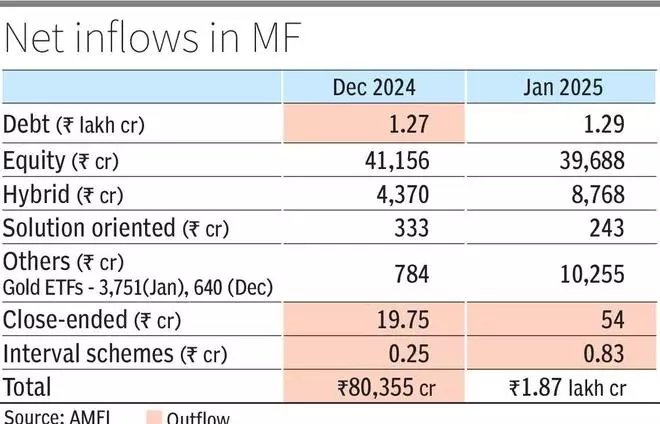

The inflows into mutual fund equity schemes dipped four per cent last month to ₹39,688 crore against ₹41,156 crore logged in December, on the back of bearish sentiments and sharp market volatility.

The equity asset was down four per cent to ₹29.47 lakh crore against ₹30.57 lakh crore largely due to mark-to-market loss, according to the Association of Mutual Funds in India data released on Wednesday.

SIP inflows was down a tad at ₹26,400 crore against ₹26,459 crore. The industry has eliminated 61.32 lakh after a reconcillation between the RTAs and exchanges. This has resulted in the number of outstanding SIP accounts falling for the first time recent years to 10.27 crore last month against 10.32 crore in December.

Among equity schemes, thematic funds received the highest inflow of ₹9,017 crore (₹15,332 crore) on the back of ₹2,838 crore received from new fund offers.

Investors continued to bet big on small and flexi cap funds which received net inflow of ₹5,721 crore (₹4,668 crore) and ₹5,698 crore (₹4,731 crore).

Venkat Chalasani, CEO, AMFI said given the current trend and SIP inflows despite market volatility, the industry does not expect any major redemption pressure or fall in equity inflows as investors are now confident of equity investment through MFs.

Himanshu Srivastava – Associate Director- Manager Research, Morningstar Investment Research India said investors focus towards making the most of the market fall in January can also be gauged from the fact that about 31 lakh new folios were added in January.

The performance of the equity markets and the returns that equity oriented mutual funds have generated in the last few years has motivated several investors to enter into the equity markets, he added.