Multi-asset funds hold well

Amid a prolonged lull in the equity market, multi-asset funds have proved their mettle. Investors who took shelter in these funds have discovered why asset allocation is a potent antidote to the market’s vagaries. The category has posted a gain of nearly 16%, even as flexi-cap funds have fetched 3%. Only gold, silver and international funds have done better. The premise is simple: Outperforming asset classes appear evident only in hindsight. If you allocate across multiple uncorrelated asset classes, losses in a few struggling assets are likely to be tempered by gains in others in a stronger position. This time, gold and silver have given multi-asset funds an edge.

Gold surged 74.5% this year, while silver soared 138% (based on December 19 closing values), even as broader equity indices either shrank or delivered flat to single-digit returns. “Multi-asset funds have hogged the limelight due to their allocation to precious metals,” observes Vivek Banka, Founder, GoalTeller. “In a year when gold and silver delivered massive returns, this ‘one fund, multiple engines’ structure appears to have held investor interest—particularly among long-term investors seeking diversification without managing multiple funds,” says Atul Shinghal, Founder and CEO, Scripbox. These may not offer chart-topping returns, but asset allocation makes portfolios more resilient over the long run.

Multi-asset funds provided buffer to market weakness

Income-plus-arbitrage funds emerged as debt fund alternatives

Income-plus-arbitrage funds

This year saw the emergence of income-plus arbitrage funds, a new hybrid category offering an alternative to tax-inefficient plain vanilla debt funds. These schemes allocate less than 65% of their corpus to fixed income, with the rest parked in arbitrage positions. Arbitrage involves taking positions simultaneously in the cash and futures markets of a security to profit from the price differential between the two. “Income-plus-arbitrage offerings typically aim to deliver steadier outcomes by combining a carry-oriented sleeve (often short-duration accrual) with an arbitrage-style sleeve that seeks to reduce directional market risk,” remarks Shinghal.

Under this fund structure, gains are taxed at 12.5% if held for more than 24 months. On the other hand, gains from a traditional debt fund are now taxed at the investor’s slab rate, irrespective of the holding period. This makes the latter tax-inefficient for those in the 20% or higher tax slabs. A pure debt fund fetching an 8% annualised return after two years will translate into a post-tax gain of 5.7% for an individual in the 30% tax bracket. A debt-cum-arbitrage fund clocking the same return will net the investor 7% post-tax gain. This makes the latter an enticing proposition. Archit Doshi, Senior Vice President, PL (Prabhudas Lilladher) AMC, says, “This combination of debt-like pre-tax returns and equity tax treatment meaningfully improves post-tax outcomes for investors with holding periods beyond two years, making them a compelling alternative to traditional debt funds and fixed deposits.”

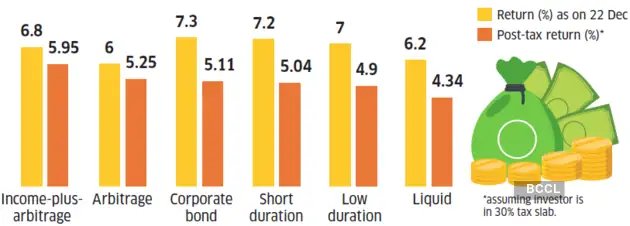

Even as a few fund houses have repackaged existing debt schemes in this new avatar, others have launched fresh offerings. Already, 20 schemes managing assets worth Rs.24,500 crore are running. It has emerged as a good option for those seeking to park surplus funds in a safe, tax-efficient manner. For those in highest tax bracket, the category delivered an average post-tax return of 5.95%.

Sebi tightens rules

The Securities and Exchange Board of India (Sebi) introduced several reforms in the mutual funds space this year. The most significant shift is in the way mutual funds can charge investors. Until now, investors have been charged a total expense ratio (TER), a single figure that did not fully capture the different expenses they incur. Under the new rules, expenses will be broken down into distinct buckets: the base expense ratio, statutory and regulatory levies and brokerage costs. While base costs have been trimmed slightly, the real savings for investors are in tighter brokerage caps and the abolition of the transitory exit load levy. This will help curtail cost leakages. Overall, fund factsheets will now show costs more honestly.

This ushers in transparency rather than materially reducing what investors pay. Doshi remarks, “Sebi’s fee reforms nudge the industry from opaque all-in charges to a cleaner, line-item bill for investors. With expense caps trimmed, brokerage limits tightened from double digits to low single digits, and taxes clearly separated from fund manager fees, investors can now see what they pay the market versus what they pay the manager.”

What to expect in 2026

Gold and silver should continue to do well, making asset allocation and hybrid funds a must-have in the portfolio. Interest rates are unlikely to fall much, so duration funds may not yield healthy returns. Investors should watch out for any regulatory changes in the defined investible universe (market cap limits) for various equity funds.