When portfolios get unwieldy with too many holdings leading to diffused holdings that neither provide diversification nor insulate from falls, they become challenging to manage.

In the mutual funds context, focused schemes seek to achieve a compact portfolio with a limit of 30 stocks that ensure diversification and reasonable exposure to individual sectors or stocks. What makes it even better from an investment universe point of view is that these funds have a flexicap mandate.

The category was concieved in October 2017 and functionalised from 2018, when market regulator SEBI stipulated rigid mandates for various categories of mutual funds.

Though the category is only eight years old, many of the older mutual funds converted their existing schemes to the focused segment, while a few others started afresh.

Here we track the performance of the funds in the category over the past eight years as that’s when the SEBI mandate actually kicked in.

There are as many as 28 funds in the category with total assets under management of ₹1.75 lakh crore as of November 2025. As many as 16 funds have a track record of eight or more years and 14 have been around for more than 10 years.

Scoring on returns

As mentioned earlier, as the category came about only in 2018, we assess the performance from January 2018.

On a point to point basis, focused funds delivered 10.6 per cent to 17.5 per cent returns compounded annually from January 2018-January 2026. The benchmark Nifty 500 TRI gave 13.5 per cent returns in the same period.

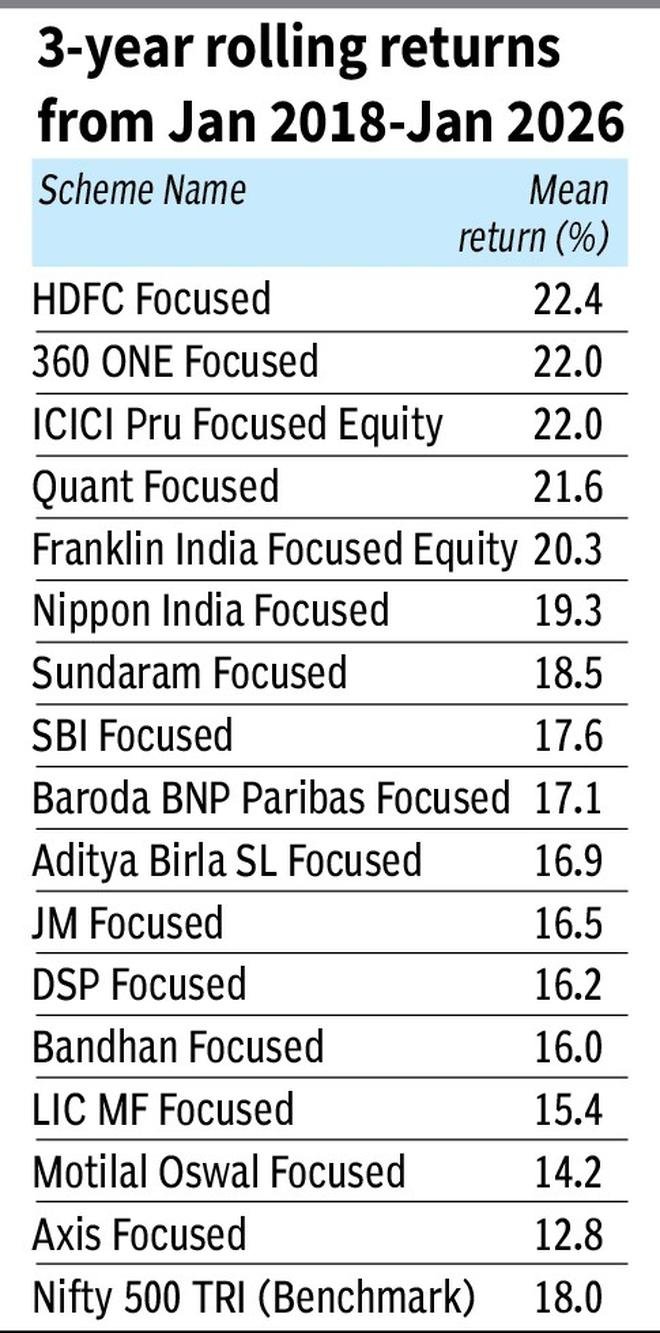

We considered 3-year rolling returns over the eight-year period of January 2018 to January 2026.

In the aforementioned rolling period and timeframe, the Nifty 500 TRI delivered 18 per cent return compounded annually.

Only seven of the 16 funds with a track record of eight or more years managed to surpass the Nifty 500 TRI’s returns.

HDFC, 360 One, ICICI Prudential, Quant and Franklin India’s focused funds were among the best performers with over 20 per cent returns delivered by these schemes.

The laggards included Axis, Motilal Oswal, LIC MF and Bandhan focused that gave 12.8 per cent to 16 per cent returns.

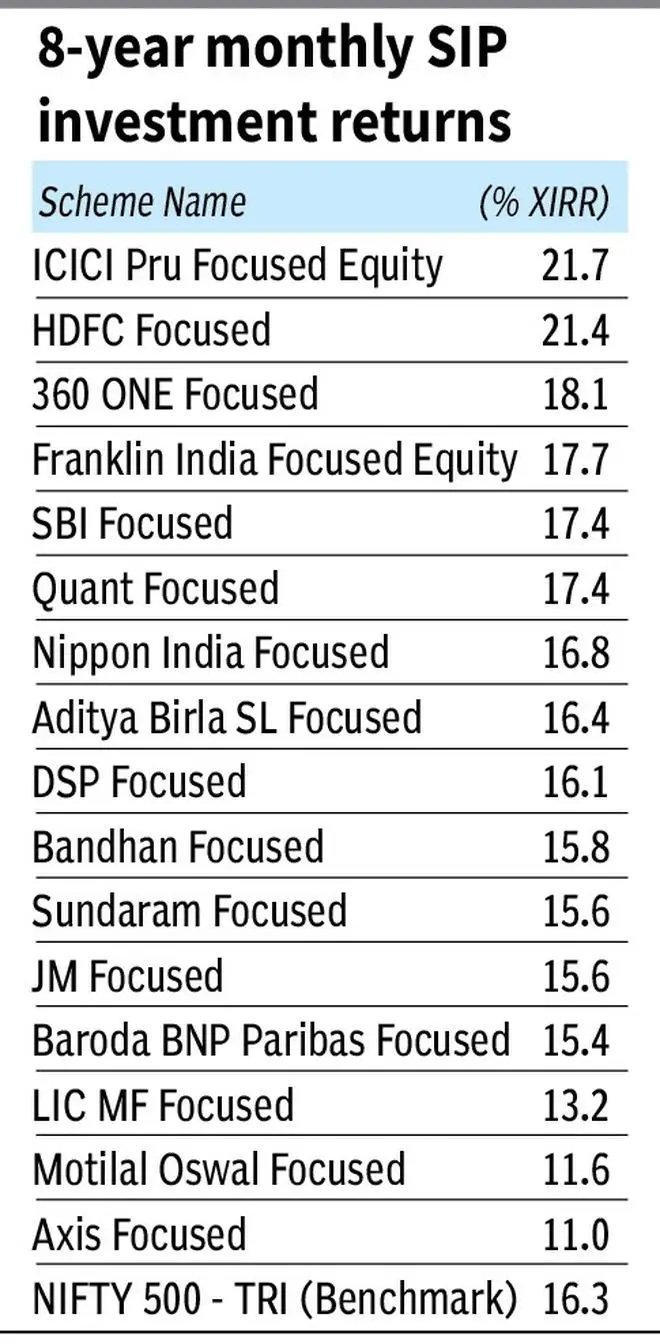

When SIP returns are considered for monthly instalments over the past eight years, the Nifty 500 TRI gave 16.3 per cent (XIRR).

Eight of the 16 funds managed to surpass the SIP returns delivered by the Nifty 500 TRI.

The same four funds mentioned earlier in the rolling returns part were also the toppers in terms of SIP returns as well, while the laggard list is also somewhat similar.

Among funds with a track record of five years, but less than eight years, Mahindra Manulife Focused, Kotak Focused and Invesco India Focused have been sturdy performers. These funds have given 18.9 per cent to 22.6 per cent over the past five years on a point-to-point basis and score in rolling basis as well.

The focused funds of HDFC, ICICI Prudential, Franklin India, Nippon India and Mahindra Manulife are the best schemes in the category. These funds lend themselves to long-term SIP investments, with HDFC’s and ICICI Prudential’s focused funds being the best.

Large-cap bias

Focused funds are allowed to take a flexicap approach in their portfolio construction.

However, focused funds have mostly tended to be heavy on large-cap exposure. The average large-cap holdings in focused funds stood at over 62 per cent as of November 2025, up from sub 60 per cent levels seen a year ago.

Large-caps have been the first to witness a revival after the market fall in the past 12-15 months and also continue to have valuation comfort.

Not surprisingly, the best performing funds had higher allocations to large-caps going beyond 70-75 per cent. These funds used mid/small-caps more sparingly as a kicker to returns than making them the core of their portfolios.

Given the steep correction in mid-caps and even more so in the small-caps in the last 18 months, those funds that had exposure of 30-50 per cent to small-caps suffered steeper cuts in returns.

Funds that took greater exposure to banks and automobiles have managed to deliver better returns given the reasonable showing of these segments.

Betting in sectors such as chemicals, agri products and consumer products have been a drag in fund returns, more so as these segments find greater representation in the beaten mid/small-cap spaces.

One interesting aspect is that SBI Focused also has exposure to international stocks to the tune of over 13 per cent of its portfolio, though the scheme has been a lukewarm performer.

Published on January 3, 2026