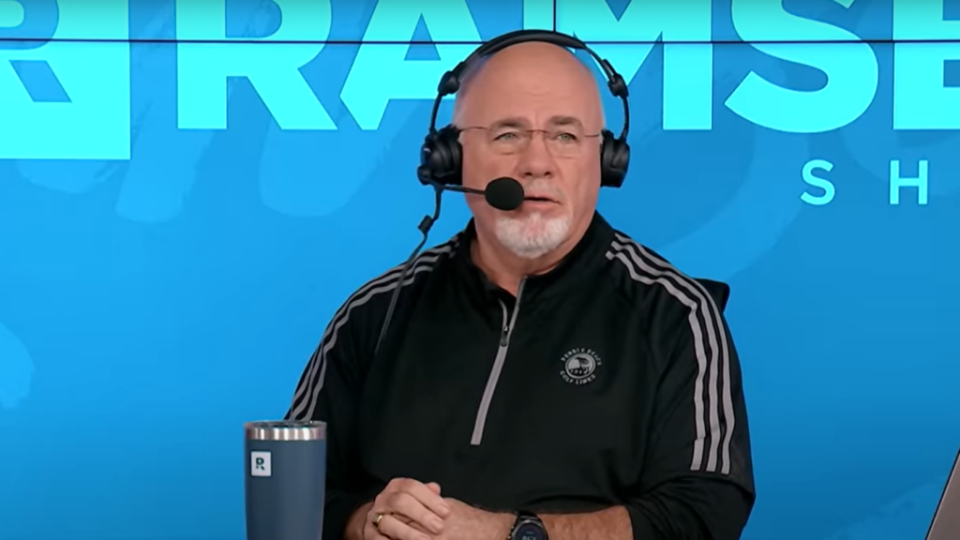

In a lively segment of the Ramsey Show, 21-year-old caller Matt sparked a spirited debate on the merits of index funds versus mutual funds. Matt, who has been investing since he was 15, called in to ask why the show’s hosts, known for their financial advice, prefer mutual funds over index funds.

Don’t Miss:

“I’m not an avid watcher of the Ramsey Show, but I see clips online where you guys talk about mutual funds and investing in mutual funds. I was wondering why you recommend mutual funds over index funds?” Matt asked.

Matt, who works full-time in marketing and earns $80-90K per year, revealed that he invests 25-30% of his gross household income. This impressive savings rate prompted George Kamel, the show’s personal finance expert and co-host, to commend Matt’s efforts. “Oh, my goodness. OK, so you’re going to be a multimillionaire regardless of this conversation that happens next. Can we agree on that?” Kamel exclaimed.

Kamel then explained the differences between index funds and mutual funds for the show’s listeners. “Index funds are basically passively managed mutual funds. They track an index, a set list of companies. Mutual funds are actively managed by an investment manager who selects the funds based on extensive research, aiming to beat the market.”

Trending: Mark Cuban believes “the next wave of revenue generation is around real estate and entertainment” — this new real estate fund allows you to get started with just $100.

Matt pointed out that mutual funds come with built-in fees, a drawback Kamel acknowledged. “There’s an investment manager to pay, so they do have fees,” Kamel explained. “The perks of index funds include diversification, low expense ratios, and predictability. However, your index funds won’t beat the market since they represent the market.” He added that the goal of mutual funds is to outperform the market, though this isn’t always a guarantee.

Matt challenged this by stating that 80% of mutual funds don’t beat the market over long periods. Kamel countered with recent data, “Morningstar reported that nearly 57% of actively managed U.S. equity funds beat the average index fund peer over the 12 months through June 2023. So, six out of 10 mutual funds beat the index.”

Despite the back-and-forth, Kamel emphasized that both investment strategies have their place. He noted that Dave Ramsey himself invests in index funds outside of retirement accounts due to their low turnover and fees but prefers mutual funds for retirement accounts to potentially achieve higher returns.

See Also: Many are surprised that they are eligible for a tax reduction on their home, with just a few seconds you can see if you can save in 3 minutes or less.

Ultimately, Kamel reassured Matt that his disciplined investing habits would ensure financial success regardless of his choice between index and mutual funds. “Matt, here’s the deal — we can argue all day, but you can be a multimillionaire just from your index funds. The key is your savings rate. That’s what’s holding people back from having money … Just freaking invest. Be like Matt — at 21 years old, investing $18,000 a year. You’re going to have money in retirement regardless of where you put it.”

This conversation underscores an essential truth in personal finance: consistent investing and a high savings rate are both important factors. While the debate between index and mutual funds may continue, the critical take-away is to start investing early and remain committed to your financial goals.

For personalized advice tailored to your specific situation, consulting a financial advisor can be invaluable in ensuring your investments align with your long-term objectives.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article 21-Year-Old Caller On The Ramsey Show Argues Index Funds Are Better Than Mutual Funds, Hosts Say ‘Just Freaking Invest’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.