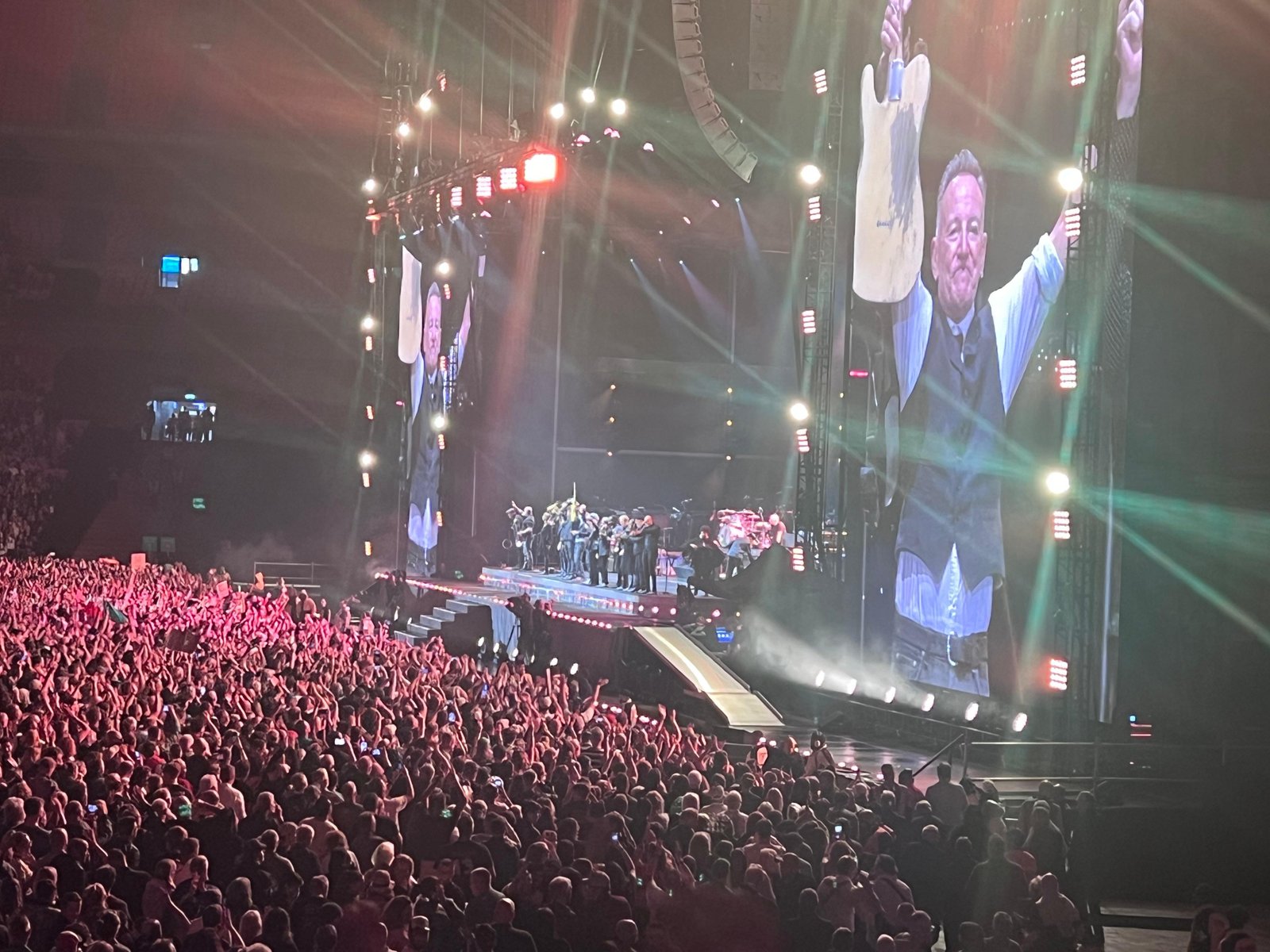

Now, unlike many younger singers of today who do two-hour concerts, the concerts of the E Street Band go on for over three hours, and are extremely high on energy, even though most band members are over 70 now.

Also, given that one wasn’t going to take the risk of arriving at the concert just-in-time and would be there at least an hour in advance, buying tickets closest to the stage would have meant standing for more than four hours. Further, taking into account that it would take an hour to get to the Wembley Stadium, then possibly 30 minutes to get out of it once the concert was over, and another hour to get back to the hotel, it would have meant standing for more than six and a half hours.

So, we bought tickets which were close to the stage—though not as close as standing-room only tickets—but which allowed us to watch the concert sitting.

At around 7.15 pm, Springsteen came on stage and the band started singing Lonesome Day. Fifteen minutes on, they were playing my favourite Springsteen number No Surrender, and the energy in the stadium had gotten people in the rows in front of us on their feet, and soon everyone was standing and singing along with the E Street Band.

View Full Image

Of course, once people in front of us were standing we also had to stand up in order to get a better view of the stage. Now, this forced those behind us and those behind them to stand up as well. The energy and the atmosphere in the stadium was responsible for this, but, so was the need to get a better view of the E Street Band on stage.

Economists have a term for a situation like this: the fallacy of composition. Or as Greg Ip writes in Foolproof—Why Safety Can Be Dangerous and How Danger Makes Us Safe: “This fallacy occurs when what benefits an individual is wrongly assumed to benefit an entire group. For example, if one moviegoer stands, he can see the show better. But if everyone in the audience stands, no one sees better, and everyone is uncomfortable.”

Something similar happened to those watching Springsteen’s concert seated. The fallacy of composition ensured that they saw the concert standing. Of course, there was enjoyment in standing, clapping and singing along with the band, but there was discomfort as well, which wouldn’t have been experienced if everyone had seen the concert sitting.

Dear reader, if you are wondering where I am going with this, allow me to explain. India’s systematic investment plan (SIP) investors are in the middle of a fallacy of composition situation like those at the Springsteen concert. Further, the retail SIP investors have no idea about this and if they continue to be ignorant, somewhere down the line it’s going to hurt them.

The SIP story

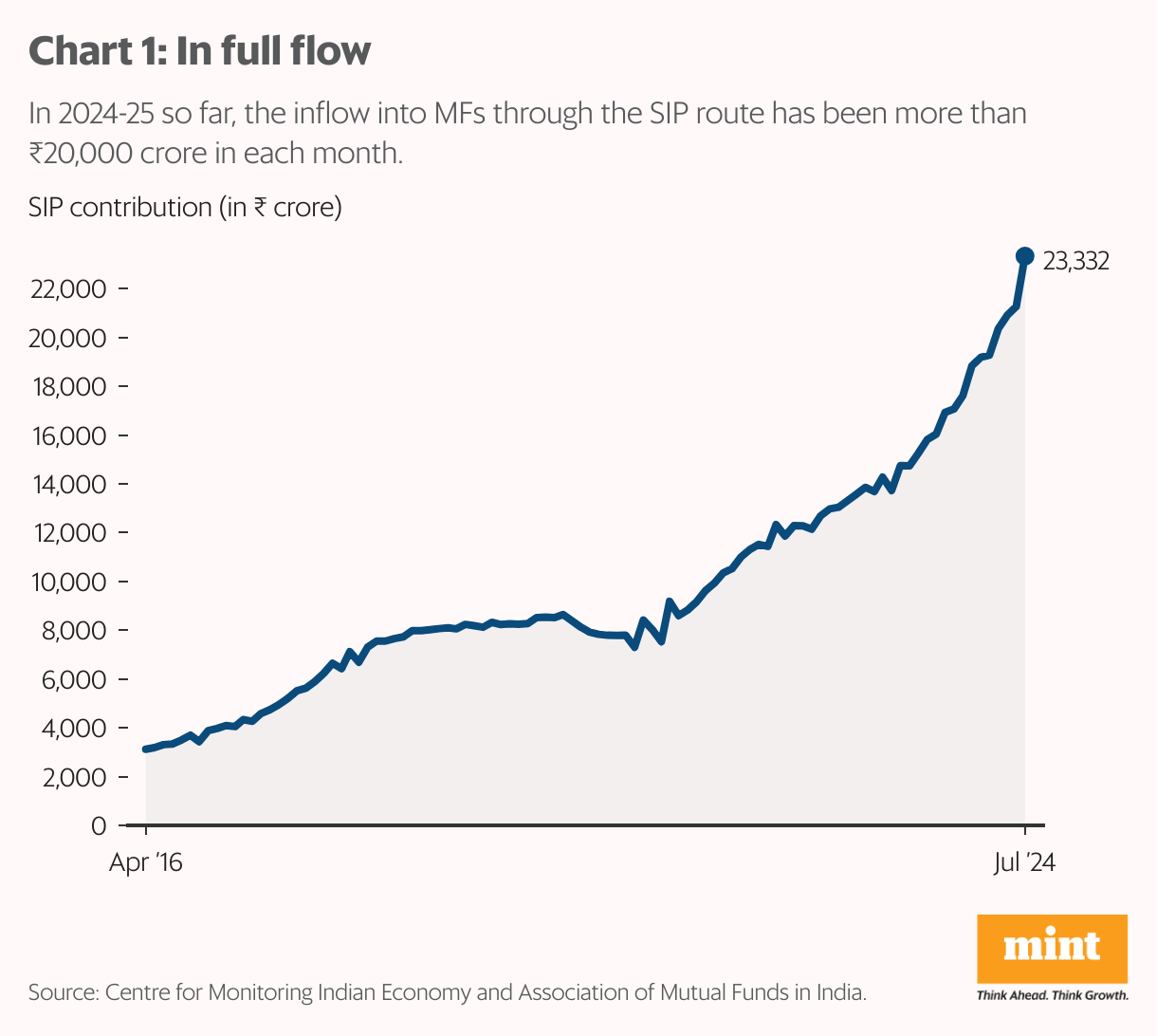

In July 2024, ₹23,332 crore was invested in mutual funds through the SIP route. An SIP is a way of regularly investing in mutual funds (MFs), particularly equity MFs. Equity MFs invest a bulk of their money in listed stocks. A January 2023 CNBCTV18.com news report quoted N.S. Venkatesh, the then chief executive of the Association of Mutual Funds in India (Amfi), the mutual fund lobby, as saying that “90% of the total SIP inflows were into equity schemes”. Which means indirectly into stocks. Now, let’s take a look at chart 1 which plots the monthly SIP inflows into MFs.

As can be seen, the total amount of money coming into MFs through the SIP route has gone up majorly. In 2024-25, the inflow was more than ₹20,000 crore in each month.

The jumps in SIP investment came at two points. First in 2017 after Amfi launched the mutual fund sahi hai ad campaign in March 2017. The second and the more significant jump came mid-2021 onwards once stock prices had run up considerably after falling big-time in March 2020.

View Full Image

The fallacy of composition

Investors investing in stocks through the SIP route is largely good news, at least on the face of it. First, investing through SIPs ensures that investors invest regularly. Second, by investing regularly investors ignore all the noise of the so-called analysis that comes with investing in stocks. Third, an SIP ensures that every month, or every week, some money is invested in stocks. Hence, regular savings happen.

So, investing in equity MFs through SIPs makes sense at an individual level. But as the fallacy of composition states what makes sense at an individual level may not necessarily make sense at an aggregate level. Among other reasons, the flood of money coming into stocks through the SIP route has ensured that stock prices have gone from strength to strength, and the prices of many stocks now are not in line with their current, or for that matter, the prospect of future earnings.

View Full Image

Hence, the SIP investors are buying stocks indirectly at higher and higher prices. This means that in order to make money in the years to come, the stock prices will have to continue going up at a fast pace from where they currently are, and thus continue to be out of whack with the prospect of future earnings of companies. And that’s not a good thing.

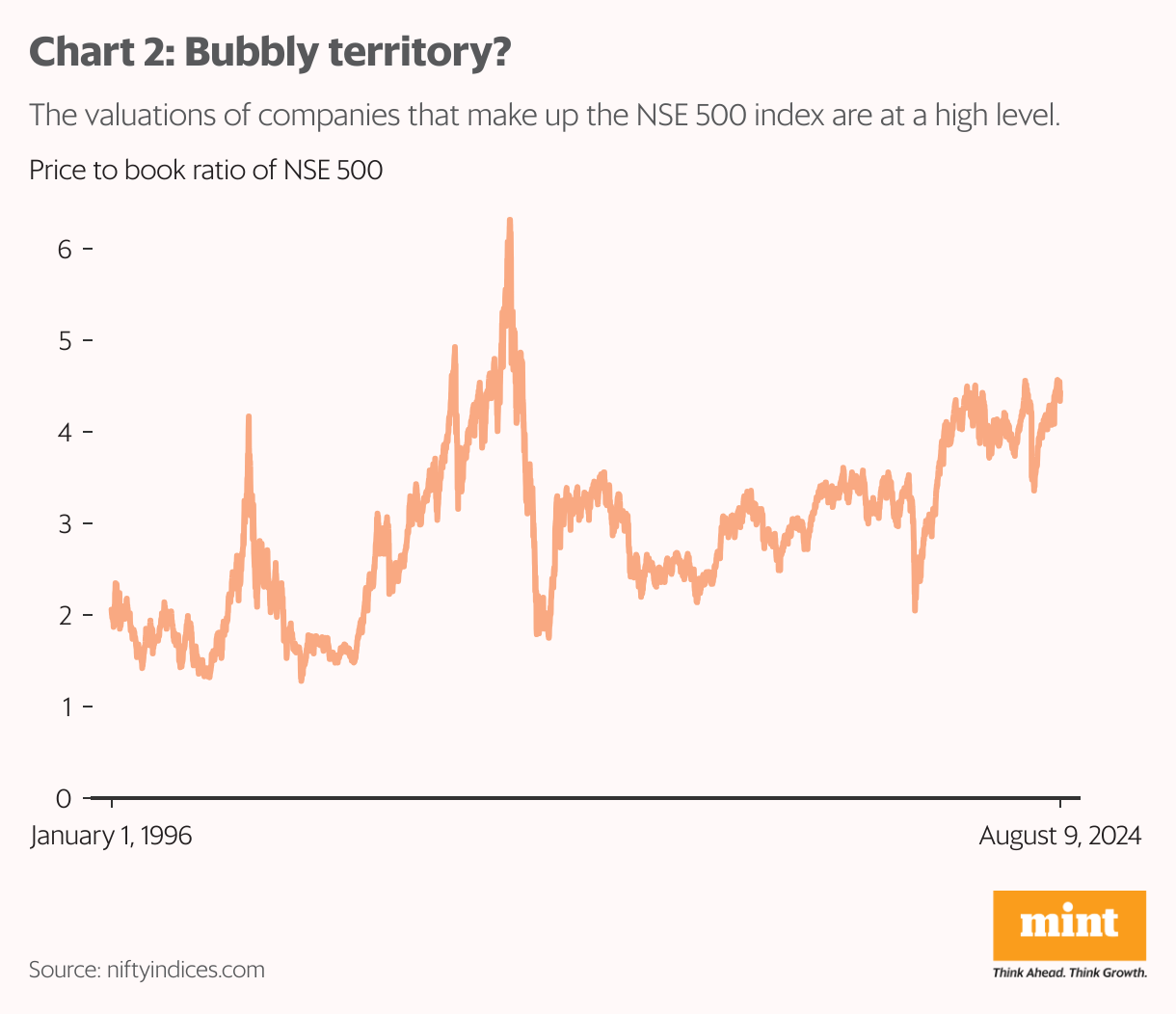

Now, let’s take a look at chart 2, which plots the price to book ratio of the NSE 500 index from 1996 onwards. The price to book ratio is a measure of valuation and the NSE 500 is a stock market index which includes 500 listed companies.

The valuations of companies that make up the NSE 500 index are at a very high level. The price to book ratio in 2024-25 has been higher than at any point of time except in 2007-08 and 2006-07, when the stock market was in bubbly territory. This explains why what is good for an individual SIP investor isn’t really good at an aggregate level. The situation is similar to the Springsteen concert, where each row was better off standing but on the whole, it hurt. Further, these high prices are creating another problem.

Cost averaging

Cost averaging is the most important part of SIP-ing. It ensures that an investor continues to buy when stock prices fall and the higher number of MF units bought at these lower prices help once the stock prices recover.

Let’s say an investor SIPing ₹15,000 buys units of an equity MF at a price of ₹15 per unit in a particular period. Hence, 1,000 units are bought. In the next period the stock prices have fallen and the price per unit stands at ₹12. This helps the investor buy 1,250 units, with the total number of units now standing at 2,250. In the third period, the price rises back to ₹15, with the 2,250 units now being worth ₹33,750, higher than ₹30,000 that has been invested, even though the price per unit is only back at where it originally was. This is how cost averaging works.

But for cost averaging to work, the stock market has to be volatile. That is, it has to go up and go down and go up again, something that has stopped happening in the Indian stock market over the last few years.

Kind of investing

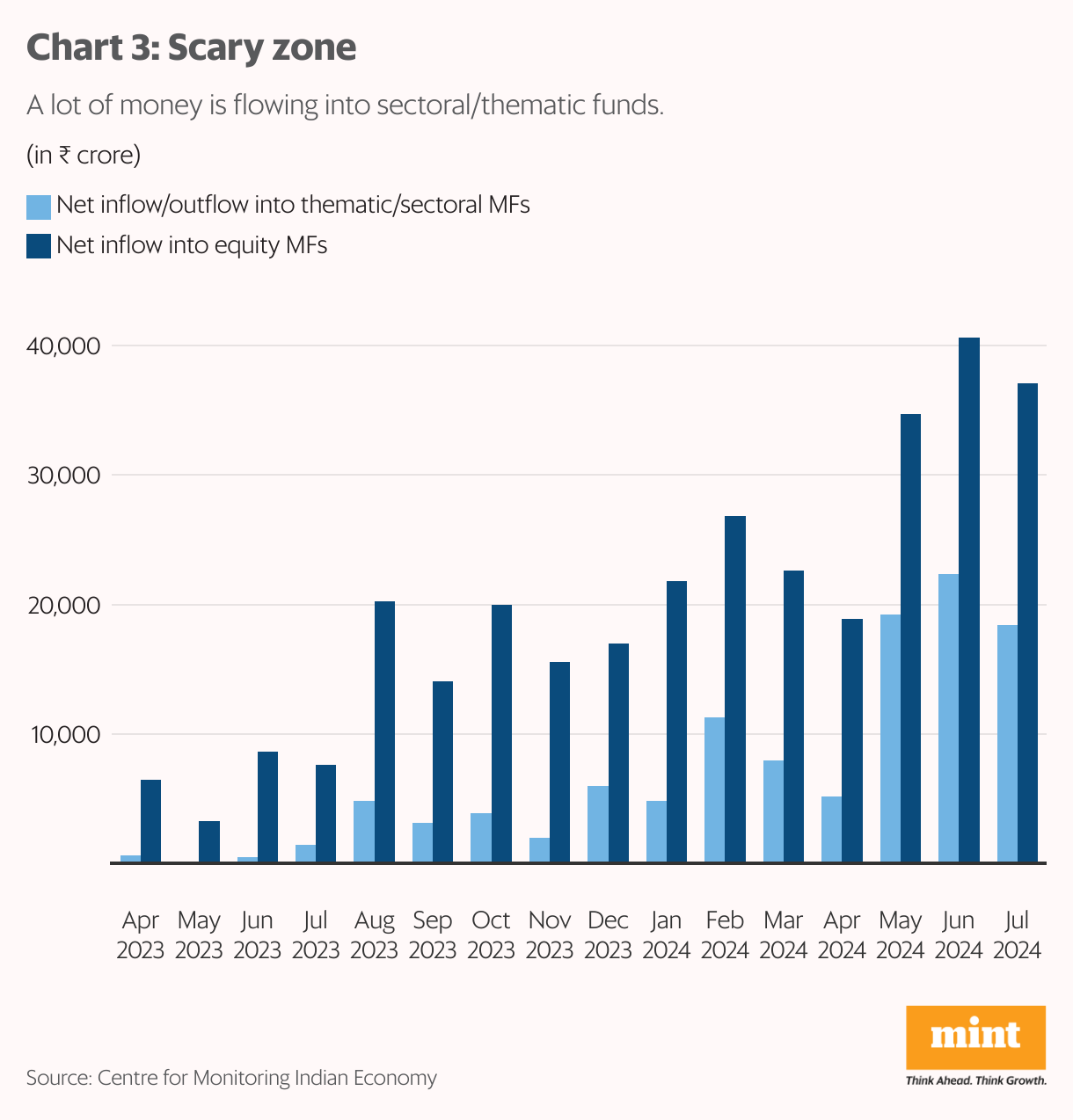

Also, what kind of equity MFs are the SIP investors actually investing in? Amfi does not provide that kind of detail. Nonetheless, some educated guesses can be made by looking at the net inflow of money into different kinds of equity MF schemes. This is the overall figure which includes money coming in through the SIP route and other routes, minus the redemptions being made. So, take a look at chart 3 which plots the net inflows into equity MFs on the whole and thematic/sectoral funds in particular.

We can see that inflows into equity MFs have gone up, and quite a bit of this money is coming into sectoral/thematic funds. From April 2023 to July 2024, a net inflow of ₹3.15 trillion has come into equity MFs. Of this, more than 35% or ₹1.11 trillion is the net inflow into thematic/sectoral funds. In 2024-25, half of the net inflows into equity MFs has been in sectoral/thematic MFs. These funds invest in stocks based on certain themes (business cycle, consumption, innovation, special opportunities, etc.) or in certain sectors (public sector units, defence, banking and so on).

Now, several insiders working with the asset management companies have been suggesting that a lot of investor money is flowing into frothy themes and sectors, where valuations are totally out of line with the prospect of future earnings, driving up prices further. Or as Neil Parikh, the CEO of PPFAS Mutual Fund tweeted in July: “The sheer number of [new schemes] launched, especially thematic funds, is a bit scary.”

View Full Image

So, the data shared above possibly hints at the fact that what’s happening in equity MFs on the whole, is also happening with SIPs, or that SIP investors in equity MFs may also be chasing these racy themes and sectors, and in the process buying stocks indirectly at very high prices.

To say this with absolute certainty will require more detailed data on the different kinds of equity MFs that SIP investors are investing in.

Further, what is interesting to see is that from April 2023 to July 2024, only ₹2,048 crore, or around 0.65% of the net investment in equity MFs, has been made in large cap equity MFs. Large-cap MFs invest in stocks that are ranked in the top 100 as measured by market capitalization. From a valuation point of view, such stocks are the most reasonably priced at this point of time.

Investors need to evaluate the types of equity MFs they are investing in. Is the bulk of the investment going into a sector which is already very frothy?

So, what should retail investors following the SIP route do? Should they stop their SIPs? No. Then?

There is a need to look at the types of equity MFs they are investing in. Is the bulk of the investment going into a sector which is already very frothy? Or is the investment going into a theme that has run out of steam? Or is the investment going into small-cap stocks which are extremely expensively priced? There is a need to sit down and figure this out.

Of course, above everything else, whether investments are adequately diversified—with money being invested across different asset classes, from stocks, directly and indirectly, to fixed deposits, gold etc.—also needs to be figured out.

Finally, the after-effect of the fallacy of composition at the Springsteen concert, of standing constantly for more than six and a half hours, was a day or two of feeling tired. Things won’t be as simple for those who have become victims of the fallacy of composition by investing in expensively-priced stocks through the SIP route. So, it’s important to course correct.

Vivek Kaul is the author of Bad Money