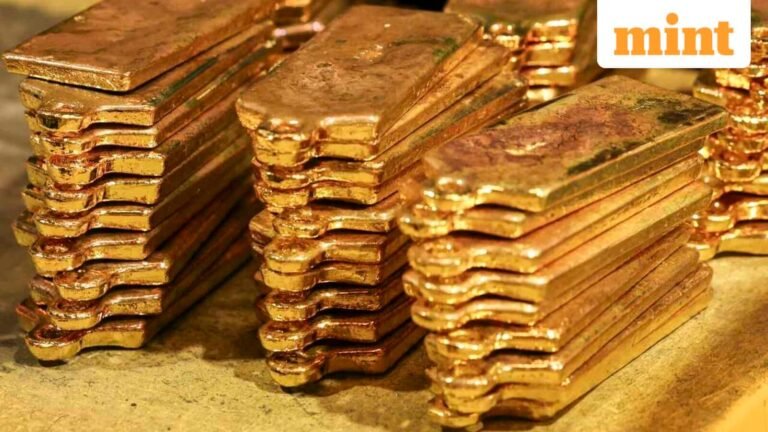

Gold prices in the country have surged to record highs in 2025. This has been fuelled by gold’s global demand due to the unprecedented economic uncertainty and geopolitical tensions resulting from the Russia-Ukraine war, Trump’s tariff complications, and other factors such as the Israel-Palestinian dispute. These factors have collectively created a grave environment of trade uncertainty.

As of 30 September 2025, 24-carat gold has reached new heights. Currently, the price of 10 grams of 24K gold in Delhi is ₹1,20,205. Gold has given a return of 51.33% over the last 12 months. This epic rise has resulted in increased investor interest in gold. This has made gold-related investment decisions even more crucial than ever for aspiring investors.

That is why clearly understanding the fundamental differences between Gold ETFs, physical gold, and gold mutual funds can help investors make the best possible investment decisions for themselves. These features and differences are briefly discussed below:

Note: The differences and features discussed above are intended to be illustrative in nature. Demat and brokerage charges may vary with the provider. Taxation on these assets is subject to government regulations. Carefully verify facts, data and conditions before making any investment decisions.

Gold’s historic rally in 2025 necessitates going ahead with an investment aligned with individual risk appetite and comfort. Physical gold continues to offer investors emotional value and legacy. Gold ETFs and mutual funds offer tech-savvy investors cost-efficient, easy-to-manage, transparent, and flexible digital investment opportunities for creating modern portfolios.

Still, given the recent rally in gold, it is best not to rush in with investments in this particular asset class. The decision between investing in Gold ETFs, physical gold, and gold mutual funds comes down to one’s risk tolerance, future financial goals, and economic aspirations.

Furthermore, it is advisable to sit down with a certified investment advisor and develop a well-thought-out investment and asset allocation plan before making any investments. Such an approach can go a long way in helping not only with wealth creation but also with wealth preservation.

Disclaimer: This article is for informational purposes only and should not be considered financial advice or a recommendation to buy or sell any financial products. Investments in gold and related instruments involve market risks, and past performance does not guarantee future results. Readers are advised to conduct their own research and consult a certified financial advisor before making any investment decisions.