Jio Financial Services has had a fast start in its journey as a standalone listed company. In the June 2025 quarter, consolidated income rose 48 per cent year on year to Rs 619 crore, while net profit held steady at Rs 325 crore.

Beneath these headline numbers, the scale-up has been striking.

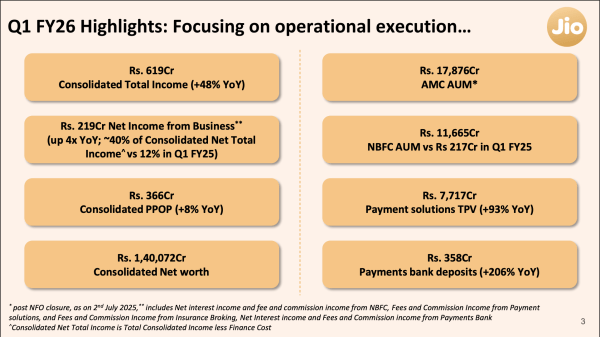

The lending arm has expanded its assets under management to Rs 11,665 crore from Rs 217 crore a year ago. Jio Payments Bank has grown its deposits threefold to Rs 358 crore and tripled its customer base to 2.6 million. The new asset management joint venture with BlackRock collected over Rs 17,800 crore in its first fund offering, making it one of the largest launches in India’s mutual fund industry.

These figures show the company is executing aggressively across multiple businesses at once. Yet, the stock price has not matched the pace of expansion, staying largely range-bound since listing.

Investors appear to be weighing the strength of the Reliance ecosystem, digital reach, and capital base of Rs 1.4 lakh crore against the realities of rising expenses, a competitive marketplace, and the challenge of turning scale into sustainable profits.

This raises the question of whether Jio Financial is an investment worth exploring at this stage.

Figure 1: Company’s Business Verticals Snapshot. Source: Q1FY26 Report

Figure 1: Company’s Business Verticals Snapshot. Source: Q1FY26 Report

Business performance: Building scale across verticals

Jio Financial Services is not limiting itself to a single line of lending or one stream of fee income. Instead, it is building a broad platform covering loans, payments, investments, and protection.

Lending: Rapid expansion of assets

The most visible progress has been in the lending arm, Jio Credit Limited. In just one year, assets under management expanded from Rs 217 crore in Q1 FY25 to Rs 11,665 crore in Q1 FY26. The growth has been driven by secured loans such as home loans, loans against property, and loans against securities.

Story continues below this ad

The company has also tapped corporate borrowers for working capital and vendor financing. Importantly, the lending subsidiary has been assigned a “AAA” credit rating, which has allowed it to raise debt at competitive rates.

During the quarter, it raised about Rs 2,500 crore through non-convertible debentures and commercial papers. The low cost of funds, combined with the backing of Reliance, has helped Jio Credit scale at a pace that few new NBFCs achieve.

Payments: Growing user base and deposits

On the payments side, both Jio Payments Bank and Jio Payment Solutions are showing traction. Jio Payments Bank now has 2.58 million customers, compared with 0.96 million a year ago. Deposits have increased to Rs 358 crore from Rs 117 crore in Q1 FY25. The network of business correspondents has expanded from just 2,299 in Q1 FY25 to over 50,000 in Q1 FY26, improving reach in semi-urban and rural areas.

The payments solutions arm handled transaction processing worth Rs 7,717 crore in the quarter, almost double the level a year earlier. These figures show that the company is not just adding accounts but also encouraging more active usage.

Story continues below this ad

Asset management: A strong beginning

The joint venture with BlackRock has provided Jio with a large-scale entry into asset management. The maiden new fund offering raised Rs 17,876 crore across debt schemes, placing the AMC among the top 15 in India by debt AUM in its very first quarter of operation.

Participation came from over 90 institutional investors and 67,000 individuals. The company has also received approvals for multiple index funds, including large-cap, mid-cap, small-cap, and government bond products. The mutual fund business has therefore started with a scale that usually takes incumbents years to achieve.

Insurance and broking: Early days

The insurance broking business continues to expand its range of plans, with more than 65 direct-to-customer offerings available. This arm is at an early stage and will take time to build meaningful volumes. Similarly, the broking and wealth management ventures under the Jio BlackRock banner have only recently received regulatory approvals and will launch in the coming quarters.

Margins and profitability: Growth meets cost pressure

The Q1 FY26 numbers highlight how Jio Financial Services is managing the balance between expansion and profitability. The company is growing its business income strongly, but expenses are also climbing as newer ventures scale up.

Story continues below this ad

Income mix is shifting

Consolidated total income stood at Rs 619 crore in Q1 FY26, up 48 per cent from Rs 418 crore in the same quarter last year. Importantly, income from active business operations formed about 40 per cent of the total, compared with just 12 per cent a year earlier.

This shift shows that JFSL is moving away from relying largely on treasury income and is beginning to generate a larger share from lending, payments, and fees. Net interest income rose to Rs 264 crore, a 52 per cent increase, supported by growth in the loan book. Fees and commission income from payments and insurance broking stood at Rs 53 crore, up from Rs 38 crore in Q1 FY25.

Profitability remains steady

Profit after tax came in at Rs 325 crore, up slightly from Rs 313 crore last year. Pre-provision operating profit was Rs 366 crore, an 8 per cent year-on-year increase. These numbers show that even as the company invests heavily in expansion, it has managed to keep the overall business profitable. The ability to sustain net profit while building multiple verticals is unusual for a financial institution at such an early stage of its life.

Expenses are rising

The other side of the picture is the rising cost base. Total expenses, including finance costs and provisions, jumped to about Rs 261 crore in Q1 FY26 from Rs 79 crore a year ago. Staff costs increased to Rs 64 crore, reflecting new hiring, and operating expenses rose to Rs 90 crore as the company built out its technology and distribution.

Story continues below this ad

Finance costs were Rs 99 crore, up from almost negligible levels a year ago, because the lending arm has now started borrowing from the market to fund loan growth. These increases mean that while revenues are scaling quickly, profit growth is much more modest.

Cash flow and capital strength

Collections and liquidity remain healthy. The company’s net worth as of June 2025 stood at around Rs 1.4 lakh crore, which provides a large cushion for future growth. The NBFC subsidiary also has a strong capital adequacy ratio of 38 per cent, well above regulatory requirements. This capital strength supports both growth and investor confidence, even as operating costs rise.

Valuation and investor perspective: Promise vs proof

Jio Financial Services is not being valued like a regular finance company. The stock trades more like a consumer-tech story than an NBFC. At a market cap of about Rs 2 lakh crore, investors are already giving it a premium because of three things: the strength of the Reliance name, the ready customer base that Jio offers, and the chance to play across lending, payments, investments, and insurance.

Why investors are excited

The big picture looks promising. The lending arm has built a loan book of over Rs 11,000 crore in just one year. The new mutual fund joint venture has already collected Rs 17,800 crore, which puts it among the bigger fund houses from day one. Deposits in the payments bank have more than tripled in a year, showing that customers are warming up to the brand. If Jio can keep this momentum, it will have multiple revenue engines running together – loans generating steady interest income, mutual funds adding fee income, and payments and insurance building their own streams. That would make today’s valuation look more reasonable over time.

Story continues below this ad

The challenges

The challenge is that the stock price has already priced in a lot of this optimism. Expenses are rising fast as the company hires, expands its network, and invests in technology. Profits are growing only in single digits, even though revenue is rising much faster. If growth slows in any of the verticals, whether loans, mutual funds, or payments, the market could start to question whether the premium is justified. Competition is also heavy, with banks, NBFCs, fintechs, and established mutual funds fighting for the same customer.

The way investors see it

Right now, the share price has stayed in a narrow range. Investors seem to be waiting for proof that high growth in bookings and deposits will consistently turn into higher profits. The case for upside is clear if Jio delivers on execution. But the risk is also clear if momentum slips. For long-term investors, Jio Financial is a bold play on how India’s financial system is shifting towards digital platforms. For short-term traders, it may still feel like a waiting game.

Note: This article relies on data from annual and industry reports. We have used our assumptions for forecasting.

Parth Parikh has over a decade of experience in finance and research and currently heads the growth and content vertical at Finsire. He holds an FRM Charter and an MBA in Finance from Narsee Monjee Institute of Management Studies.

Story continues below this ad

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.