The Indian equity market peaked in late September 2024 with numerous stocks across the large-cap, mid-cap, and small-cap segments touching their lifetime highs.

However, since then the mood in the market has been sombre as headwinds such as rich valuations, earnings slowdown, global trade uncertainties, etc. weighed on investor sentiments. The BSE Sensex has tumbled 12.2%, BSE Midcap has dropped 18.6%, and BSE Smallcap index has plunged 20.5% from their respective peaks, as of February 21, 2025.

Equity mutual funds across categories too have faced the heat amid the sharp downswing in the market, resulting in declines in NAV in the range of 4-26%, based on 5-month returns.

It is noteworthy that Mid Cap Funds and Small Cap Funds have been the worst hit, while Large-cap oriented funds and funds with a value-biased approach have fared better. While several schemes across sub-categories of equity mutual funds have been struggling, a few managed to outperform not just their respective indices but also majority of their category peers.

In this article we have listed down 5 equity mutual funds that have displayed better resilience in the recent market turmoil, turning out to be top performers in their respective categories:

Parag Parikh Flexi Cap Fund

Launched in May 2013, Parag Parikh Flexi Cap Fund is a Flexi Cap Fund that adopts a value-centric approach to pick quality stocks having a significant margin of safety. It employs a buy-and-hold investment strategy to realise the full potential of its holdings.

In the last 5 months, Parag Parikh Flexi Cap Fund’s NAV has declined by 4.3%, much better than the Flexi Cap Fund category average decline of 14.9%.

As of January 31, 2025, Parag Parikh Flexi Cap Fund has allocated 61.5% of its assets in large caps, 2.6% in mid caps, 2.6% in small caps, 13.7% in overseas equities, 10% in debt instruments, and the balance in cash.

Its top stock holdings comprise HDFC Bank, Bajaj Holdings & Investment, Power Grid Corporation of India, Coal India, and ITC.

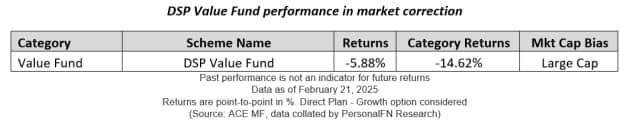

DSP Value Fund

Launched in December 2020, DSP Value Fund aims to invest in fundamentally sound domestic and international equities that are trading below their intrinsic value. For the final building of the portfolio, the fund uses a mix of quant filters to screen stocks with the involvement of the fund manager.

In the last 5 months, DSP Value Fund’s NAV has declined by 5.9%, much lower than the drop in Value Fund category average of 14.6%.

As of January 31, 2025, DSP Value Fund has allocated 44.3% of its assets in large caps, 6.5% in mid caps, 14.9% in small caps, 21.1% in overseas mutual fund units, 9.8% in overseas equities and ADRs & GDRs, and the balance in cash.

The fund frequently churns a portion of its portfolio and is currently bullish on HDFC Bank, Berkshire Hathway Inc, Infosys, L&T, and ITC.

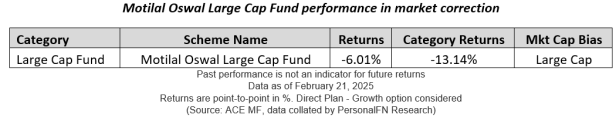

Motilal Oswal Large Cap Fund

Launched in February 2024, Motilal Oswal Large Cap Fund is one of the youngest schemes in the Large Cap Fund category. The fund aims to invest in a compact portfolio of around 40 quality stocks having reasonable growth potential and are available at a fair price.

In the last 5 months, Motilal Oswal Large Cap Fund’s NAV has declined by 6%, compared to a fall of 13.1% in the Large Cap Fund category average.

As of January 31, 2025, Motilal Oswal Large Cap Fund stayed fully invested in equities, allocating 87.5% of its assets in large caps, 3% in mid caps, 7.3% in small caps, and the balance in cash.

The fund has higher exposure in bluechips such as HDFC Bank, ICICI Bank, Reliance Industries, Infosys, and Bajaj Holdings & Investments.

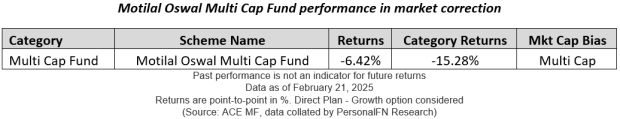

Motilal Oswal Multi Cap Fund

Launched in June 2024, Motilal Oswal Multi Cap Fund aims to maintain a well-balanced exposure across market caps, regardless of market conditions. The fund focuses on holding a high-conviction portfolio of around 35 stocks, emphasising companies with a strong competitive position or economic moat, good business prospects, and are run by a competent management.

In the last 5 months, Motilal Oswal Multi Cap Fund’s NAV has declined by 6.4%, compared to Multi Cap Fund category average returns of -15.3%.

As of January 31, 2025, Motilal Oswal Multi Cap Fund has allocated 24% of its assets in large caps, 28.4% in mid caps, 25.6% in small caps, with some exposure in Derivatives – Futures, and the balance in cash.

The fund’s top exposure is skewed towards Coforge, Polycab India, Trent, Shaily Engineering Plastics, and Persistent Systems.

HDFC Focused 30 Fund

Launched in September 2004, HDFC Focused 30 Fund aims to to invest in a portfolio consisting of 30 high-conviction stocks that have the potential to outperform the market over the medium to long term. The fund seeks attractive opportunities across various market caps and sectors, but maintains a large-cap bias.

In the last 5 months, HDFC Focused 30 Fund’s NAV has declined by 8.2%, compared to Focused Fund category average returns of -14.5%.

As of January 31, 2025, HDFC Focused 30 Fund has allocated 66.2% of its assets in large caps, 3.8% in mid caps, 13.9% in small caps, 3% in REITs & InvITs, and the balance in cash.

The fund’s top stock exposure is in ICICI Bank, HDFC Bank, Axis Bank, Maruti Suzuki India, and SBI Life Insurance Company.

To Conclude…

While the aforementioned schemes have delivered better returns, investors should note that a few months’ performance is not sufficient to give a fair idea of how it may perform in the future. Given the sharp volatility and correction in the equity market, investors should stick to their defined asset allocation plan based on their risk profile, financial goals, and investment horizon instead of chasing top-performing schemes of recent past.

Amidst the ongoing market correction, many stocks are now trading at reasonable valuations, allowing fund managers an opportunity to pick stocks with healthy long-term prospects. Therefore, investors can continue to allocate in equity mutual funds via SIP or by investing lump sum in a staggered manner with a long-term perspective.

Depending on their risk profiles, one may continue with large-cap, flexi-cap, hybrid, and value strategies. Mid-cap and small-cap strategies should only be considered by investors with a very high risk appetite.

This article first appeared on PersonalFN here.

Disclaimer: The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.