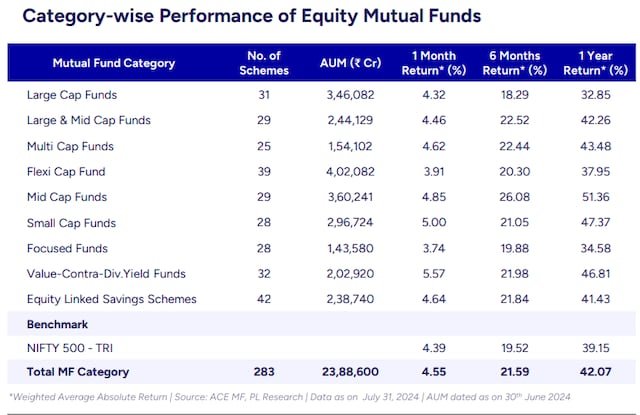

Equity mutual funds have delivered stellar returns in the last one year despite facing volatility in the short term. According to a study by PL Capital, the wealth arm of Prabhudas Liladhar, the overall equity mutual fund category generated a commendable 42% return in the last year. Mid and Small Cap funds emerged as the top performers, delivering returns of 51.36% and 47.37% respectively, over the past year. These categories have consistently outpaced the broader market.

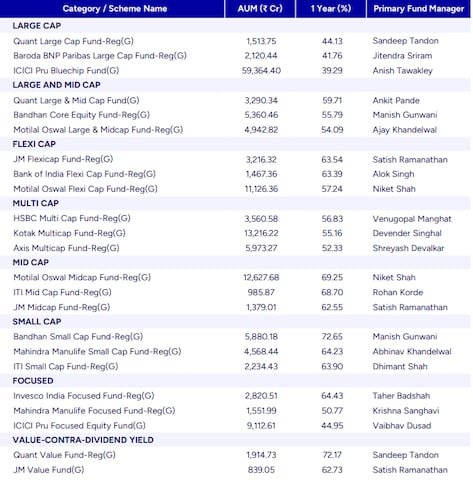

Here are the top performing mutual funds in the last one year

Large cap funds continued to be a favorite among investors, with several schemes delivering outstanding returns. Large Cap Funds invest predominantly in large cap stocks. The schemes need to invest 80% -100% of

the portfolio in large cap stocks, as defined by Sebi.

Quant Large Cap Fund topped the charts with a 44.13% return, followed closely by Baroda BNP Paribas Large Cap Fund at 41.76%.

Top Mutual Funds: 1 Year Returns

Mid and Small Cap Brilliance

Motilal Oswal Midcap Fund took the lead with a staggering 69.25% return, showcasing the potential of this category. Mid cap funds, which primarily invest in mid-sized companies, generated a one-year return of 51.36%, significantly outperforming the benchmark index by 3.99%. This highlights the potential of mid-sized companies to drive growth and create wealth for investors.

However, the performance of mid cap funds has been uneven in the short term. While 11 out of 29 funds managed to outperform the benchmark in the past month, the number of outperforming funds increased to 24 in the six-month period.

Small Cap Funds invest predominantly in small cap stocks. The funds invest a minimum of 65% of the assets in small cap stocks as defined by SEBI. Over the past year, small cap funds delivered a return of 47.37%, which while substantial, lagged the benchmark index by a significant margin of 16.53%. This underperformance highlights the volatility inherent in the small cap space.

Furthermore, the category has struggled to outperform the benchmark in both the one-month and six-month periods. Only two out of 24 funds managed to outperform the benchmark in the past year, underscoring the challenges faced by fund managers in this segment.

In the small cap space, Bandhan Small Cap Fund emerged as the top performer with a 72.65% return.

Flexi Cap and Multi Cap Flex

Flexi cap and multi cap funds, known for their flexibility in asset allocation, also delivered strong results. JM Flexicap Fund and HSBC Multi Cap Fund stood out with impressive returns of 63.54% and 56.83%, respectively.

Flexi Cap Funds invest across large cap, mid cap, small cap stocks as per SEBI guidelines. They maintain an exposure of 65%-100% to equity.

Over the past month, only 13 out of 39 flexi cap funds managed to outperform their benchmark. However, the performance improved over longer time periods, with 22 and 16 funds outperforming in the six-month and one-year periods, respectively.

The category as a whole has delivered returns of 3.91%, 20.30%, and 37.95% for the one-month, six-month, and one-year periods, respectively. While these returns are respectable, they lag behind the broader market, represented by the Nifty 500 Index, which delivered returns of 4.39%, 19.52%, and 39.15% over the corresponding periods.

Multi Cap Funds invest 25% in large cap, 25% in mid cap and 25% in small cap stocks as per SEBI guidelines. They are required to have a 75% equity exposure at all times. The rest of the 25% is at the Fund Manager’s discretion.

With a total asset under management (AUM) of Rs. 1,54,102 crore, the category has garnered significant investor interest.

Over the past one year, multi-cap funds delivered a return of 43.48%, surpassing the benchmark index by a margin of 1.71%.

While the category has shown strength over the longer term, it’s important to note that the one-month return of 4.62% marginally trailed the benchmark’s 4.59%.

Focused and Value Funds Shine

Focused funds, with their concentrated bets, and value funds, seeking undervalued stocks, have rewarded investors too. Quant Value Fund and Invesco India Focused Fund delivered exceptional returns of 72.17% and 64.43%, respectively.

Focused Funds invest in a limited the number of stocks (maximum 30), and need to invest a minimum 65% of its assets in equity, across market-caps. Over the past year, focused funds generated a return of 34.58%, trailing the benchmark index by 4.62%.

Value Funds follow a value / contrarian / dividend yield investment strategy and maintain minimum 65% investment to equity.

ELSS: A Tax-Saving Option with Rewards

Equity Linked Savings Schemes (ELSS) not only offer tax benefits but also generated substantial returns.

Leading the pack is Motilal Oswal ELSS Tax Saver Fund with a stellar 59.16% return, followed by SBI Long Term Equity Fund at 56.50%. While Bank of India ELSS Tax Saver also delivered a commendable 53.84% return.

These returns s surpass the broader market indices, including the Nifty 50, which gained 27.84%, and the Nifty 500, which rose by 39.15%.

Disclaimer: Past performance is not indicative of future results. Mutual fund investments are subject to market risks. Please read the scheme information document carefully before investing.