Amid market volatility, advisors are opting for active strategies and looking to providers for expertise, according to the latest Advisor Brandscape® report

LIVONIA, Mich., Aug. 20, 2025 (GLOBE NEWSWIRE) — Financial advisors are showing renewed conviction in the value of active management, directing an average of 57% of total assets to actively managed investments, with expectations to increase allocations to 60% in the coming months. That’s according to the latest findings from the 2025 Advisor Brandscape®, a Cogent Syndicated report from Escalent that tracks the attitudes and behaviors of financial advisors.

Invest in Gold

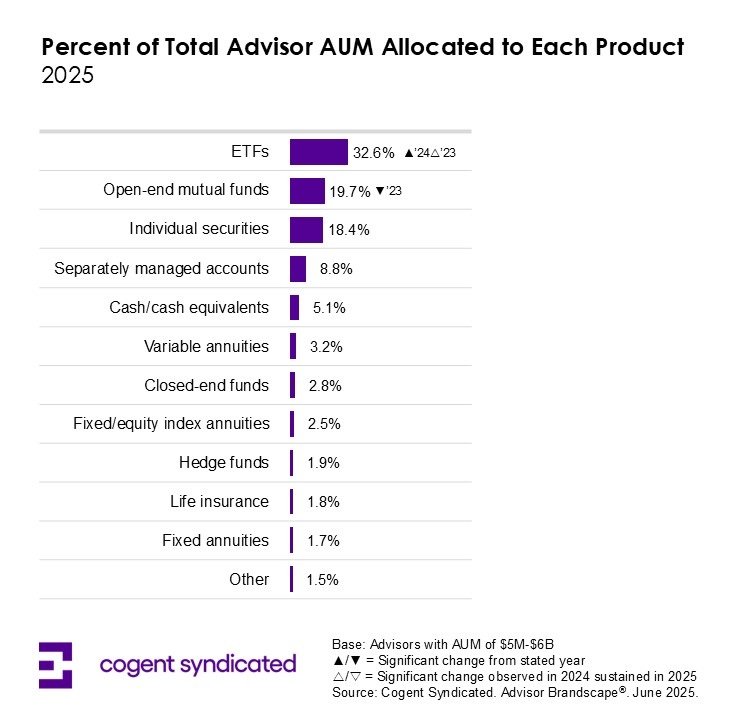

The movement toward active strategies is particularly evident in the rapid growth of exchange-traded funds (ETFs). This year, advisor allocations to ETFs rose to one-third (32.6%) of assets under management (AUM), up from 23.6% in 2023, while mutual fund allocations declined from 26.5% in 2023 to 19.7% this year. This trend is being fueled, in part, by the mounting demand for actively managed assets: average allocations to active ETFs reached 29% of ETF assets in 2025 (up from 25% in 2023), as the proportion of advisors using active ETFs increased to 80%.

“We’re seeing a notable shift in advisor sentiment, with heightened interest in actively managed investments, including US equities, US fixed income, and ETFs,” said Meredith Lloyd Rice, lead author and vice president in Escalent’s Cogent Syndicated division. “For years, mutual funds have led the way as ETFs slowly gained ground. Now, we’re seeing a sharp acceleration in active ETF allocations as advisors tout low costs, liquidity, transparency and access to a wider range of markets, sectors, and strategies.”

At the same time, the advisor profile is evolving. Continuing a trend first observed last year, advisors are spending more time acquiring and maintaining client relationships (up from 56% in 2023 to 59% this year) and less time on portfolio construction (down from 37% in 2023 to 33% this year). As client engagement takes precedence, advisors are embracing artificial intelligence (AI), with almost half (49%) using the technology in some capacity within their business. Reliance on home office models is also on the rise, with two-thirds (66%) of advisors reporting at least occasional use, reflecting the broader transition away from technical decision-making and toward a more relationship-driven approach.

This stronger emphasis on client engagement mirrors a growing appetite among advisors for expertise and guidance from asset managers. External wholesaler meetings remain the preferred way to interface with providers, followed by emails, phone calls, and websites. Among less traditional platforms, podcasts gained traction since last year, with advisors listening to and sharing content from leading asset manager podcasts with clients and peers.