Despite often being overshadowed by equity investments, debt investments are equally essential for building a well-balanced portfolio. Instead of considering debt mutual funds merely as temporary parking ground, investors can use them to build long-term portfolios. Debt funds offer lower return volatility than most other asset classes. During market downturns, high-quality debt funds often retain or gain value, offsetting equity losses and enhancing portfolio resilience.

In India, debt mutual funds are available in 16 categories, alongside target maturity-oriented passive funds, catering to investors with varying risk appetites, investment horizons, and yield expectations. Overnight, liquid, ultra-short-duration, and low-duration funds primarily use an accrual strategy for interest income. Gilt funds, dynamic bond funds, and various duration-based funds adopt a duration strategy to benefit from interest rate fluctuations. Meanwhile, short-duration funds, corporate bond funds, and banking & PSU funds integrate both approaches.

Certain debt fund categories are particularly well-suited for long-term portfolios. These include:

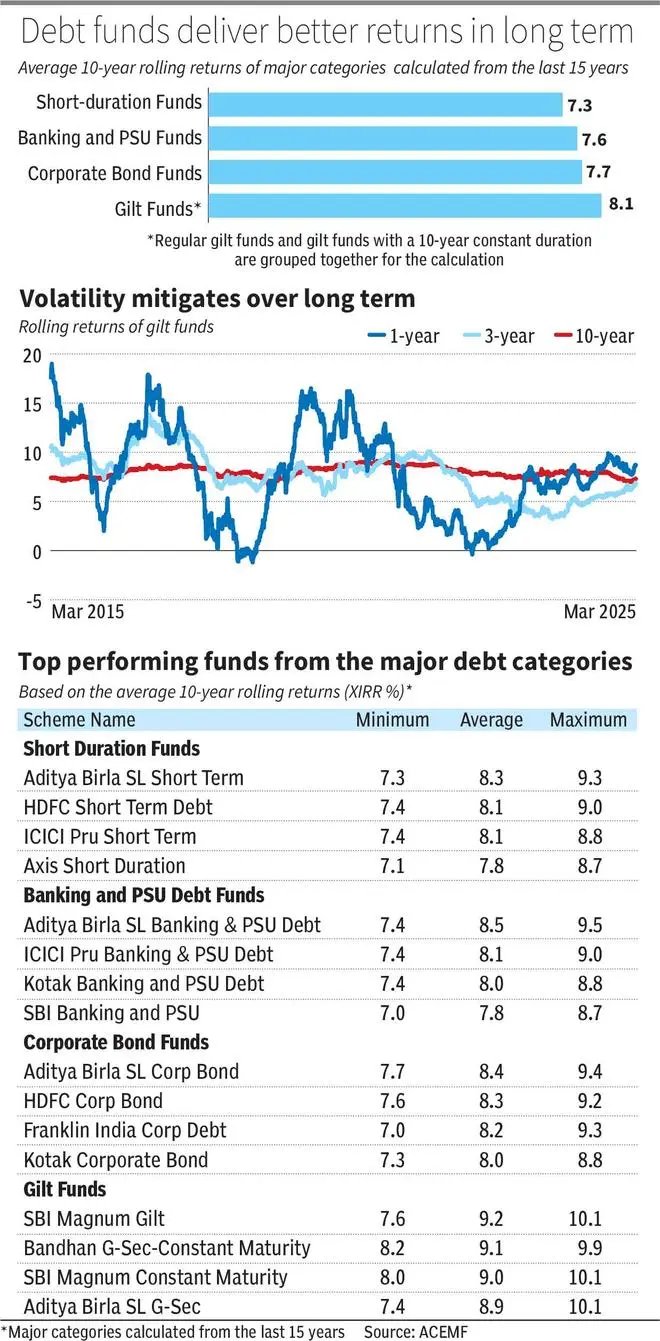

Short-duration Funds: These funds provide a balance between liquidity and returns while maintaining moderate sensitivity to interest rate changes. These funds are required to invest in debt instruments, maintaining a Macaulay duration between one and three years. In a rising rate environment, it enables quicker portfolio adjustments and reinvestment at higher yields. The performance, based on data from the past 15 years, assessed using a 10-year rolling return, indicates that short-duration funds achieved an average annualised return of 7.3 per cent, while the gilt funds category recorded 8.1 per cent.

Corporate Bond Funds: Investing at least 80 per cent in high-quality corporate debt instruments (predominantly AAA and AA rated), these funds provide higher yields than government securities while maintaining reasonable risk profiles. Long-term investors benefit from the compounding effect of these enhanced yields, which can deliver better returns over extended investment horizons. A 10-year rolling return over the past 15 years shows corporate bond funds averaged a 7.7 per cent annualised return.

Banking and PSU Funds: These funds invest predominantly in debt securities issued by banks and public sector undertakings, offering enhanced safety profile with minimal credit risk, yields typically 50-75 basis points above government securities. Banking and PSU funds represent a middle ground between the safety of government securities and the yields of corporate bond funds, making them ideal for conservative long-term investors. The category posted a 7.6 per cent annualised return based on a 10-year rolling analysis over the past 15 years.

Gilt Funds: Investing exclusively in government securities, gilt funds eliminate credit risk as they are backed by sovereign guarantees. However, investors must be mindful of their exposure to interest rate fluctuations. Within the gilt categories, gilt funds with a 10-year constant duration maintain a consistent interest rate risk by targeting bonds with approximately 10 years of remaining maturity.

The minimum, average, and maximum 10-year returns of funds in the overall gilt category, as calculated from the last 15 years of data, were 5.5 per cent, 8.1 per cent, and 10.4 per cent, respectively.

The accompanying table demonstrates that while these funds may experience short-term volatility, they tend to provide relatively stable returns over the long term.

Target Maturity Funds: Target maturity funds (TMF) are passively managed and invest in bonds with fixed maturity dates, reducing interest rate risks when held until maturity. They primarily hold government securities, State Development Loans (SDLs), and PSU bonds. Their predictable return profile makes them suitable for goal-based investments such as retirement planning. Moreover, their index-based structure typically results in lower expense ratios than actively managed alternatives.

Allocation strategies

As investors approach their financial goals or retirement, gradually shifting a higher percentage into debt funds can help reduce risk, safeguard investments, and maintain stability.

Investing in debt mutual funds through SIP (Systematic Investment Plan) can be a preferred option for the salaried investors. SIPs average out purchase costs during interest rate fluctuations, potentially improving overall returns through rupee-cost averaging.

Long-term investments in debt mutual funds not only lower overall portfolio volatility but also provide steady, balanced returns. For optimal fund selection, investors can also consider debt funds rated four or five stars in bl.portfolio Star Track Mutual Fund Ratings.

Published on April 5, 2025