Diversification, being one of the fundamental tenets of investing, is often a top priority when investing in mutual funds.

The primary objective is to minimise the risk during volatile market conditions and earn better risk-adjusted returns in the long run.

However, does merely holding multiple mutual fund schemes guarantee effective diversification?

Many investors, in the endeavour to diversify often keep adding mutual fund schemes to their portfolio. At times, the schemes added are of similar management styles, mandates, and/or portfolio characteristics.

The decision to add the scheme is made because a next-door neighbour, friend, relative, or colleague suggested investing or because some fund house has launched a new scheme and distributor/agent recommended it for his/her personal gains.

The Indian mutual fund industry has been in a race to garner more Assets Under Management (AUM) by launching several New Fund Offers (NFOs). In CY 2024 alone, 428 New Fund Offers (NFOs) were introduced, and as of February 28, 2025, 95 more have been launched. Investors are often drawn to NFOs due to the Rs 10/- proposition and hoping that getting in early on would be a potentially lucrative investment.

However, many mutual fund houses too, build their product basket based on what investors are favouring rather than what would be a prudent choice for investors. For example, several fund houses launched Sector & Thematic Funds, Small Cap Funds, as well as Index Funds and Exchange Traded Funds (passive funds).

As a result, investors have ended up over-crowding or over-diversifying their portfolios. In certain cases, we have seen investors holding over 40-50 mutual fund schemes in their portfolio and, in many cases, there are overlapping holdings in terms of investment styles, market cap exposure and sectoral exposure.

While this may create an illusion of a well-diversified portfolio, in reality, this leads to mutual fund overlap, which is counter-productive to the objective of diversification and wealth creation.

What Is Mutual Fund Portfolio Overlap?

Mutual fund overlap refers to a situation of duplications of securities in the portfolio. It happens when you hold two or more schemes that are investing in similar securities.

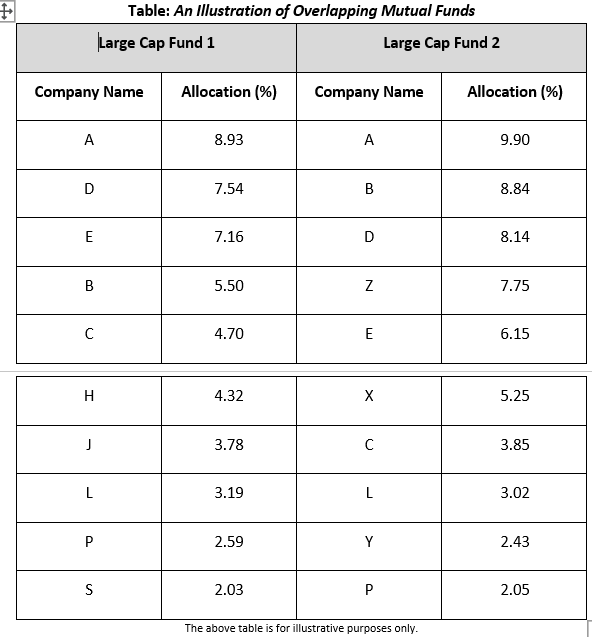

As you can see from the above illustration, the top 10 holdings of Large Cap Fund 1 and Large Cap Fund 2 have 7 stocks in common.

If you, the investor have both these funds in the portfolio, the high overlap defeats the purpose of diversification. It exposes your investment portfolio to concentration risk, leading to polarised returns skewed towards a few sets of stocks, sectors, market cap, or investment styles.

Overlapping funds not only make monitoring and portfolio review/rebalancing difficult but also results in fund management fees for similar type of funds, eating into your overall returns.

Similarly, it is also important to avoid concentrating your investments within a single fund house.

This is because holding more than two or more schemes from the same fund house exposes you, the investor to ‘fund house concentration risk’. Unless the schemes are very different or unique in their investment mandate, it wouldn’t add much value.

You see, beyond a certain point, every scheme added to your portfolio only occupies space without meaningfully lowering the risk or offering any extra benefit. Thus, consider adding a scheme to your portfolio only if it offers a unique investment mandate through its strategy and style.

“When it comes to investing, there is no such thing as a one-size-fits-all portfolio,” aptly states Barry Ritholtz, an American author, newspaper columnist, and equity analyst. Investing is essentially an individualistic exercise.

Hence, ideally, when you are building your portfolio, you need to evaluate your risk profile, broader investment objectives, the financial goals you plan to address, and the time horizon needed to achieve them, rather than invest randomly. It is important to ensure that the scheme aligns with your overall investment strategy and adds genuine value to your portfolio.

Avoid investing in any scheme simply because or next-door neighbour, friend, relative, colleague or agent is suggesting, or some NFO is launched, or for that matter, the respective category and sub-category of mutual funds have delivered better returns in the past. Keep in mind, that past returns are in no way indicative of future returns.

How to Check for Portfolio Overlap

There are several online tools available to check if there is a portfolio overlap of two or more mutual fund schemes.

You simply need to select the category and sub-category, then enter the scheme names to analyse the results.

These tools generally provide insights into the number of common stocks, the percentage of portfolio overlap, and the unique holdings in each fund. For a sound and practical comparison, assess funds within the same category and sub-category.

As an investor, you should keep in mind that a certain degree of portfolio overlap cannot be avoided. The high concentration risk arises when the overlap is remarkably high, such as 65% or more.

How to Optimise Your Portfolio to Avoid Mutual Fund Overlap

If you’re holding too many mutual fund schemes, here’s what you can do to declutter your portfolio:

- If you have multiple schemes within the same category, remove those that have consistently underperformed their benchmark and category average over the long term.

- Exit schemes that do not align with your financial goals and instead increase the overall risk of your portfolio.

- Avoid holding more than one or two schemes in the same category, as they tend to invest in a common set of stocks. For instance, Large Cap Funds may easily have 50%-70% portfolio overlap as they are mandated to invest at least 80% of their equities in the top 100 stocks in terms of market capitalisation. On the other hand, Small Cap Funds may have around 20%-30% overlap due to a wider stock universe.

- Minimise exposure to multiple schemes managed by the same fund house or fund manager, as they are likely to follow similar investment styles and strategies. Ideally, your portfolio should contain no more than 8 to 10 well-chosen schemes, diversified across different categories and sub-categories, each offering a unique investment proposition that aligns with your needs.

However, the portfolio cleanup exercise should account for the prevailing market conditions that may influence your decision to sell, the tax implications, and the exit load (if applicable).

In the current scenario, where valuations in small-caps (as well as mid-caps) still do not look cheap despite the correction and they could be vulnerable to downside risk, it would be worthwhile to be underweight on Small Cap Funds and reallocate the money to Large Cap Funds, Value Funds and/or Contra Funds. It would also be meaningful to hold a Multi Asset Allocation Fund in the portfolio now to benefit from tactical allocation to three key assets – equity, debt, and gold. Asset Allocation will play an important role in 2025 and beyond.

Note that even after the cleanup, regularly reviewing your portfolio is essential. Fund managers frequently adjust underlying portfolios, which can lead to changes in overlap levels.

Moreover, a regular evaluation would also help you assess the overall performance and the health of your portfolio, which is beneficial for your long-term financial well-being.

The Key benefits of a periodic portfolio review include…

- Helps replace underperforming mutual fund schemes with better alternatives

- Potentially improvement in the risk-adjusted returns of the portfolio

- Provides reassurance that you’re on track to achieve your envisioned financial goals

- Accounts for any changes in your cash flow or financial situation

- Resetting asset allocation within the limits best suited for you

- …and more!

To Conclude…

As the saying goes, “Too much of anything is good for nothing”. Adding too many mutual fund schemes to your portfolio leads to overlapping investments that increase concentration risks, dilute your returns, and make it challenging to monitor portfolio performance.

Legendary investor, Warren Buffett has famously quipped, “Wide diversification is only required when investors do not understand what they are doing.”

So, consider adding mutual fund schemes to your investment portfolio only if it offers a unique investment strategy/style and align with your overall financial goals. Review your portfolio at least once a year to weed out any underperforming scheme or rebalance it to suit your personal asset allocation plan.

Be thoughtful in your approach.

Happy investing!

This article first appeared on PersonalFN here.

Disclaimer: The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.