Many parents invest in mutual funds on the children’s behalf. But once the child turns 18 – going from minor to major – there’s some paperwork required to ensure these investments can continue without a hitch.

Here’s how it works.

Beat the freeze

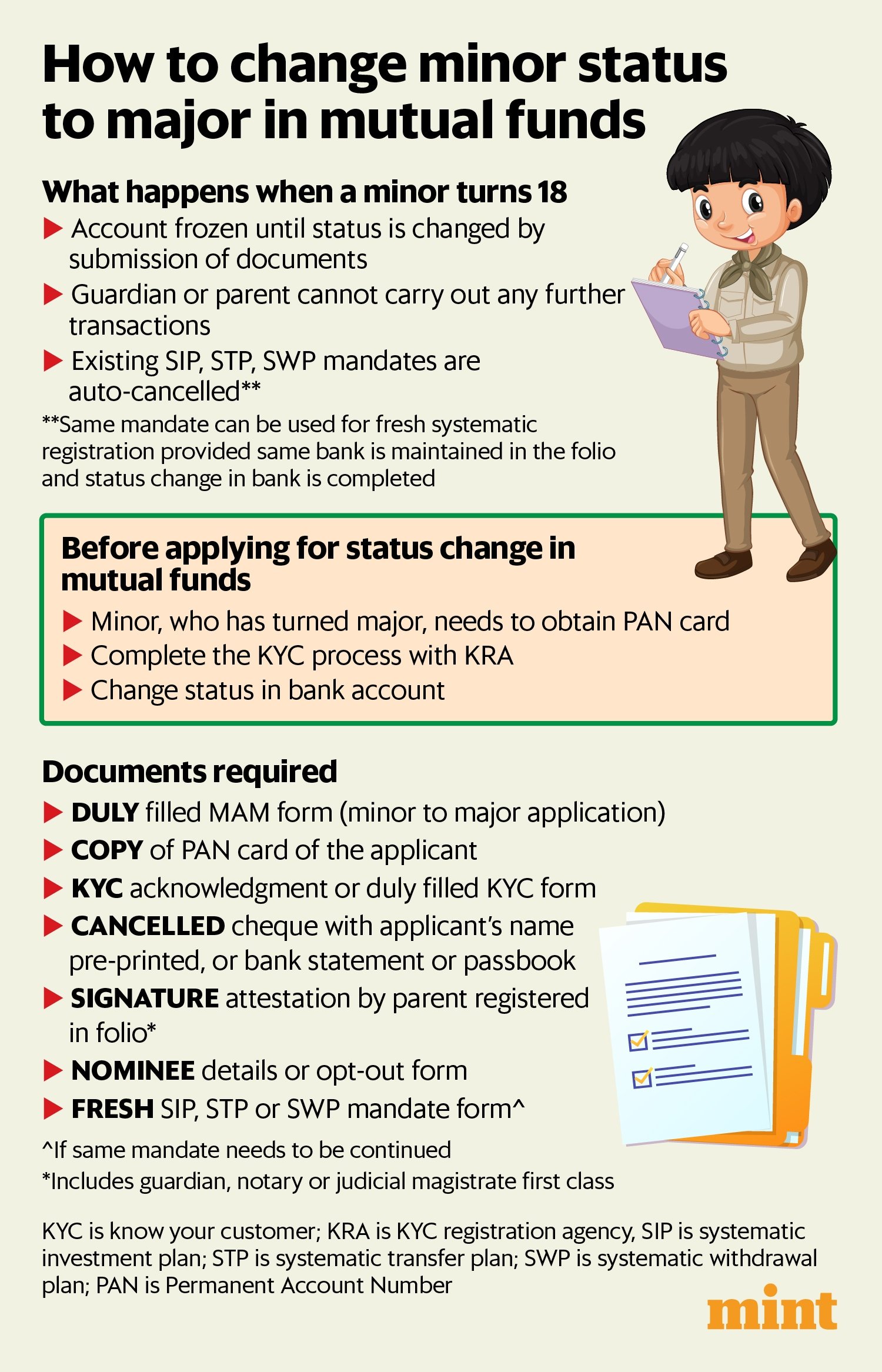

Under Sebi’s rules, when a child turns 18, the parent or guardian can no longer make transactions on their behalf. These include systematic investment plans (SIPs), systematic transfer plans (STPs), and systematic withdrawal plans (SWPs) that were already set up. These mandates are automatically cancelled until the required paperwork is completed.

Also read: When one stock rules your portfolio—and risks it all

The same mandates can be used to register fresh systematic plans, but only if same bank is maintained in the folio and the status change from minor to major is completed at the bank. The minor in whose name the investment was made is required to provide all know you customer (KYC) details and updated bank account details, including a cancelled cheque of the new account.

View Full Image

What you need for the status change

Before applying for a change of status from minor to major, the minor-turned-major must first to apply for and obtain a Permanent Account Number (PAN).

Also read: How real estate helps Vijay Kedia invest in stocks

Next, the KYC process needs to be completed with a KYC registration agency (KRA). The applicant also needs to change his or her status from minor to major at the bank.

Documents required

Once this is done, the applicant needs fill in and submit a minor to major application (MAM) form and submit a copy of their PAN card.

They also need to submit a KYC acknowledgement from the KRA or a filled-in KYC form, a cancelled cheque with their name pre-printed, or a bank statement or passbook.

Their signature must be attested by the parent or guardian registered in the folio, or a notary or judicial magistrate first class.

The applicant must also submit nomination details or opt out of this. To continue with the same SIP mandate as before, a fresh mandate form must be filled in and submitted.

Also read: Why that fund of funds may turn out to be costlier than you think