Currently, there are 37 closed-end mutual funds listed on the Dhaka Stock Exchange (DSE), but only three of these funds are trading above their face value of Tk10

Infographics: TBS

“>

Infographics: TBS

In recent years, closed-end mutual funds traded on the country’s stock market have failed to meet investors’ expectations due to consistently poor returns.

This has been reflected in their unit prices, which often trade significantly below their face value.

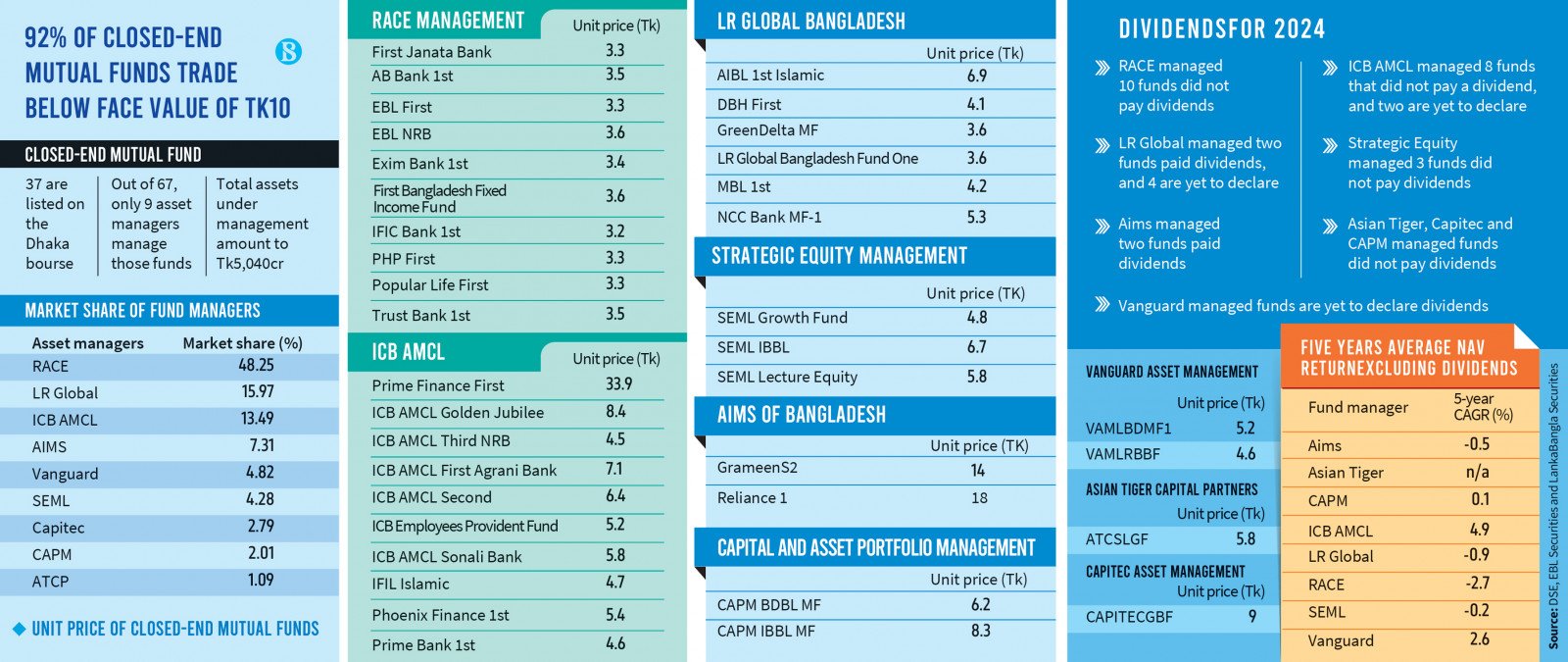

Currently, there are 37 closed-end mutual funds listed on the Dhaka Stock Exchange (DSE), but only three of these funds are trading above their face value of Tk10.

Analysts have noted that most fund units are trading at discounts of up to 70% from their net asset value (NAV). However, this situation has a silver lining: when these funds are liquidated after their tenure, investors could potentially realise significant returns compared to their initial cost price.

They further explained that funds consistently providing dividends tend to have their unit prices trading above face value, indicating that investors are interested in holding these funds regardless of their market prices.

The three exceptional funds trading above face value are Grameen One: Scheme 2 and Reliance One, both managed by AIMS of Bangladesh, along with Prime Finance First Mutual Fund, which is managed by ICB AMCL. These funds have consistently paid dividends, contributing to their performance in the market.

A senior analyst at a fund management company stated that the two main reasons behind the failure of the country’s mutual funds are largely the poor policy decisions of the regulatory authority, the Bangladesh Securities and Exchange Commission (BSEC), and the inefficiency and greed of asset management companies.

Generally, a mutual fund is traded within plus or minus 10% of the NAV value. Currently, however, closed-end mutual funds are being traded at around 70% lower than their net asset value.

What does this mean? It indicates that nobody trusts them. No unitholder or investor has faith in the asset management companies. Investors lack confidence in both their skills and their honesty, he added.

He further explained that another significant reason for investors’ indifference to mutual funds is that they do not know when they will get their money back. The tenure of a closed-end mutual fund is 10 years, and investors are supposed to receive their money back after the liquidation of the mutual fund.

However, many asset management companies have extended the tenure by another 10 years through lobbying the BSEC. Then why would people invest in mutual funds? Closed-end funds are not supposed to operate indefinitely, he said.

Fund managers’ performance

Out of 67 asset managers, nine are responsible for managing closed-end mutual funds. Among these, only four funds posted profits in the last fiscal year, while the remaining funds incurred losses and were unable to pay dividends.

RACE Asset Management leads the closed-end mutual fund industry with a 48.25% market share, managing a total of 10 closed-end mutual funds, which are currently trading below face value. Moreover, these funds experienced losses in the last fiscal year, resulting in their failure to pay dividends to their unitholders.

Hasan Taher Imam, managing director of RACE Asset Management, told The Business Standard earlier that RACE-managed funds had paid Tk522 crore in dividends over the past three years. However, in FY24, they were unable to generate sufficient profit to declare dividends.

Chowdhury Nafeez Sarafat holds around a 25% stake in RACE and currently serves as a director of the company. Both Nafeez and Hasan Taher have been accused of violating regulations and using investors’ funds for their own interests.

Meanwhile, in June of this year, the Bangladesh Financial Intelligence Unit (BFIU) instructed all scheduled banks in the country to freeze banking transactions involving 12 mutual funds managed by RACE. The BSEC also blocked the beneficiary owner (BO) accounts of these funds.

Hasan Taher addressed the allegations of embezzlement and money laundering against him, stating, “My name is coming up in various allegations because of Nafeez. I have no other activities outside of RACE. Moreover, no truth has been found in the allegations made against me.”

On 7 October, a Dhaka court imposed a travel ban on Chowdhury Nafeez Sarafat. Nafeez is linked to another asset manager, Strategic Equity Management, which operates three closed-end mutual funds, all of which incurred losses and were unable to pay dividends.

LR Global Bangladesh, the second-largest fund manager, oversees six funds with a total value of approximately Tk1,000 crore. Out of these, two funds declared dividends for the last fiscal year.

In 2019, unitholders wanted to change LR Global for two mutual funds – DBH Mutual Fund and Green Delta Mutual Fund – over allegations of irregularities against the asset manager.

Investors in the two funds have recently voiced concerns about the asset manager’s decision to invest their money in a less profitable media venture. They also questioned the transparency of the investment process. However, in the end, the two funds did not leave LR Global’s management.

Furthermore, according to the BSEC, LR Global is also putting investors’ funds at risk by investing in a delisted company named BD Quest.

ICB Asset Management Company, a subsidiary of the state-owned Investment Corporation of Bangladesh (ICB), manages 10 mutual funds. Among these, eight funds did not distribute dividends, while the remaining two have yet to declare any dividends.

Asian Tiger, Capitec Asset Management, and Capital and Asset Portfolio Management have failed to maintain investors’ interest. Analysts suggest that investors are increasingly turning to open-end mutual funds due to the poor performance of closed-end mutual funds.

Open-end funds offer the advantage of allowing investors to withdraw their investment at any time by liquidating the fund. In contrast, closed-end funds do not provide the option for liquidation before their expiration, making them less appealing in the current market environment.