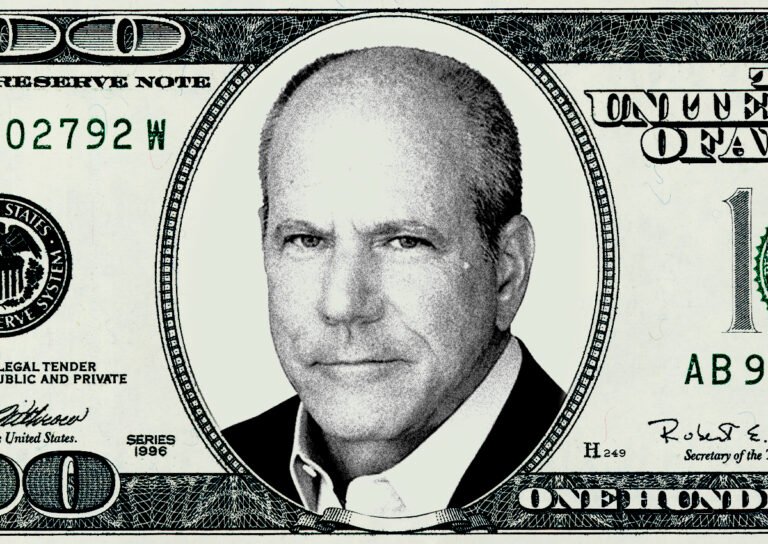

As more properties face distress, Winkelried said his firm will continue to invest in “high-quality assets,” hoping to maximize returns. The firm will continue to look for strategic partners as it uses its deep pockets to invest, he said.

TPG plans to focus on more resilient sectors, like student housing and industrial properties, while slow playing office investments.

The firm has plenty of dry powder to burn through, but Winkelried says TPG will take the same approach it took in the first half of the year, after its $2.7 billion acquisition of Angelo Gordon was finalized at the end of last year.

“We expected that over time, as a result of some stress in the system, we would see interesting assets be available for sale,” Winkelried said during the earnings call. “And that’s exactly what’s happened.”

TPG isn’t the only investor eager to make an aggressive play this year. Crow Holdings has raised a $3.1 billion fund and is targeting value-add real estate investments across the U.S. The Dallas-based firm, led by CEO Michael Levy, will focus on multifamily, industrial, and other sectors. More than 25 percent of the fund has been deployed already.

—Caysey Welton