(Bloomberg) — Municipal bond funds are seeing the largest burst of demand in months as confidence builds that the Federal Reserve will start lowering interest rates as soon as September, bolstering the outlook for fixed-income more broadly.

Most Read from Bloomberg

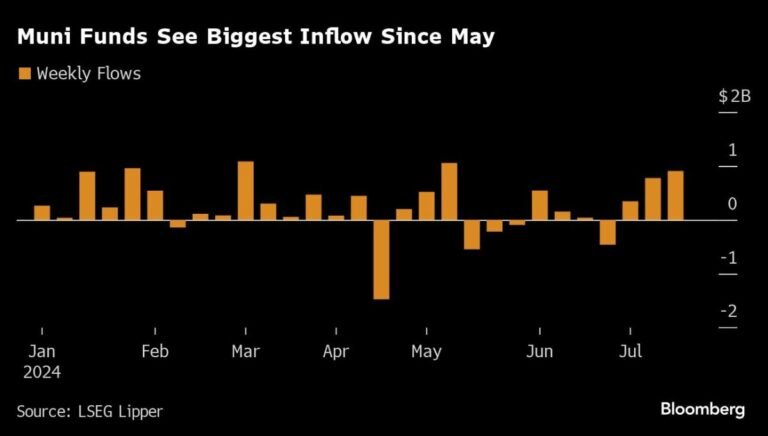

Investors added about $900 million to funds focused on US state and city debt in the past week, the most since May, according to LSEG Lipper Global Fund Flows data. It was the third straight week of additions, and followed the muni market’s best month this year, which could help spur continued improvement in investor appetite, according to BlackRock’s municipal bond group.

It’s a solid backdrop for the muni market heading into a seasonally strong performance period, with benchmark yields still about a half-point above their year-end levels. A key focus ahead will be the Fed’s month-end policy meeting for further clues to the timing of potential rate cuts.

“Trends favor fund flows to continue to generate positive momentum, to continue to reflect growing demand,” said John Miller, head and chief investment officer of the high-yield muni credit team at First Eagle Investments. “The one biggest upside is the Fed cutting rates.”

What’s more, he said, “people chase performance, and better performance tends to be a catalyst for more inflows.”

Muni mutual funds, one of the market’s most influential buyer bases, have added about $2.3 billion year to date, according to LSEG Lipper, after seeing a significant exodus the previous two years as the Fed hiked rates to tame inflation.

Tax Cloud

Of course, there are clouds on the horizon for the market, as the growing momentum behind Donald Trump’s campaign to retake the White House fuels concern that the muni bond tax-break may be scrapped to help pay for permanent tax cuts.

But the uptick in demand is a good sign for municipalities looking to borrow for infrastructure projects and other needs, especially with more than $6 trillion sitting in money-market funds and primed to potentially shift into other assets.

It’s also encouraging for muni demand that money is streaming into speculative-grade tax-exempts, said Terry Goode, senior portfolio manager at Allspring Global Investments. High-yield funds gained $364 million in the latest week, about 40% of the total inflow.

The junk part of the muni universe is trouncing the rest of the market, returning almost 5% this year, versus 0.4% for munis overall, Bloomberg index data show.

“The strong performance in the high-yield municipal market year to date could definitely drive more flows into the municipal market,” Goode said.

–With assistance from Amanda Albright.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.