Mutual funds often come with more than just investment exposure; they carry hidden costs that can quietly erode long-term gains. While the average expense ratio for an actively managed fund hovers around 1%, some mutual funds charge exponentially more. In 2025, the most expensive funds on the market cost investors hundreds, or even over a thousand, dollars annually for every $10,000 invested. Knowing how to spot and avoid these high-fee funds is essential to preserving your returns.

Key Takeaways

- 1The most expensive mutual fund in 2025 charges an expense ratio of 13.94%, or $1,394 per year on a $10,000 investment.

- 2The average active U.S. equity fund charges 1.08%, while many passive funds cost under 0.10%.

- 3Hidden fees like 12b‑1 charges and sales loads further increase the true cost of ownership.

- 4Cost-conscious investors should consider index funds, ETFs, or robo-advisors as lower-cost alternatives.

Breaking Down Mutual Fund Fees: What You’re Really Paying

Expense Ratio: This is the percentage of your investment that’s deducted annually to cover management and operational costs.

- Average for active U.S. equity funds: 1.08%

- Typical for passive ETFs: 0.03% to 0.10%

What That Means in Dollars: To calculate your annual cost, multiply the expense ratio by your investment amount.

- Example: A 1% fee on $10,000 = $100 per year

Other Common Fees to Watch For

- 12b‑1 Fees: Marketing and distribution charges can be up to 1% annually

- Sales Loads:

- Front-end loads: Up to 5%–8%, charged when you buy shares

- Back-end loads (CDSC): Charged when you sell shares

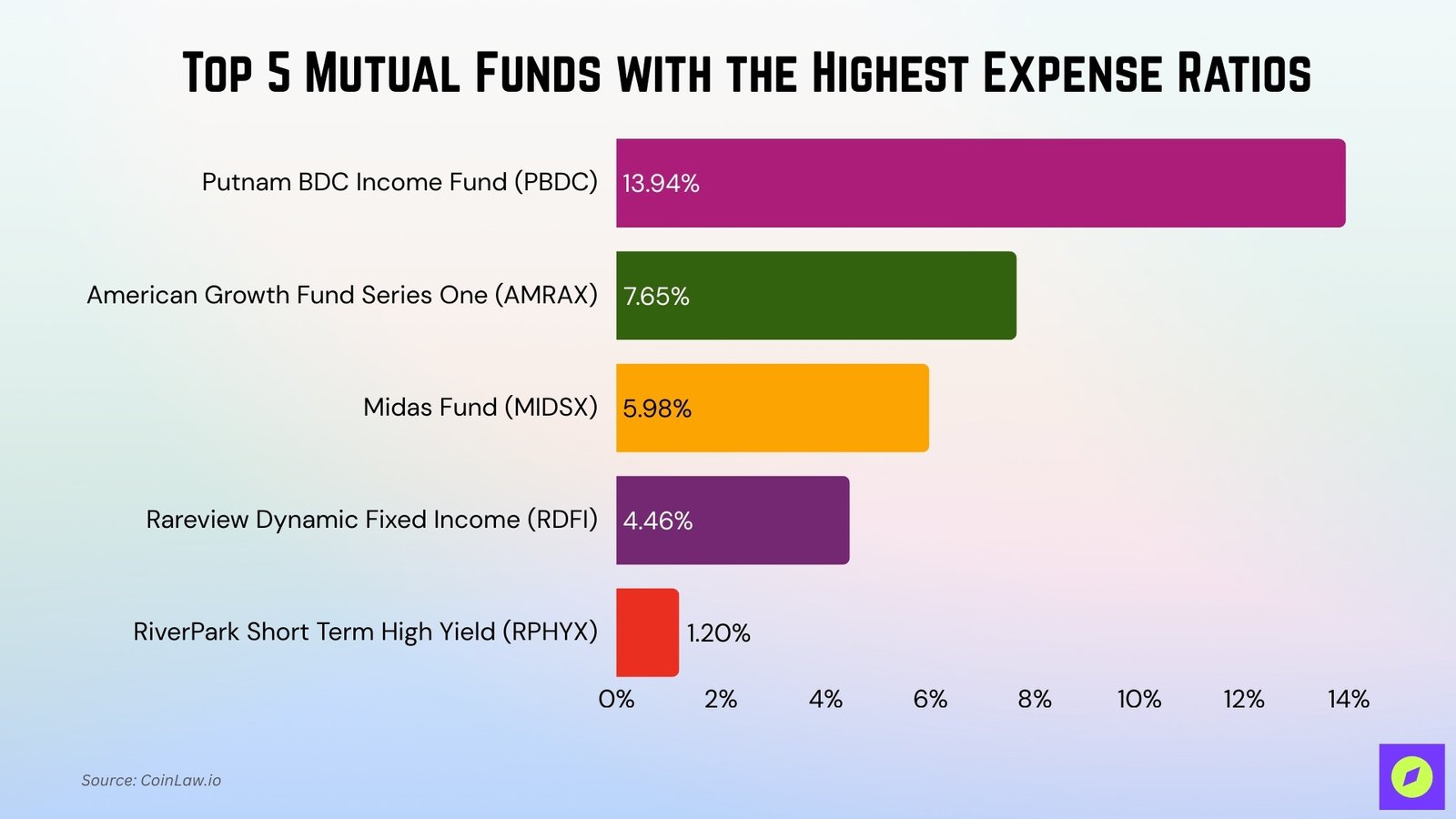

Top 5 Most Expensive Mutual Funds

Some mutual funds stand out not for their performance, but for the exceptionally high fees they charge investors year after year. These funds serve as examples of how costs can vary dramatically across the investment landscape and why careful due diligence matters.

| Rank | Fund Name | Expense Ratio | Annual Cost ($10K Investment) | Fund Type / Focus |

| 1 | Putnam BDC Income Fund (PBDC) | 13.94% | $1,394 | Business Development Companies |

| 2 | American Growth Fund Series One (AMRAX) | 7.65% | $765 | Aggressive Growth / Equity |

| 3 | Midas Fund (MIDSX) | 5.98% | $598 | Precious Metals / Gold |

| 4 | Rareview Dynamic Fixed Income (RDFI) | 4.46% | $446 | Tactical Fixed Income |

| 5 | RiverPark Short Term High Yield (RPHYX) | 1.20% | $120 | High-Yield / Short-Term Bonds |

1. Putnam BDC Income Fund (PBDC)

Putnam Investments is one of the oldest mutual fund managers in the U.S., known for its actively managed portfolios across asset classes. The firm emphasizes innovation and income-generating strategies, particularly in alternative and private markets.

- Expense Ratio: 13.94%

- Annual Cost on $10,000 Investment: $1,394

- Why It’s Expensive: PBDC invests in private, illiquid debt and equity deals, requiring hands-on active management and complex structuring.

- Key highlight:

With an annual fee exceeding $1,300, this fund must consistently deliver double-digit outperformance, an extremely rare feat.

2. American Growth Fund Series One (AMRAX)

Established in the late 1950s, American Growth Fund has built its legacy on long-term capital appreciation through equity investments. It operates under the umbrella of World Capital Brokerage, targeting retail investors seeking aggressive growth.

- Expense Ratio: 7.65%

- Annual Cost on $10,000 Investment: $765

- Why It’s Expensive: Loaded with both front-end and 12b‑1 fees, the fund’s operational inefficiencies and underperformance amplify its already steep costs.

- Key highlight: At $765 per year, AMRAX charges over 7 times the average fee of a typical equity fund, with little evidence of better returns.

3. Midas Fund (MIDSX)

Midas Funds specializes in precious metals and natural resources, offering investors targeted exposure to gold, silver, and mining-related equities. The company has a niche focus and positions itself as a strategic inflation hedge provider.

- Expense Ratio: 5.98%

- Annual Cost on $10,000 Investment: $598

- Why It’s Expensive: Frequent trading, commodity-specific research, and small fund size contribute to its hefty annual charges.

- Key highlight: You’ll pay $598 every year to stay invested, regardless of whether gold prices rise or fall.

4. Rareview Dynamic Fixed Income Fund (RDFI)

Rareview Capital is a boutique asset manager that delivers tactical, flexible investment strategies across the fixed income spectrum. It emphasizes macroeconomic awareness and adaptive allocation in managing risk and return.

- Expense Ratio: 4.46%

- Annual Cost on $10,000 Investment: $446

- Why It’s Expensive: The fund’s flexibility comes at a price, with high turnover and complex global bond allocation strategies.

- Key highlight: For fixed income exposure, $446 per year is nearly 9x more expensive than top bond index ETFs.

5. RiverPark Short Term High Yield Fund (RPHYX)

RiverPark Funds is a New York-based investment management firm known for blending traditional asset management with hedge fund-style strategies. It targets both institutional and retail investors with a focus on yield, capital preservation, and credit research.

- Expense Ratio: 1.20%

- Annual Cost on $10,000 Investment: $120

- Why It’s Expensive: Although modest compared to others on this list, its higher turnover and research-intensive bond selection drive costs above the industry average.

- Key highlight: Even at $120 annually, RPHYX costs 3x more than similar short-term bond ETFs offering comparable results.

High Fees = Guaranteed Losses (Regardless of Performance)

One of the most overlooked truths in investing is this: mutual fund fees are guaranteed, while returns are not. Whether your fund performs brilliantly or poorly, the fees get deducted year after year without fail. That means the fund company earns money, even if you lose it.

Let’s break that down further:

- You pay the fee even in down markets: When markets decline, fund fees still apply, further reducing your investment returns. For instance, if a portfolio drops 10% in value, a fund with a 5% annual expense ratio could deepen that loss significantly, depending on how and when fees are calculated throughout the year.

- High-fee funds must outperform just to catch up: A fund charging 2% or more per year has to beat a low-cost index fund by a wide margin just to match net returns. If an index fund earns 7% with a 0.10% fee, a high-fee fund charging 2% must deliver a gross return of at least 8.9% annually to keep pace, and that’s before taxes or other transaction costs.

- Over decades, fees have become the biggest performance drag: When investing over long periods (such as 20–30 years), even a 1% difference in fees can mean tens, or hundreds of thousands of dollars in lost growth. The longer the time horizon, the more compounding amplifies the effect of fees. It’s not the market, poor timing, or volatility that eats away at returns most; it’s often the steady erosion of high annual costs.

Fee vs. Return: What Funds Must Deliver to Compensate

The higher the fee, the more a mutual fund must outperform the market just to match the returns of low-cost alternatives. Here’s how even strong performance can be wiped out if fees consume too much of your gains.

| Expense Ratio | Required Annual Outperformance to Match a 0.10% Index Fund |

| 1% | 0.9% |

| 2% | 1.9% |

| 5% | 4.9% |

| 13.94% | 13.84% |

And very few funds, if any, deliver this kind of alpha consistently over time.

Conclusion: Minimize Costs, Maximize Results

High-fee mutual funds may promise expertise, niche strategies, or “exclusive” access, but over time, they rarely outperform and often underdeliver. The numbers don’t lie: paying 5%–14% in annual fees can devastate your long-term financial goals, costing you hundreds of thousands in missed compounding.

Today, investors have more control than ever. By choosing low-cost index funds, ETFs, or robo-advised portfolios, you’re not just cutting fees, you’re improving your odds of long-term success. Because in investing, it’s not just what you earn, it’s what you keep that truly matters.