Last Updated:

SBI Large and Midcap Fund, started in 1993, offers a 32-year return of 13.33%. Managed by Saurabh Pant since 2016, its AUM is Rs. 28,681 crores as of January 2025.

Crorepati Mutual Fund SIP Return.

Crorepati Mutual Fund SIP Return: A systematic investment plan (SIP) is a disciplined investment strategy where you regularly invest in equity or debt markets. Mutual funds offer SIPs, allowing investors to invest at fixed intervals. Professional fund managers handle these investments, aiming to generate profits and distribute returns after deducting fees.

Crorepati Mutual Fund Scheme: SBI Large and Midcap Fund

A Strong Performer SBI Large and Midcap Fund is an excellent example of a SIP investment opportunity. Established in 1993, this open-ended equity scheme invests in both large and mid-cap stocks. As of February 28, 2023, the fund has completed 32 years with an impressive overall return of 13.33% since its inception.

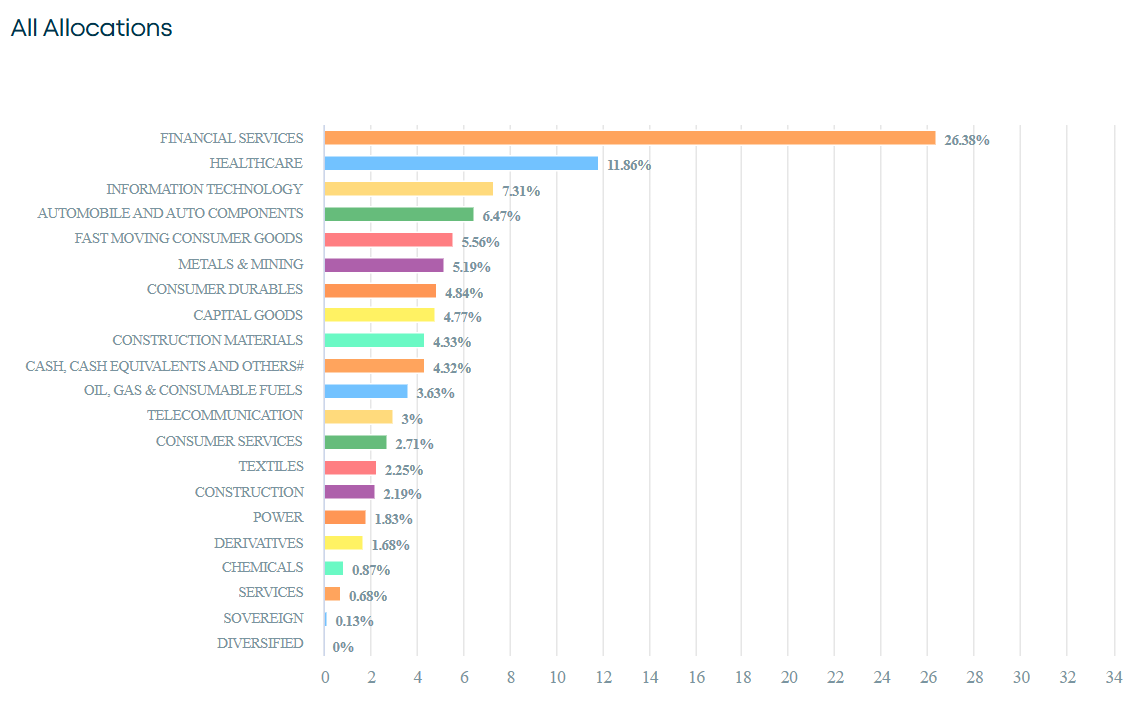

The fund invests in a mix of large and mid cap companies, ensuring a minimum of 35% exposure to each category. The fund managers use a combination of growth and value investing styles, along with a top-down and bottom-up approach to select the best stocks across various sectors. Up to 30% of the fund’s assets can be allocated to other equities, debt instruments, or money market instruments, providing further diversification.

SIP Of Rs 10,000 Since Inception Turns Rs 6.75 Cr Today

If a monthly SIP would have been made in the scheme of Rs. 10,000 since inception (Rs.36.2 lakhs invested), it would be worth over Rs. 6.75 crores today, delivering returns of 15.71%.

Similarly, the scheme has delivered returns of 15.6% (15 years), 15.57% (10 years), 18.44% (5 years) and 13.65% (3 years) vis-à-vis its benchmark Nifty Large Midcap 250 TRI returns of 15.65% (15 years), 16.04% (10 years), 18.32% (5 years) and 13.59% (3 years).

The AUM of the scheme stands at Rs. 28,681 crores as on 31th January 2025. The fund is being managed by Saurabh Pant since September 2016.

SBI Large & Midcap Fund: Top Holdings And Allocation

Disclaimer: The views and investment tips by experts in this News18.com report are their own and not those of the website or its management. Users are advised to check with certified experts before taking any investment decisions.