The clouds around the Indian markets over the past year are slowly clearing. From a scenario of slowing consumer demand, continuous FPI selling, geopolitical tensions and penal US trade tariffs, the tide is turning.

Income tax reduction, GST reforms and the upcoming pay commission (for government employees) are likely to spur demand. After facing off on trade tariffs, India and the US are back at the negotiating table. Government spending on infrastructure is witnessing a revival and GDP growth has been healthy in the first quarter of FY25.

A rate cut by the US Federal Reserve with two more planned later in the year are other positives.

However, the market buoyancy has resulted in valuations slipping to uncomfortable levels in many pockets. Large-caps, however, still seem reasonably priced.

In this regard, a focused fund (with a large-cap bias) to gain from any rallies seems appropriate for investors with a moderate risk appetite.

ICICI Prudential Focused Equity Fund (ICICI Prudential Select Large Cap earlier) is a scheme suitable for investors with a perspective of 5-plus years.

It is a fund with a strong and consistent track record, and can be considered for the key part of an investor’s portfolio. Taking the SIP route with a long-term horizon would help in saving towards specific goals, apart from averaging costs and riding out market volatility.

Top-notch

ICICI Focused Equity fund has upped its performance record significantly over the past several years.

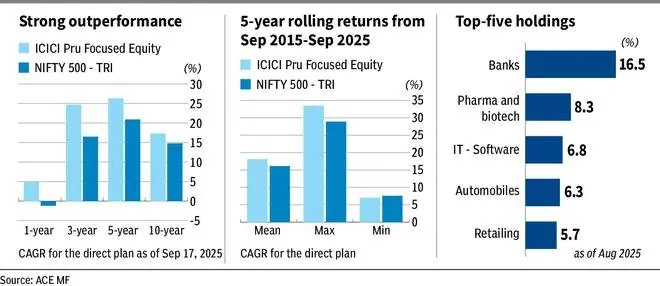

When point-to-point returns over the past one, three, five and 10-year periods are considered, the fund outperformed the Nifty 500 TRI by 2.5-7 percentage points.

Five-year rolling returns from September 2015 to September 2025 show ICICI Prudential Focused Equity’s consistent performance, with the fund beating the Nifty 500 TRI almost 68 per cent of the times. Furthermore, in 5-year rolling returns over the aforementioned 10-year period, the fund generated more than 12 per cent returns for a healthy 94 per cent of the times and in excess of 15 per cent for 56 per cent of the time.

A monthly SIP in the fund over the last 10 years would have delivered a return (XIRR) of 19.1 per cent. If an SIP had been done in the Nifty 500 TRI for the same period, the returns would have been 15.8 per cent.

Overall, the fund’s performance place it among the best in the category, while ranking high on consistency.

The fund has an upside capture ratio of 115.6.8, indicating that its NAV rises much more than the benchmark during rallies. It has a downside capture ratio of 82.2, suggesting that the scheme’s NAV falls much less than the benchmark during corrections. A score of 100 indicates that a fund performs in line with its benchmark. This inference is based on returns from September 2020 to September 2025. Other key risk measures such as Jensen’s alpha, Sortino ratio and Sharpe ratio are all healthy.

The aforementioned data pertain to the direct plan of ICICI Prudential Focused Equity.

Smart churning

Being a focused fund, the scheme generally maintains a portfolio of around 30 stocks, keeping with its mandate. But barring the top 2-3 stocks, exposure to individual firms is generally much lower than 5 per cent.

ICICI Prudential Focused Equity has a heavy large-cap bias. In the recent portfolio, over 86 per cent of the portfolio is made up of large-caps. In general, depending on market conditions, the proportion can go down to 75 per cent levels, as it did during periods when broader markets rallied steadily. In the rising markets during 2023 and 2024, it was not uncommon for the fund to have 15-17 per cent of its investments in mid-caps.

Overall, the large-cap bias lends considerable stability to the portfolio.

In terms of sector holdings, banks have always topped the charts across markets.

Other sector investments are driven largely by the value style with the odd element of growth as well. In 2021 and 2022, the fund upped stakes in IT as the post-Covid demand for digitisation was high. In 2023, as the IT sector started witnessing a slowdown, the fund increased exposure to the automobiles sector. Then it raised stakes in petroleum products as well. Insurance and retailing were other key holdings in 2024.

As IT stocks corrected sharply over the past one year and pharmaceuticals, too, underperformed in this period, ICICI Prudential Focused Equity once again increased exposure to these sectors this year as valuations turned reasonably attractive.

The fund also has reasonable allocations to the growing realty segment.

On the whole, the fund is able to smartly juggle sectors to ensure steady outperformance.

The scheme remains fully invested for most parts with cash and debt exposures generally being less than 3 per cent.

The fund can be a good addition to your portfolio from a long-term perspective.

Published on September 20, 2025