CLASH OF IDENTITY

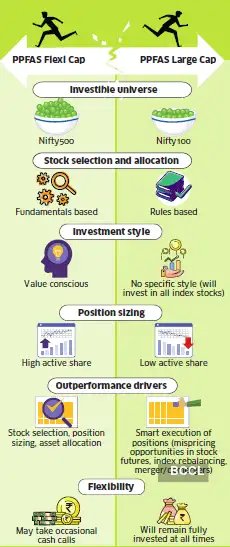

How the new fund will differ from the existing strategy.

The elusive holy grail

PPFAS Mutual Fund has earned its stripes running India’s largest equity fund—the Rs.1.25 trillion Parag Parikh Flexi Cap Fund—with a distinct approach. It adopts the ‘Swiss army knife’ philosophy, plying a highly adaptive ‘go-anywhere’ approach that allows it to invest across market caps, geographies and occasionally sit on piles of cash. Its unique style and proven execution has often put it comfortably above peers over entire market cycles. All this time, the fund house has doggedly run a single equity offering, with a firm resolve not to introduce look-alike funds. It will only introduce a new fund if it believes it can materially differentiate itself from others. The fund house now believes it has found its niche in the large-cap category, where outperformance has often proved elusive for many.

For this foray, the fund house plans to deviate sharply from the strategy that powers its flagship. Instead of a fundamentals-led, value-conscious approach, its largecap offering will run a rules-based, index-centric portfolio. It will deliberately run a low active share, investing in the same constituents as the Nifty100 index, but weighted differently. It plans to outsmart the index not via superior stock picking, but smart execution of positions. This includes tapping opportunities arising out of mispricing in index and stock futures, merger or demerger events as well as index rebalancing.

WHO THE FUND IS FOR

This fund is for investors who:

- Seek broad diversification

- Want index-like return

- Prefer to avoid risk of underperforming significantly

- Want low expense ratio

WHO THE FUND IS NOT FOR

The fund is not meant for investors who:

- Prefer concentrated bets on select stocks and sectors

- Want active stock selection based on fundamentals

- Expect the fund manager to avoid overvalued pockets

- Seek significant outperformance over the index

For instance, the fund may use futures to buy the stock when at a discount to the cash market, to create exposure at a better price. When a company in the index is merging with another firm, the fund may buy the stock at a discount to the merger ratio. The fund will further seek to move in and out of positions ahead of planned rebalancing in individual stocks of the index.

Essentially, this active large-cap fund will consciously run an index-hugging portfolio. Yet, it will not simply mirror the index either. It will do things which an index fund cannot. The genesis of the idea comes from inherent shortcomings of index funds. Rajeev Thakkar, CIO, PPFAS Mutual Fund, pointedly observed in a recent PPFAS MF unit-holders meet, “Many people complain that active fund managers underperform the benchmark. What they don’t talk about is that almost all passive funds underperform the benchmark.” He further pointed out how index funds are easily taken advantage of by traders and arbitragers who buy and sell ahead of them as the index rebalancing happens much later than the notification. “Index funds have their own limitations. The active mandate can take advantage of that inefficiency,” asserts PPFAS Mutual Fund’s Rukun Tarachandani, who will manage the new fund.

The fund clearly differentiates itself from any others in the large-cap space, treading a fine line between active and passive investing. “It will be index-based but will take actively managed calls rather than blindly following index,” indicates Deepak Chhabria, CEO, Axiom Financial Services. It is positioned for conservative investors who seek index-like returns. The fund will also keep expense ratio low at around 10-30 basis points, in line with passive offerings. It is not geared for investors who crave sharp outperformance, high conviction, concentrated bets based on fundamentals or a value-driven approach. Mahesh Mirpuri, Founder, InvestMutual, says, “The fund house possibly recognises that there are a lot of takers for index funds and the universe for active large-cap funds is far restrictive. They have opted for a passive-plus offering that differentiates itself from anything else in this segment.”

Pedigree to performance

Given the pedigree of the fund house, pulling off such a differentiated strategy may be achievable, many experts suggest. Kirtan Shah, Founder & CEO, Truvanta Wealth, maintains, “The fund house is not taking a very risky bet. The intent is purely to outsmart lazy investors with minimal efforts.” Mirpuri asserts, “The fund house had become too big to run only one equity fund. A second fund was needed, and they have come with a distinct positioning that may do better than any index fund.”

Even so, some recommend that investors wait for the fund to build a track record. It remains to be seen if the fund house can execute the strategies consistently. “Outperforming in the large-cap space is easier said than done, irrespective of their existing track record. Only time will tell if they can execute consistently,” Chhabria remarks. Some of the mispricing opportunities the fund intends to capitalise on (index rebalancing, mergers, demergers) are likely to occur only intermittently. This leaves a very narrow window for the fund to generate excess return. Some point to a contradiction with the fund house’s existing offering. The mostly large-cap biased PPFAS Flexi Cap is now a bulky fund managing Rs.1.25 trillion in assets. This fund has persistently held high cash positions in excess of 20%, ostensibly owing to lack of investible opportunities, even amid the recent bout of market correction. Meanwhile, the fund house is inviting investors in a pure large-cap fund that will remain fully invested at all times. However, the fund manager insists the two offerings are for distinct set of investors. “The flexicap fund remains for investors seeking differentiated active bets, including holding cash if necessary. The large-cap fund is for another set of investors who don’t want the fund manager to take that call and will do the asset allocation in their own portfolio,” insists Tarachandani.