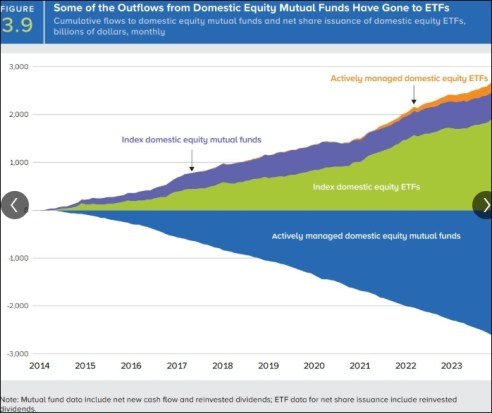

Exchange-traded funds or ETFs are a popular investment option in the US compared to mutual funds. U.S. exchange-traded fund industry assets reached a new record of $10.7 trillion at the end of January, ETFGI reports. In January, the U.S. ETF industry amassed net inflows of $90.3 billion, the highest figure ever recorded. Is a favorable taxation rule behind the popularity of ETFs in the US?

Nithin Kamath, the founder and CEO of Zerodha seems to have figured it out. In his X post, Nithin raised an important point regarding the popularity of exchange-traded funds or ETFs in the US.

In his X post, Nithin highlights why ETFs in the US are preferred over MFs – “US mutual funds are pass-through vehicles—if they generate capital gains, these must be distributed to unit holders who pay the taxes on the gains which make MFs less tax-efficient.

ETFs avoid this through ‘in-kind’ creation/redemption that washes away gains. This tax advantage is significant. This is one underrated reason for the popularity of index funds, especially ETFs in the US.

In India, both MFs and ETFs don’t pass taxes to unit holders, while CAT 1 and 2 AIFs taxes are passed through. CAT3 AIF isn’t passthrough.”

(Source: Nithin Kamath’s X post)

Essentially, the way the ETFs and mutual funds in US are taxed, makes the former a preferred investment vehicle in the US.

ETFs can potentially generate fewer capital gains for investors since they may have lower turnover and can use the in-kind creation/redemption process to manage the cost basis of their holdings. ETFs can be tax efficient because many ETFs buy and sell portfolio securities in in-kind exchanges (rather than for cash). This means ETFs typically have fewer capital gain distributions than mutual funds. As a result, ETF shareholders may pay less in taxes on a similar investment.

(Source: Nithin Kamath’s X post)

On the other hand, a sale of securities within a mutual fund may trigger capital gains for shareholders — even for those who may have an unrealized loss on the overall mutual fund investment.

Also Read: S&P 500 or Nasdaq 100? These funds help you get exposure in the US stock market

ETFs are different from Mutual funds in the sense that ETF units are not sold to the public for cash. Instead, the Asset Management Company that sponsors the ETF (Fund) takes the shares of companies comprising the index from various categories of investors like authorized participants, large investors and institutions.

In turn, it issues them a large block of ETF units. Since dividends may have accumulated for the stocks at any point in time, a cash component to that extent is also taken from such investors. In other words, a large block of ETF units called a “Creation Unit” is exchanged for a “Portfolio Deposit” of stocks anda “Cash Component”.

Also Read: Gold vs. Sensex: A 20-year analysis reveals crucial lessons for asset allocation

The number of outstanding ETF units is not limited, as with traditional mutual funds. It may increase if investors deposit shares to create ETF units; or it may reduce on a day if some ETF holders redeem their ETF units for the underlying shares. These transactions are conducted by sending creation/redemption instructions to the Fund.

The Portfolio Deposit closely approximates the proportion of the stocks in the index together with a specified amount of Cash Component. This “in-kind” creation/redemption facility ensures that ETFs trade close to their fair value at any given time.

Also Read: US CPI data put Fed at a crossroads: Pause, rate cut or hike?