Despite managing ₹2 lakh crore in assets, passive debt mutual funds in India remain unfamiliar territory for retail investors due to limited awareness and the popularity of active debt funds. The passive debt fund space only gained significant attention after the Bharat Bond ETF launch in December 2019, though the first passive ETF—Liquid BeES—has been available since 2003.

Bharat Bond ETFs, India’s pioneering corporate bond ETFs, initially attracted investors with their fixed maturity options, government backing, predictable returns, AAA-rated portfolio, tax benefits through indexation, and remarkably low expense ratios of 0.0005 percent. However, the 2023 Union Budget eliminated indexation and capital gain advantages for debt mutual funds, significantly reducing their appeal. Despite this setback, the passive debt fund ecosystem has continued to grow in both diversity and volume.

While institutional and large investors dominate this space, retail investors can strategically incorporate these instruments into their portfolios for diversification, stability, and income generation to achieve their financial goals.

Structure and varieties

Similar to passive equity investments, the passive debt realm comprises both ETFs and index funds. Currently, there are 138 passive debt funds, including 19 gilt and bond ETFs, 16 liquid ETFs, and 103 index funds, according to ACEMF data.

Functioning like their equity counterparts, debt passive funds mirror the performance of their benchmark indices by holding underlying fixed income securities in proportionate weights. In India, these vehicles primarily track indices established by NSE and CRISIL.

Debt ETFs follow two main approaches: Target Maturity Funds (TMFs) and regular debt ETFs. TMFs operate similarly to bank fixed deposits, holding bonds until a specified maturity date and offering predictable returns when held to term. Examples include ‘BHARAT Bond ETF – April 2031’. In contrast, regular debt ETFs are perpetual in nature, with no defined maturity date. They maintain continuous exposure to their chosen bond segments by regularly rolling over their holdings. Most index funds in the passive debt segment adopt the Target Maturity Fund structure.

Types of passive debt instruments

The passive debt segment can be broadly categorized into three types: gilt and bond ETFs, gilt and bond index funds, and liquid ETFs.

Gilt and Bond ETFs

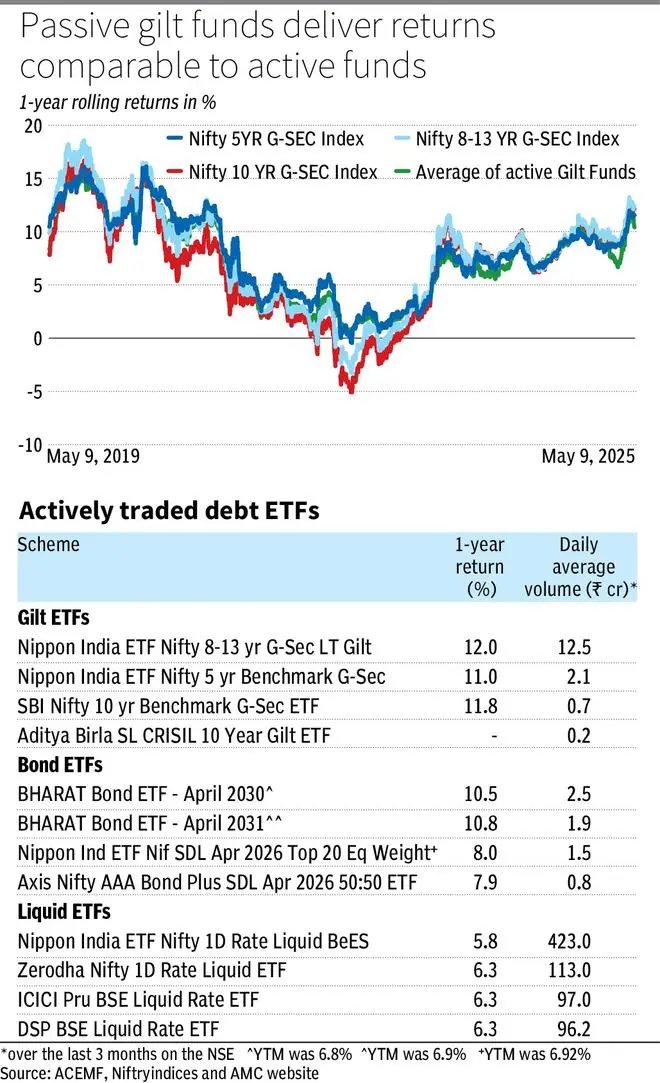

The market features 14 ETFs tracking gilt indices, 4 tracking Bharat Bond indices, and one tracking the SDL index. Gilt ETFs are categorized based on the duration of securities they track—5-year, 10-year, and 8-13 years. For instance, ‘SBI Nifty 10 yr Benchmark G-Sec ETF’ tracks the Nifty 10 yr Benchmark G-Sec index, which is based on the price of the 10-year bond issued by the Indian government. This ETF currently holds just one g-sec: ‘6.79% GS 2034’. Rebalancing occurs when a new 10-year G-sec is issued.

Among gilt ETFs, ‘Nippon India ETF Nifty 8-13 yr G-Sec Long Term Gilt’ and ‘Nippon India ETF Nifty 5 yr Benchmark G-Sec’ are the most actively traded, with average daily volumes of ₹13 crore and ₹2 crore respectively over the past three months.

The four Bharat Bond ETFs follow the TMF structure with maturities in 2030, 2031, 2032, and 2033. These fixed-maturity products minimize interest rate risk when held to maturity. Investors can trade them on exchanges in real-time, aligning with their investment horizon. However, investors should verify the residual maturity and Yield-To-Maturity (YTM) before investing, information available on the Edelweiss mutual fund website. ‘BHARAT Bond ETF – April 2030’ and ‘BHARAT Bond ETF – April 2031’ are top traded with average daily volumes of ₹2.5 crore and ₹2 crore respectively over the last quarter.

Gilt and Bond Index Funds

These funds primarily adopt the target maturity approach with varying fixed maturity dates. These funds are either focused on G-secs, SDLs, or AAA-rated PSU and financial services bonds, with some holding a combination of these instruments. SEBI recently allowed passive debt funds focused on the financial services sector to allocate up to 100 percent in NBFCs and housing finance companies—a feature not permitted in active debt funds due to sectoral caps, creating new opportunities for passive investors.

Maturity dates can extend as far as 15 years. The recently launched index funds focusing on Financial Services debt instruments are perpetual in nature, maintaining continuous exposure to their chosen bond segments through regular portfolio roll over.

For example, the ICICI Pru CRISIL-IBX Financial Services 3-6 Months Debt Index Fund allocates investments in underlying fixed income securities based on proportional weights and rebalances them in line with its benchmark index.

Liquid ETFs

Liquid ETFs serve as transactional tools rather than investments, primarily helping equity traders settle trades efficiently through instant liquidity and stability. Unlike typical debt ETFs, they enable net settlement of stock trades, allowing simultaneous liquidation of ETF units to fund stock purchases on the same day.

With a constant NAV of ₹1000, they provide clarity and simplicity. Originally offered with daily dividend options, growth options have become more common due to taxation changes, with dividends credited weekly.

Currently, 16 liquid ETFs are available, investing mainly in one-day maturing instruments like tri-party repos. Nippon leads this segment with over 8 lakh folios and an impressive daily average volume of ₹423 crore over the past three months. While these ETFs offer minimal returns, they serve as more efficient alternatives to holding idle cash. Currently, the one day call money and TREPS rates were about 5.8 per cent.

Challenges to Consider

Investors should be aware of disadvantages when considering passive debt funds:

Structural differences: Active debt funds rely on manager expertise to select securities and time markets, while passive funds track underlying indices with minimal intervention. Active managers can dynamically adjust duration, credit exposure, and sector allocations based on market conditions and interest rate outlook, while passive funds maintain rigid adherence to their benchmarks regardless of market shifts.

Investment limitations: Regulations restrict passive debt funds to allocating only in G-secs, State Development Loans (SDLs), and AAA-rated bonds with up to 15 years maturity. In the past, two TMFs were launched with maturities of nearly 15 years. In contrast, active gilt and bond funds can invest across maturities and credit spectrums as permitted for their respective categories.

Liquidity concerns: Trading volume is crucial for ETFs in India. Since they trade on exchanges, active buyers and sellers are needed for fair pricing. Most debt ETFs experience thin trading, which may force investors to purchase units at premium prices, potentially lowering returns.

Expense considerations: Bharat Bond ETFs offer the lowest expense ratio at just 0.01 percent as of April 2025. Gilt ETFs charge between 0.09 and 0.25 percent, while regular index fund plans have expense ratios ranging from 0.23 to 0.79 percent. Their direct plans are more cost-effective, with fees between 0.08 and 0.49 percent.

Investors should be aware that a higher expense ratio, combined with brokerage fees, bid-ask spreads, and NSDL charges, could result in a higher cost of ownership—especially in illiquid ETFs.

Yield transparency: Yield to Maturity (YTM) represents the total return an investor can expect when holding a bond or debt fund until maturity, assuming reinvestment of interest payments. Investors considering target maturity funds should verify the YTM before investing. While AMCs disclose YTM on their websites, disclosure frequency varies—some update daily while others update weekly.

Should you invest?

Interestingly, an analysis of 1-year rolling returns over the last ten years reveals that passive gilt funds have delivered returns nearly on par with active gilt funds for most periods, thanks to low cost structure.

For small investors looking to add fixed income exposure to their portfolios, passive debt index funds may be a more suitable choice than ETFs given their simple investment structure. Their predictable return profile makes them appropriate for goal-based investments like retirement planning. Also, TMFs minimize interest rate risk when held to maturity.

With a variety of offerings, investors can choose funds matching their risk profiles. When selecting passive funds, options with low expense ratios, minimal tracking error, and larger corpus size are preferable. For those interested in ETFs specifically, liquidity becomes an additional important consideration.

Published on May 10, 2025