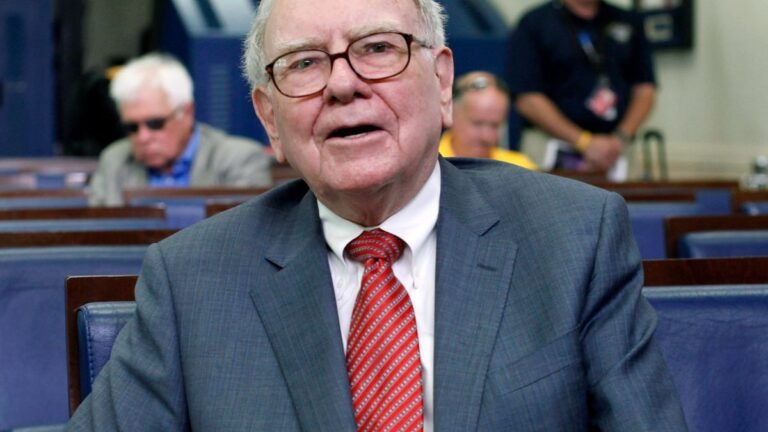

Billionaire investor Warren Buffet said on Saturday that he wants to step down as chief executive of Berkshire Hathaway at the end of the year. The revelation came as a surprise as the 94-year-old had previously said he did not plan to retire.

Buffett, one of the world’s richest people and most accomplished investors, took control of Berkshire Hathaway in 1965 when it was a textiles manufacturer. He turned the company into a conglomerate by finding other businesses and stocks to buy that were selling for less than they were worth.

His success made him a Wall Street icon. It also earned him the nickname “Oracle of Omaha,” a reference to the Nebraska city where Buffett was born and chose to live and work.

Here are some of his best and worst investments over the years:

Buffett’s Best Investments

1. National Indemnity and National Fire & Marine

Purchased in 1967, the company was one of Buffett’s first insurance investments. Insurance float — the premium money insurers can invest between the time when policies are bought and when claims are made — provided the capital for many of Berkshire’s investments over the years and helped fuel the company’s growth.

Berkshire’s insurance division has grown to include Geico, General Reinsurance and several other insurers. The float totalled $173 billion (€152.7bn) at the end of the first quarter this year.

2. Buying blocks of stock in American Express, Coca-Cola Co. and Bank of America at the right time

Warren Buffet bought significant chunks of stocks in the above companies during times when they were out of favour because of scandals or market conditions. Collectively, the shares are now worth over $100bn (€88.3bn) more than what Buffett paid for them, not including all the dividends he has collected over the years.

3. Apple

Buffett long said that he didn’t understand tech companies well enough to value them and pick the long-term winners, but he started buying Apple shares in 2016. He later explained that he bought more than $31bn (€27.4bn) worth because he understood the iPhone maker as a consumer products company with extremely loyal customers.

The value of his investment grew to more than $174bn (€153.7bn) before Buffett started selling Berkshire Hathaway’s shares.

4. BYD

On the advice of his late investing partner Charlie Munger, Buffett bet big on the genius of BYD founder Wang Chanfu in 2008 with a $232 million (€205m) investment in the Chinese electric vehicle maker.

The value of that stake soared to more than $9bn (€8bn) before Buffett began selling it off. Berkshire’s remaining stake is still worth about $1.8bn (€1.6bn).

5. See’s Candy

Buffett repeatedly pointed to his 1972 purchase as a turning point in his career. Buffett said Munger persuaded him that it made sense to buy great businesses at good prices as long as they had enduring competitive advantages.

Previously, Buffett had primarily invested in companies of any quality as long as they were selling for less than he thought they were worth. Berkshire paid $25m (€22.1m) for See’s and recorded pre-tax earnings of $1.7bn (€1.5bn) from the candy company through 2011. The amount continued to grow but Buffett didn’t routinely highlight it.

6. Berkshire Hathaway Energy

Utilities provide a large and steady stream of profits for Berkshire. The conglomerate paid $2.1bn (€1.9bn), or about $35.1 (€30.9) per share, for Des Moines-based MidAmerican Energy in 2000.

The utility unit subsequently was renamed and made several acquisitions, including PacifiCorp and NV Energy. The utilities added more than $3.7bn (€3.3bn) to Berkshire’s profit in 2024, although Buffett has said they are now worth less than they used to be because of the liability they face related to wildfires.

Buffett’s Worst Investments

1. Berkshire Hathaway

Buffett had said his investment in the Berkshire Hathaway textile mills was probably his worst investment ever. The textile company he took over in 1965 bled money for many years before Buffett finally shut it down in 1985, though Berkshire did provide cash for some of Buffett’s early acquisitions.

Of course, the Berkshire shares Buffett began buying for $7 (€6.2) and $8 (€7.1) a share in 1962 are now worth $809,350 (€714,689.4) per share, so even Buffett’s worst investment turned out relatively alright.

2. Dexter Shoe Co.

Buffett said he made an awful blunder by buying Dexter in 1993 for $433m (€382.4m), a mistake made even worse because he used Berkshire stock for the deal. Buffett says he essentially gave away 1.6% of Berkshire for a worthless business.

3. Missed opportunities

Buffett said that some of his worst mistakes over the years were the investments and deals that he didn’t make. Berkshire easily could have made billions if Buffett had been comfortable investing in Amazon, Google or Microsoft early on.

However, it wasn’t just tech companies he missed out on. Buffett told shareholders he was caught “sucking his thumb” when he failed to follow through on a plan to buy 100 million Walmart shares that would be worth nearly $10 billion (€8.8bn) today.

4. Selling banks too soon

Not long before the COVID pandemic, Buffett seemed to sour on most of his bank stocks. Repeated scandals involving Wells Fargo gave him a reason to start unloading his 500 million shares, many of them for around $30 (€26.5) per share.

However, he also sold off his J.P. Morgan stake at prices less than $100 (€88.3). Both stocks have more than doubled since then.

5. Blue Chip Stamps

Buffett and Munger, Berkshire’s former vice chairman, took control of Blue Chip in 1970 when the customer rewards program was generating $126m (€111.2m) in sales. But as trading stamps fell out of favour with retailers and consumers, sales steadily declined; in 2006, they totalled a mere $25,920 (€22,881.4).

However, Buffett and Munger used the float that Blue Chip generated to acquire See’s Candy, Wesco Financial and Precision Castparts, which are all steady contributors to Berkshire.