Multicap funds continue to attract mutual fund investors. According to the Association of Mutual Funds in India (Amfi), these funds saw inflows of Rs 7,084 crore in July 2024, the highest among diversified equity schemes. Traditionally, the mutual fund industry has offered actively managed multi-cap schemes.

However, recent days have seen a surge in passive fund offerings within this category, including Navi Nifty 500 Multicap 50:25:25 Index Fund, HDFC Nifty 500 Multicap 50:25:25 Index Fund, and Mirae Asset Nifty 500 Multicap 50:25:25 Exchange-Traded Fund (ETF). “With the markets scaling fresh highs in July 2024, passive multi-cap funds can be a good choice for investors since they provide a well-distributed exposure to large, mid, and small companies. They have a moderate risk-return profile and are less risky than pure midcap and smallcap funds,” says Siddharth Srivastava, head – ETF product and fund manager, Mirae Asset Investment Managers (India).

The multicap universe

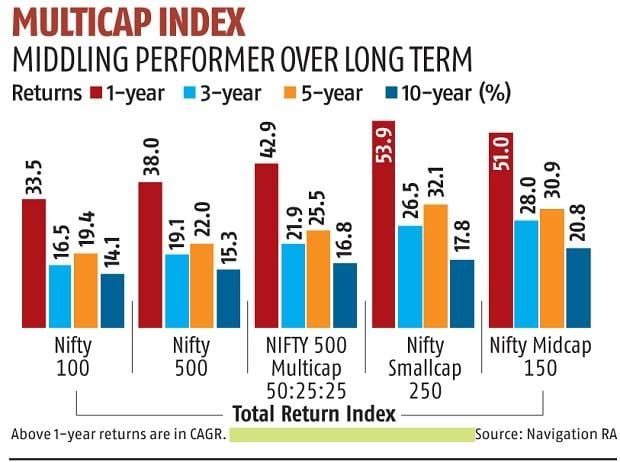

As of July 31, 2024, 26 multi-cap schemes managed assets worth Rs 1.68 lakh crore, according to Amfi data. The performance of these schemes is often benchmarked against the Nifty Multicap 50:25:25 Total Return Index, which includes 503 stocks across large, mid, and smallcap companies, weighted at 50 per cent, 25 per cent, and 25 per cent, respectively. The top three sectors in the index are financial services, capital goods, and information technology, with weights of 25.1 per cent, 8.8 per cent, and 8.3 per cent, respectively.

Active vs passive funds

Passive funds eliminate fund manager risk. “In the past three years, active multicap funds have allocated 37-44 per cent to large caps, 21-27 per cent to mid caps, and 25-30 per cent to small caps. In contrast, the ETF-based Nifty 500 Multi-cap 50:25:25 Index provides a fixed 50 per cent exposure to largecap and 25 per cent each to midcap and smallcap segments. Being rule-based, there is no risk of over or under-allocating to a market cap segment, sector, or stock based on the fund manager’s view,” says Srivastava.

However, passive funds have limited flexibility in adjusting holdings according to market conditions. “If certain sectors underperform, passive funds cannot shift away. Investors miss out on the alpha that active multicap funds generate. Exposure to mid and smallcap stocks introduces volatility and risk compared to largecap funds,” says Ravi Kumar.

Best for the undecided

Multicap schemes are beneficial for investors unsure about their allocation within equities. They make rebalancing across market cap segments tax-efficient and smooth. Individuals may find it challenging to rebalance on their own. “Passive multicap funds suit investors who prefer a long-term, hands-off approach and are content with market-matching returns. Those seeking to benefit from broader market changes, as captured by active fund managers, should consider active multicap funds,” says Ravi Kumar. “Cost-conscious investors may favour a passive multicap product like an ETF, which carries no exit load and can be traded on exchanges just like stocks,” adds Srivastava.

First Published: Aug 19 2024 | 10:22 PM IST