Many others like Chowdhury have been stewarding a silent, overt crusade to support this economically vulnerable segment—maids, cooks, drivers, nannies—who help in the smooth running of households, but remain bereft of financial safety nets. The National Sample Survey Office (2011-12) has pegged the number of domestic workers in India at 3.9 million, with 2.6 million women, while the International Labour Organisation estimates this number to be much higher at around 20-80 million.

This unorganised and marginalised sector has had few financial rights or economic security, with little or no long-term savings and funds to educate their children or retire in old age, no health insurance for medical needs or life insurance, and meagre knowledge about investing avenues. Women helpers are in a worse situation, many of them working as single mothers and sole bread winners.

While several government schemes, including those for life and health insurance, pension, affordable housing, etc., have been launched in the past few years to improve the financial security for this segment, not many domestic workers are aware of or know how to benefit from these (see table). “There are thousands of welfare schemes that they don’t know about. This is why, be it schemes or investing, it’s important to first educate the households and employers, who can then help their domestic helpers,” says Roopa Venkatkrishnan, Director, Sapient Wealth, a Mumbai-based financial advisory and distribution firm. Venkatkrishnan has been walking the talk since 2004 by holding financial literacy sessions for both the households and domestic staffers.

Going a step further is Bengaluru-based Haqdarshak (https://haqdarshak.com), a for-profit social enterprise, which helps low-income segments access government welfare schemes. It claims a digital database of over 7,500 state and central welfare programs—health and life insurance, disability pension, education subsidies, housing subsidies, among others—and offers a ‘Yojana Card’ that can tell the worker about the schemes he is eligible for. It could help your helpers if you can inform them about it.

Apprising them of the government welfare schemes is not the only way you can help your domestic staffers. They need assistance on every front: identifying saving and investing options for their kids’ education and medical needs, tech-enablement, budgeting advice, career guidance, and saving up for their old age.

“You don’t necessarily need to become their financial adviser, but guidance in navigating the formal financial systems, hand-holding and helping them with forms or digital onboarding, explaining terms, or demonstrating digital tools can also lead to a tremendous improvement in their financial stability and well-being,” says Atul Shinghal, Founder and CEO, Scripbox.

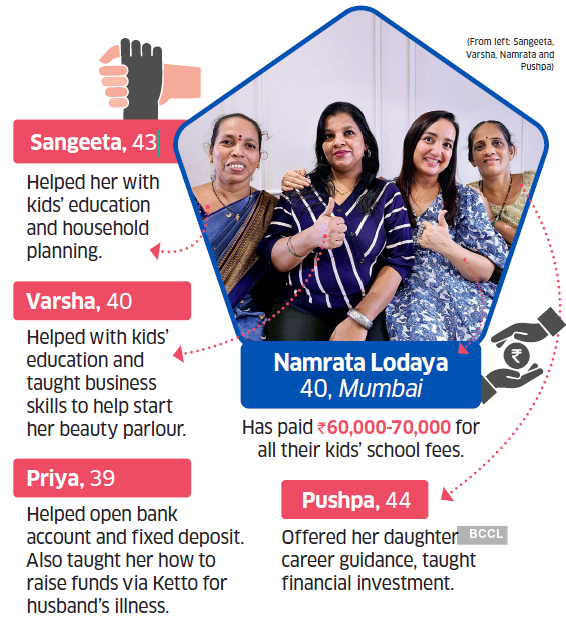

Mumbai-based Namrata Vishal Lodaya knows about hand-holding, having helped all her three maids and two cooks with financial advice on career, investment, entrepreneurship, savings and much more. “I taught business skills to Varsha tai to help open her beauty parlour and offered Pushpa tai’s daughter career guidance in fashion designing,” says the 40-year-old.

Here are some areas you can also help the people who make a critical contribution in ensuring that your lives run smoothly.

Savings & investments

As a first step, if your helpers don’t have a bank account yet, help them open one under the Pradhan Mantri Jan Dhan Yojana. There is no minimum balance to be maintained and account holders get a RuPay debit card. They also get a Rs.2 lakh accident insurance with RuPay card, an overdraft facility up to Rs.10,000, and eligibility for various government schemes with the account.

Rashida, 40

Chawla pays an annual premium of Rs.12,617 for a Rs.4 lakh family floater health plan for Rashida and her two children.

Shikha Chawla (right)

42, Noida

Next, prompt them into investing their money instead of keeping it in bank. You could start them on simple instruments that are easy to understand, such as a recurring deposit, fixed deposit, Post Office term deposit or even the Public Provident Fund (PPF) (see table). For women, a good option is the Mahila Samman Savings Certificate, and for their girl children, the Sukanya Samriddhi Yojana, both of which offer high interest rates.

While Lodaya helped her maid, Priya, 39, open a bank account and fixed deposit, Chowdhury went a step ahead. She started a recurring deposit and Sukanya Samriddhi account by contributing Rs.10,000 for each account for her maid, Ram Dulari, and her daughter, in 2012. She also took other helpers to the post office to invest in Kisan Vikas Patra (KVP) and National Savings Certificates (NSC). “I always felt they should save more by investing in instruments that offer a higher interest rate, instead of keeping the money in bank,” says the Delhibased IT professional.

Investment options for your domestic helpers

Venkatkrishnan even advocates mutual fund SIPs for long-term savings and high returns. “I tell them that they can invest in mutual funds with as low a sum as Rs.100 or Rs.500 and get high returns over the long term,” she says.

“Another important thing is to tell them to keep away from chit funds and move to formal investing options like FDs. Insurance companies have also made deep inroads and sell plans pitching high returns, but they need to move to better forms of investing,” says Mrin Agarwal, Founder, Finsafe India. Agrees Venkatkrishnan: “People lose money through Ponzi schemes, insurance plans and chit funds and should know about it.”

Buying insurance

Another financial pitfall for this segment is medical and hospitalisation expenses. “Most families with limited means try to secure food, shelter and education, but forget about emergency health fund. During an illness, they are forced to look around, desperate for help from employers, friends, anyone,” says Noida-based Communication Consultant Shikha Chawla. She bought a family floater health insurance plan worth Rs.4 lakh for Rashida and her two children in 2018. She continues to pay the annual premium of Rs.12,617 even though Rashida no longer works for them.

A good option is the government scheme, Ayushman Bharat or the Pradhan Mantri Jan Arogya Yojana, which offers a Rs.5 lakh cover per family for secondary and tertiary care hospitalisation. “I also tell them and their employers to register with hospitals with their ration cards so that they can get free treatment,” says Venkatkrishnan.

For life insurance, you can help them buy the Pradhan Mantri Jeevan Jyoti Bima Yojana as it can secure their children in case of the helpers’ untimely death. For 18-50 age group with a bank account, it offers a life cover of Rs.2 lakh and the annual premium is `436, which is auto-debited from the bank account. The scheme is offered by the Life Insurance Corporation and other life insurers that provide it on similar terms.

Financial & tech literacy

One of the most important contributions you can make in your helpers’ lives is by teaching them the basics of finance and making them tech-literate. “Guide them in using UPI apps like Google Pay or PhonePe. This drastically simplifies transactions, bill payments and transfers, reducing reliance on cash,” says Shinghal.

Also teach them about basic concepts like household budgeting, long-term investments, covering risk through insurance, taking loans, or even starting their own small businesses. Help them with documen-tation and online access to welfare schemes. Lodaya has mastered the art of leading by example when it comes to upskilling her helpers. “I talk to them about how I manage my finances or use technology and then they follow suit. For instance, when I needed to raise funds for my husband’s medical expenses, I used Ketto, and when Priya ben’s husband fell ill later, she managed to raise Rs.55,000-60,000 by doing the same,” says Lodaya.

Pension & loans

While saving for retirement may seem difficult for helpers trying to survive from month to month , the government Atal Pension Yojana is a good vehicle that is open to all savings bank/post office savings bank account holders in the 18-40 age group. It offers a guaranteed minimum monthly pension of Rs.1,000-5,000 to the subscriber after 60 years, and after him to his spouse.

When it comes to taking loans, try and desist your helpers from taking informal, unsecured loans with high interest rates. Steer them towards formal bank loans. “I tell the employers to give their helpers salaries via cheques, so that they can show income and file their tax returns. This is because with three years of returns they can avail of home loans easily,” says Venkatkrishnan.

If loans are not feasible for them, help them out with personal contributions, say, for their children’s education, weddings, etc.