istock photo for BL

| Photo Credit:

iStockphoto

Investments in the highly popular and preferred retail vehicle of mutual funds have received strong traction in the post-Covid period. A notable aspect of this growth trajectory is that smaller cities and towns are seeing assets swell much faster than the established large locations over the past few years.

Relatively less prosperous States are now taking the lead in investing in market-linked schemes. For perspective, Uttar Pradesh has edged past Tamil Nadu in mutual fund assets, Rajasthan has gone past Telangana, and Madhya Pradesh is ahead of Kerala.

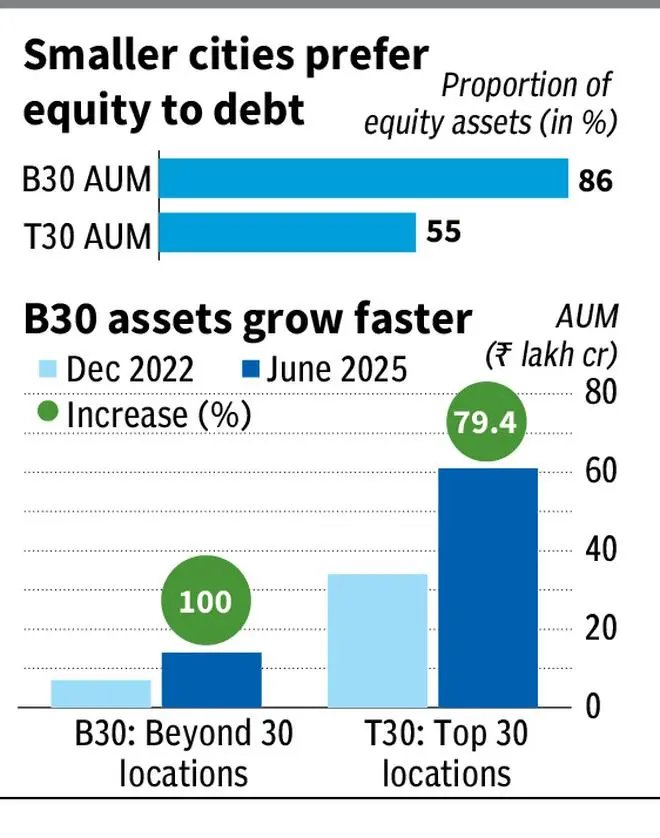

Of the nearly ₹75-lakh crore mutual fund assets, 18.5 per cent of the AUM (assets under management) or almost ₹14-lakh crore came from B30 (beyond top 30) cities as of June 2025, according to data from trade body AMFI. In the last five years, T30 (top 30 cities) assets grew at a CAGR of 23 per cent, while B30 AUM rose at 28 per cent compounded annually. The overall mutual fund AUM grew at a CAGR of 24 per cent in this period.

The smaller cities are also aggressively betting on equity funds in their investments.

Measures including increasing awareness of the SIP mode of investing even with small amounts, prevalence of digital applications for easy onboarding via direct and distributor modes, greater financial inclusion via banking access, have all aided the trend. The additional incentive structure for distributors gathering assets from B30 locations over the past several years has also contributed to increased penetration.

Hinterland primes up

Assets from T30 cities grew about 79.4 per cent in the last two and half years, while the AUM from B30 locations doubled over the same period.

States such as Uttar Pradesh and Rajasthan have grown at comfortably higher than 25 per cent compounded annually over the past five years (June 2020-June 2025). Even in the last one year, when index returns were negative, AUMs from these States rose well above 20 per cent. In contrast, Karnataka, Tamil Nadu and West Bengal saw their AUM growth slip well below 20 per cent in the last one year.

The numbers are showing. Uttar Pradesh with ₹3.51- lakh crore AUM in mutual funds edged past Tamil Nadu at ₹3.39-lakh crore, for example. Rajasthan has a higher mutual fund AUM at ₹1.44-lakh crore versus, say, Telangana’s ₹1.28-lakh crore. Madhya Pradesh, with ₹1.15-lakh crore is well ahead of Kerala’s ₹93,000 crore.

CAMS data for FY25 indicate that in the B30 segment cities and towns such as Wardha, Panchkula, Kochi, Jalandhar, and Mehsana saw a surge in new SIP registrations from FY23 levels, growing at 45-74 per cent.

In the table on States, we have excluded New Delhi and Maharashtra (with Mumbai) as these tend to account for almost half the country’s mutual fund assets.

equities preferred

States where many of these B30 cities are located have also tended to prefer equities much more than top cities do. Uttar Pradesh, Bihar, Rajasthan, Madhya Pradesh and Jharkhand, for example, have equity funds accounting for 83-90 per cent of their overall aAUM. Contrast this with Karnataka, Tamil Nadu, Haryana and Gujarat where the proportion of equity-oriented funds in the mix is 62-71 per cent.

The presence of institutions more in the T30 locations and their large holding of bond funds could partly explain the difference in the mix. Of course, since newer investors have tended to come in larger numbers from B30 locations, their starting point is likely to be in equities.

Overall, as much as 86 per cent of the AUM in B30 location comprises equity-oriented schemes, while the corresponding figure for T30 cities is 54 per cent as of June 2025, according to AMFI data.

Published on August 9, 2025